Otis

One of USV’s newest portfolio companies, Otis, had a coming out party yesterday.

The idea behind Otis is that cultural assets like fine art, rare books and comic books, jewelry and watches, sneakers and skateboards, etc are appreciated by everyone but are only collectible/affordable by wealthy people.

Otis intends to change that by securitizing these cultural assets and selling them off in shares for as little as $25 per share. These fractionalized cultural assets will be shown publicly while they are owned collectively.

You can see how this all works by downloading the Otis mobile apps here.

I did that yesterday and I have already set myself up to try to buy a share of Kehinde Wiley’s Saint Jerome Hearing The Trumpet Of Last Judgement on August 13th.

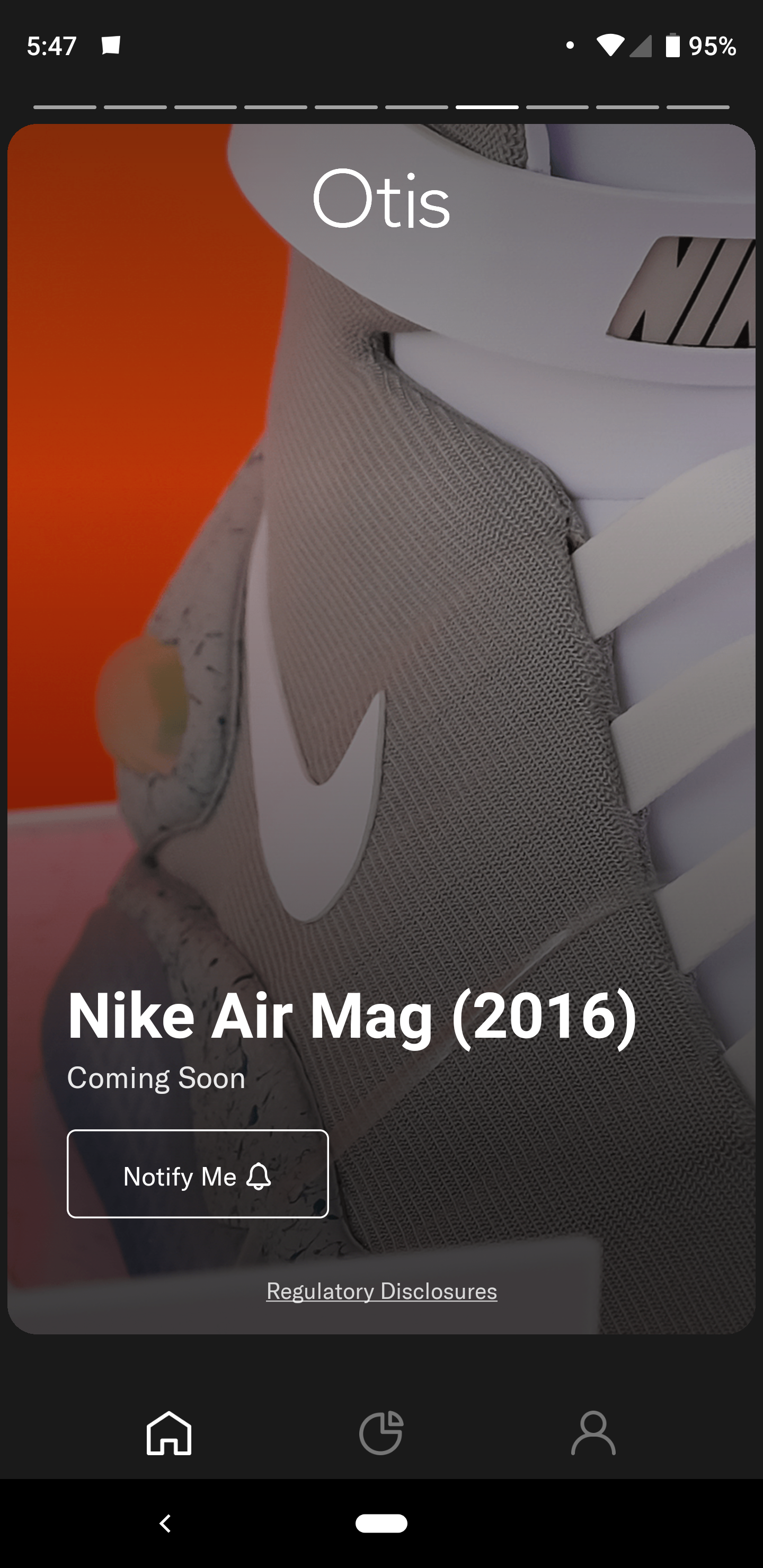

I’ve also opted to be notified when these assets “drop” so I can purchase a share of them too.

I am not a sneakerhead but for those of you who are this might be of interest to you:

This is just the start of what will hopefully be a highly liquid secondary market for the trading and collecting of shares of cultural assets. The market is starting out highly curated by Otis but that may change over time as things develop.

USV’s focus right now is on backing trusted brands that can open up access to captial, knowledge, and well-being and Otis fits in all three of those categories. We are very excited to be involved in this ambitious effort.

Comments (Archived):

Otis is sure to elevate.

I see what you did there.

.Otis v Dover v Schindler v ThyssenKrupp — always pick the elevator brand that has the most maintenance men in town. Pro tip.JLMwww.themusingsofthebigredca…

This company is starting out with a name that is “owned” by someone else. A shocking beginning. Their unintuitive https://withotis.com underlines that blunder. My guess is that they will try to rename within a year.

Yep, there is also a school of art in LA named OTIS

… and be trusted. 🙂

Really fascinating concept and ahead of the curve. Congratulations!

Not exactly, they are a bit behind the curve – via the google

Fascinating and analagous to work I’m doing with NFTs.Lots of similarities on the creation of a human value chain that needs to drive a secondary exchange.How you present exchangeble/saleable value is the great conundrum to crack.Fred–curious if you’ve thought much about Harberger Tax?https://medium.com/@simondl…

