Price Stability

One of the use cases that has eluded cryptocurrencies to date is “means of exchange” (something you would spend).

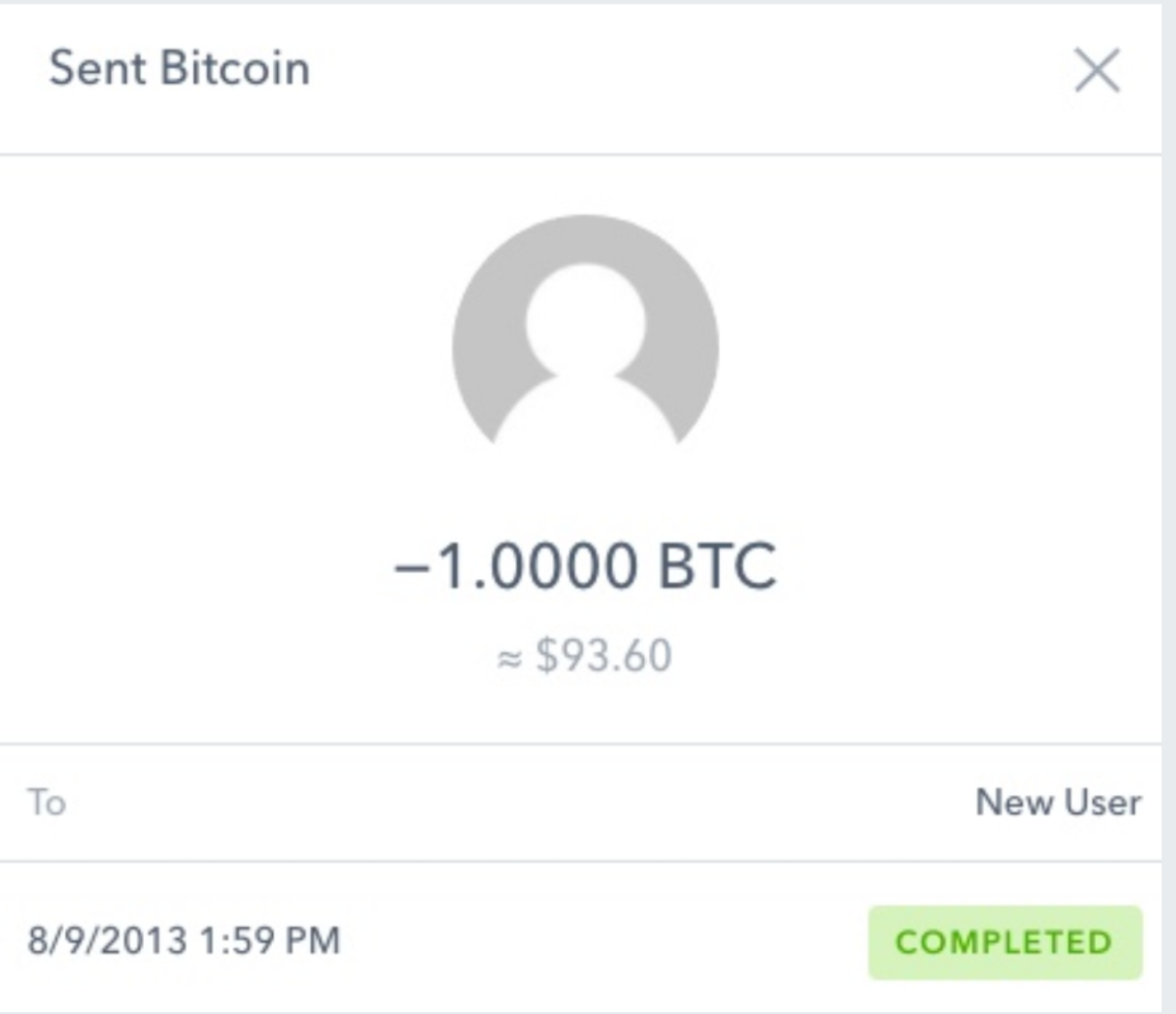

I wrote about this a couple years ago and showed this transaction in that blog post:

That was a payment I made to a caddie named Kris after he carried my bags one morning six years ago.

We played today and he was carrying a friend’s bag and I asked him if he still had that Bitcoin and he smiled and said “absolutely.”.

That made me feel good but the truth is nobody should be paying for anything, including caddying services, with something that can appreciate 123x. That’s just not rationale behavior.

Which is why stablecoins, cryptocurrencies which have price stability built in to them, are one of the important sectors in crypto right now.

There is the “dollar pegged” approach, like Tether (which may not actually be dollar pegged) and USDC (which is actually dollar pegged). One of the issuers of USDC is Coinbase, a USV portfolio company.

There is the Libra cryptocurrency, which USV is involved with as a Founding Member of the Libra Association. Libra will not be pegged to a specific fiat currency, but will have a reserve made up of many fiat currencies so it will have price stability.

And then there are stablecoins that are asset backed but not fiat backed like Dai.

Finally there are stablecoins that attempt to deliver price stability programmatically. I am not confident that approach will work.

I am confident that one way or another consumers will adopt cryptocurrencies that are price stabilized and when they do they will start transacting in them. And that will unlock a lot of utility that has so far been elusive.

Comments (Archived):

Someone i know has been accepting btc for services since about then, average payment was 500 to 1000 in btc, they have never sold any, boy are they happy

I can get you on most courses out here for 25 bucks a head, 5 goes to the starter.We take Canadian and USD.