New to me. Googling now to read up on it

Link above I added late is a good place to start.Comes out of the Glen Wyle’s RadicalXchange movement and the book Radical Markets.Some experiments like https://wildchain.io/ and https://wildcards.world/ are interesting as while originally thought of for art, like a way to support an artist with each change of ownership, can potentially function to create an annuity stream for non-profit environmental projects like we wanted to do with Honu back a year ago.

Why not via tokens?

That’s how this started and likely how it will evolve. But the team decided that they should prove that there is a market for this before investing heavily in a Blockchain/crypto platform

My first thought as a lot of analogs to the crypto collectibles market.

Or similar to https://stockx.com/. Not exactly the same though

I think this is part of stockX long term vision

What if the token is the object? That would be an interesting technical innovation for blockchain.

All NFTs are by definition tokens and objects.That is the core of it and yes, huge design innovation.

but i mean the object itself *is* the token. This goes beyond digital creations (a Frog or a Kitty et.c.) in my mind.

that is how it works.go to opensea.every object is a token.these are Not the same as a digital currency, they are object stores of value.the interesting piece is where does the value come from as it does not come simply from market forces–or won’t when it finds its pace.

if this is not clear @jasonpwright:disqus glad to try again.for a digitally created object–art piece or game piece–the token is the object, immutable, unique.for a real world object like for example, there are x number of endangered white rhinos for example, of corral reefs in BVI, you can taken each one in an NFT, one to one, and take online,the technical building blocks are all here from wrappers, to extended wrappers, to exchanges. not to mention economizing tools as well for artists, makers and environmental projects,.and a host of needs and behaviors.fascinating stuff.

I will dive in. Thanks.

Fractional ownership is a popular token use case.

Very impressive.I will definitely take a look at being a fractional fine arts owner/investor.Now that we are seeing sreas being disrupted by fractional ownership or new ways of engagement, an area I also find fascinating is to create a community token for professional networking through a reputation and engagement token to reward members of a network for their participation, leadership, and curation of content.This is an area of great interest to me and I am working on a project now.Open to conversation on this.topic.

If this works, will it increase the sell-on value of (for example) sneakers, and then drive the price of the originals up even further?

How does this solve for the tragedy of the commons though? Or who ultimately owns the work of art? @Fred, if I purchase 51% of the shares of your lovely piece, can I choose to destroy it? (If I we’re a malicious actor)

See Radical Markets for some other views of this.Interesting if you are not aware of it.Strong community growing everywhere on this.

Referencing Harberger Taxes? Very innovativeOr is there something else?

Yup, Harberger Tax.Possibly strongest use case for it might be for support of endangered species through games and collectibles.Obviously also super germane to the collectibles market and possibly/finally a way for the blockchain and a scaleable infrastructure to support the artisanal maker and artist.Cool stuff. Perfect fit for the capabilities of NFTs.

Valid concerns. I found this on the https://withotis.com/ website:Custodianship – All assets are stored in a museum-quality storage facility at UOVO Fine Art in Orangeburg, NY.Insurance – All assets are insured by Aspen American Insurance Company. Otis insures all assets during transport and storage.Compliance – Otis retains North Capital Private Securities, Corp, members FINRA/SIPC as its registered broker dealer.

Timeshare + gallery + museum + buckets.Will the SEC have a role to play in this innovation?

yes, this will be an SEC regulated marketplace

If this works only an an antidote to freeport art ‘bunkering’ then that’s a very good thing for the richness of our human culture.

Wow, I am so jealous about this is the best possible way! … next, check with compliance at work to see if I can get in on the action.

Congrats on this new marketplace!!

Very cool project!

Very clever. This looks like a good example of business model innovation. I was thinking earlier on the concept that business model innovation is more disruptive than technical innovation. To be more specific, my interpretation of disruptive is that it can scale more quickly with less capital and technology risk. Attractive for early stage company development leaving the heavy technology innovation to governments, universities and large companies. On its 50th anniversary the Apollo 11 program is still awe inspriring.Not being a collector myself I wonder if this particular service addresses some of the non-financial aspects of owning (a fractional part) of a collectible? i.e having the painting on my wall or the comic book in my collection. Good stuff!

Can this be done with real estate? Could we create a subdivision where low income families could buy shares at the cost that a developer would pay for the land and the construction. Then the homeowners would pay a lower cost and pocket the value increase that a developer would have taken. The project would still be built by a project manager, but the middleman would be taken out.

.Most low income multi-family/single family projects are financed using Federal housing credits. It is a fairly sophisticated market that essentially sells off tax credits at a discount.JLMwww.themusingsofthebigredca…

I literally pitched Jeff Wilpon, owner of the NY Mets, with the notion of selling shares to the club’s minor league teams to fans. Owning a chunk of a major league pro team would be too prohibitive given club valuations, but on a minor league level fractional club shares would be more affordable. Wilpon was intrigued enough with the idea he set me up w/ a few internal meetings, but at the end of the day current minor league baseball bylaws made the concept too challenging.Investing delivers two elements in varying degrees: the emotional gratification of ownership and/or financial rewards. If you can’t physically possess a collectible, then where’s the emotional gratification? Owners of art and collectibles generally like to showcase their wares. And if there’s no on-going way to track its value, say like a stock or bond, then how can you assess the assets current and potential financial rewards?Maybe I’m an outlier here, but this biz model seems too abstract and lacking in any serious, tangible form of investor gratification. It’s a bit of a novelty act.

.Agreeing more with you than you do with yourself.JLMwww.themusingsofthebigredca…

Green Bay is locally owned. Why not other professional teams?