Yeah but what is going to incentive US consumers to use crypto? That’s the big hurdle. People in US don’t care about stability. USD is already stable. They’re has to be a different answer then just stability for mass adoption of crypto in the US. Crypto needs to do more. I think a focus on inclusion and social responsibility is absolutely key here.

Maybe borders matter more than we think?Nice snag for his caddie!

Yes. Borders will play a huge part in adoption of crypto.

I suspect that neither inclusion nor social responsibility will resonate to any significant degree with most of the world.

Fair enough. But self-interest will. IMO a protocol that offers crypto rewards after each transaction is part of the answer

Back to the central question; “Why?”Do stable cryptos like Libra solve problems that cannot be solved by other means? I would like to think that Libra will bring financial services to the poorest in rural area that lack access to banking, let alone safe water, reliable energy (electric or fossil fuels) and roads that are serviceable all year long. I would love to see this happen and would love it if Libra does this. Is crypto currency enough? What else is needed?

3 novel elements with Libra or any other cc:1/ programmability. It is programmable money. You can’t program the dollar, yen, euro or pound, unless you’re the central bank that issues them. 2/ cost of transaction is much lower when you settle or transfer assets via a blockchain. 3/ the promise of a more decentralized governance is appealing so that central actors don’t abuse their powers.

Wonder why liquidity is not #1 for you.All things being equal, this is where it hits the road for me as a user.Walking down the street in Lisbon or sitting on the beach in Sardinia buying, selling, sending, receiving with a click.That behavior multiplied by hundreds of millions of times is a behavioral and societal change agent.The rest is plumbing albeit important yet abstract.

Stablecoins can be categorized as follows:- Asset-backed on-chain (eg to Ether, like Dai)- Asset-backed off-chain (to USD, fiat or other real assets, eg Libra, Coinbase’s)- Algorithmic (based on smart contracts and algorithm)2018 was a big year for stablecoins. There are prob 150-200 by now.Moreover, from a utility point of view, they can divided into 2 groups: a) general purpose (eg Libra, Dai), or special purpose (eg one for real estate only). Then, there’s the degree of programmability that they each have.I’m bullish as well on stablecoins use cases. Still waiting for their CryptoKitty moment though.

I wonder if they are better without the CK moment.Wonder if CK was not better without it at times.With consumer products (in my experience), with games especially, the spike is not as important as the stair step new levels post where you can learn, interact rather than chase another updraft if it sours.

CK opened the door for the non-fungible asset use case which is a huge one.

No question!I work in its aftermath in all three use cased of NFTs. Great group of people.That is not what I am saying though obviously.

Noting the Argento-LBX BTC Bond – do you have any thoughts on it as a favorable indicator to the evolving marketplace?

I think it’s one of many instruments/products that will be emerging. It’s not a panacea…but a good data point for things to come.

How is Asset-backed on-chain stable? Dia is stable vs. ETH but not USD or EUR or Gold.I instead split stablecoins into two categories:- Added trust- ByzantineAny stablecoin that is backed by an off-chain resource adds a layer of trust to the system. Do that and I don’t see much value in the system that Visa or PayPal is providing. If, like Tether or Libra, you have to trust then USDs exist, then why bother with thr crypto wrapper?I’ve yet to see an algorithmic, Byzantine solution that keeps the token value stable with the same layout level of decentralization as Bitcoin. Basecoin had some good ideas toward that end, but their full solution is unlikely to actually work in practice, at least not without massive scale of adoption.

How is Asset-backed on-chain stable?- via its algorithmsIt has some appeal in crypto purist environments.

We do not have a world currency for a reason. Lets trust the challenges of US Currency and money supply to cryptocurrency, in hands of a group who wouldn’t know the difference macroeconomics and macronutrients, all to make a few people wealthy, c’mon people use your brains.

A nation state fiat currency is a form of domestic imperialism. It is deployed to capture all activity, all value, all people, all transactions, for the benefit of the issuer class.I prefer the idea of multiple tokens, with each one specialising in a narrow and specific range of goods and services, as micro markets, preventing wealth from pooling centrally under the control of a technocratic elite. Money is politics.

Makes sense. But like others mentioned, once it is stable and trusted what is the value proposition for users relative to exsiting currencies. I am sure folks are working on articulating this for potential mainstream users, financial institutions etc. The unbanked is interesting.The concept of currency is complex with a long history back to bartering. It seems like an inherently centralized function so will be interesting to see how a stable crypto currency might leverage the peer-peer capabilities to enhance the user experience.As an investible assest Bitcoin is really interesting. The price is creeping up again and a lot of people have probably made good money, and lost as well. Like anything, need to do your homework, Long or Short side. Gold has been trading for a long time and the market is pretty well defined. Mining costs etc.

Do you see a world where these stablecoin’s find their own markets? Eg. Today we have currencies that citizens are more or less locked into. In the future will our money be a choice instead of a default?

btw, for 1 BTC I hope you broke 80!

I was thinking, what stops Tether to print (mint) additional 100M of Tethers, or 10B?? I would highly appreciate any answer. Tnx!

Interested in your thoughts on $AMPL Ampleforth.org.

Literally nobody wants this is the main problem with adoption. The thought of having a meter clicking away coins for everything you want to do online (or off) is certainly a libertarian dream, but it causes a lot of anxiety for people who are used to paying 80 bucks a month to just do their thing. Right now, the problem of paying for things online is solved, so nobody is looking for much that is radically different.. credit cards are great for that and much more secure (for the end user) than crypto can be without involving a financial institution

Regarding Libra: I’m a little confused by how it would allow the poorest communities to open bank accounts. Don’t you need a bank account and transfer money in order to be able to use Libra?If someone can enlighten me on this, that would be great.