Packers grandfathered in. Current NFL bylaws restrict ownership to no more than 32 owners. All kinds of restrictions on Packers’ shares. Plus, team valuations now are insane relative to 1923.

when they securitize it and list tokens, they should list at openfinance.io

This certainly will incentivize hype machines, people who own shares in “cultural” things – that then get promoted because the “army of HODLers” related to the item are incentivized to promote and talk positively/excitedly about it; everyone should have to clearly state anytime they speak of something they have ownership if they are talking or writing about it.Edit: I wonder if this has the potential to start ruining culture by monetizing it, making it profitable to the masses. Certainly another clever business model like the evolution of the new Ponzi-Pyramid schemes.

The big problem with the model is lack of liquidity and ease of price manipulation – they are also late to the party with 3-4 companies with the same model

.I get completely the premise — persons can own a share of cultural assets that normally would only be available to wealthy individuals.What I don’t get is why that would deliver to me the same psychic benefits.I have an original painting of some modest value in my office (five feet from where I sit). I bought it 20+ years ago. The artist passed away. It is worth substantially more than what I paid for it, but the real benefit to me is that I love looking at it.It is a pic of two kids fishing in a stream in what I know to be a New England setting. Every time I look at it, I get a little surge of pleasure.I just turned around and looked at it and the surge is still there. It just tickles my funny bone.On two other walls, I have Chinese stock/bond certificates from the late 1800s and early 1900s that were defaulted when the Commies got control of China. They have exquisite etchings depicting the use of the funds.The bond indentures and stock descriptions are in four different languages and the unredeemed coupons are on the back of the securities.I used to collect these and give them to people as Christmas presents. Some of these are quite valuable as they are not making any more and they are being collected since the emergence of China.So, my “dividend” in my foray into “culture” is some measure of personal happiness — that whole “pursuit of happiness” thing in the Dec of Ind.Crudely — it burnishes my ego; my self-esteem is nourished.How does owning a fractional share of any of that convey to me the same psychic benefits?I don’t suppose that I can ever get my hands on the cultural assets? Have them at a party at my house?Not seeing the allure though I totally agree to the premise.JLMwww.themusingsofthebigredca…

Hmm..but would a man of culture display cultural assets at a party in their house JLM ?(Joke). I wouldn’t know since I am not one.

.When my kids were small, I always wanted to have “the” house that all the kids came to. We have a huge gameroom that is above the garage that is completely private.The kids never figured out I could listen in through the intercom. I headed off a few disasters by nipping them in the bud.We have a nice pool with a hot tub.I always let the kids do whatever they wanted as long as it was at our house. I would ensure they had a lot of snacks, but they both became very healthy eaters (from their mother).It has been a very happy house that I am now in the last throes of getting ready to sell — renovated 6 bathrooms to the studs, new kitchen, powder room, utility room, roof — as it is way too large even for someone as big a personality as me.I am going to miss this house.One of the doors from my office has a scratched door from a loyal Labrador. I forbid it being painted over because it will cover the sentiment.So, this has been a working house with a lot of living.JLMwww.themusingsofthebigredca…

I want a tour before you sell it 🙂 with stories 😉

If Gwant escapes home, 30+ years from now, that would be the first place I would look for him.Dad told me he always had dreams about our original family home. His Dad built it, Dad finished paying the mortgage and bought his sister’s half. I lived for 22 years in that house. I could rebuild it in absolute detail.They sold it during the 80’s real estate boom in Santiago and then, instead of the original plan to move to a flat and following Mom’s wishes, they bought a spectacular house up in the hills, their retirement home.I watched plenty of sunsets over the valley beside him in that balcony. A few times he said to me: “Do you know? Sometimes, I miss home…”I think that what we really miss, if we are lucky, are the moments that happened inside those homes. I am very conscious and deliberate when I spend time with my grandchildren about the fact that we are building memories for the future.I am absolutely sure that great memories are waiting to be built in Savannah.

Take the door.

The metaphysics of cultural appreciation.

That sounds cool. Do you think it might be possible to take a $100K student loan to go study that ?

Culture and money? How vulgar ;)The major’s in appropriation. $250K.

Your wealth of personality is blocking you here.For $20, people can get that psychic kick on their phone. It will work.De centralized, direct, condition based action is the right wave to ride – check this version out: http://www.fox2detroit.com/…

“OTIS IS A FUNDING PLATFORM, NOT A BROKER-DEALER. SECURITIES ARE OFFERED TO INVESTORS THROUGH NORTH CAPITAL PRIVATE SECURITIES, A REGISTERED BROKER-DEALER AND MEMBER OF FINRA AND SIPC, LOCATED AT 623 EAST FT. UNION BLVD, SUITE 101, SALT LAKE CITY, UT 84047 WITH WHICH OTIS HAS PARTNERED. YOU CAN REVIEW THE BROKERCHECK FOR NCPS HERE. PRIVATE INVESTMENTS ARE HIGHLY ILLIQUID AND RISKY AND ARE NOT SUITABLE FOR ALL INVESTORS. YOU SHOULD SPEAK WITH YOUR FINANCIAL ADVISOR, ACCOUNTANT, AND/OR ATTORNEY WHEN EVALUATING PRIVATE OFFERINGS.NEITHER OTIS NOR NORTH CAPITAL MAKES ANY RECOMMENDATIONS OR PROVIDES ADVICE ABOUT INVESTMENTS.THE INFORMATION YOU WILL HEAR TODAY MAY MAKE FORWARD-LOOKING STATEMENTS ABOUT INVESTMENTS WHICH HAVE NOT BEEN REVIEWED BY OTIS OR NORTH CAPITAL. YOU SHOULD NOT RELY ON THESE STATEMENTS BUT SHOULD CAREFULLY EVALUATE THE OFFERING MATERIALS IN ASSESSING ANY PRIVATE INVESTMENT OPPORTUNITY, INCLUDING THE COMPLETE SET OF RISK FACTORS THAT ARE PROVIDED FOR YOUR CONSIDERATION.OTIS INTENDS TO SPONSOR A PUBLIC OFFERING PURSUANT TO REGULATION A UNDER THE SECURITIES ACT OF 1933, AS AMENDED. NO MONEY OR OTHER CONSIDERATION IS BEING SOLICITED AT THIS TIME WITH RESPECT TO SUCH OFFERING, AND IF SENT IN RESPONSE TO THESE MATERIALS FOR SUCH AN OFFERING, IT WILL NOT BE ACCEPTED. NO OFFER TO BUY SECURITIES CAN BE ACCEPTED AND NO PART OF THE PURCHASE PRICE CAN BE RECEIVED FOR AN OFFERING UNDER REGULATION A UNTIL AN OFFERING STATEMENT IS QUALIFIED BY THE U. S. SECURITIES AND EXCHANGE COMMISSION, AND ANY SUCH OFFER MAY BE WITHDRAWN OR REVOKED, WITHOUT OBLIGATION OR COMMITMENT OF ANY KIND, AT ANY TIME BEFORE NOTICE OF ITS ACCEPTANCE GIVEN AFTER THE QUALIFICATION DATE. AN INDICATION OF INTEREST MADE BY A PROSPECTIVE INVESTOR IN A REGULATION A OFFERING IS NON-BINDING AND INVOLVES NO OBLIGATION OR COMMITMENT OF ANY KIND. COPIES OF THE PRELIMINARY OFFERING STATEMENT FOR THE REGULATION A OFFERING MAY BE OBTAINED”That is our culture.

So, not Rally Road.

Really interesting stack of creative tools.NFTs, Harberger, and now this one as well:https://github.com/ethereum…@fredwilson:disqus might be interested in this if new to him as basically you can bolt on the market value of other nfts and fungible currencies as well.add a huge marketplace, and the powerful fact that these are not currencies controlled by math or the market but based on value.inspiring stuff. schlepping to brooklyn tonight to see what the radicalxchange local community thinks about my obsession with wrapping these together in new ways.