Audio Of The Week: Sarah Beatty and Montgomery Builds

The Gotham Gal loves this conversation with Sarah Beatty about her Montgomery Builds project and suggested that I give it a listen. So I am doing the same with all of you.

The Gotham Gal loves this conversation with Sarah Beatty about her Montgomery Builds project and suggested that I give it a listen. So I am doing the same with all of you.

When I got to NYC in the early 80s the subway cars were like moving paintings with graffiti all over the cars. Going down into the subway station was like going to an art show.

This retrospective of Henry Chalfant’s photography of that era at the Bronx Museum captures that period so well and I helped support it today.

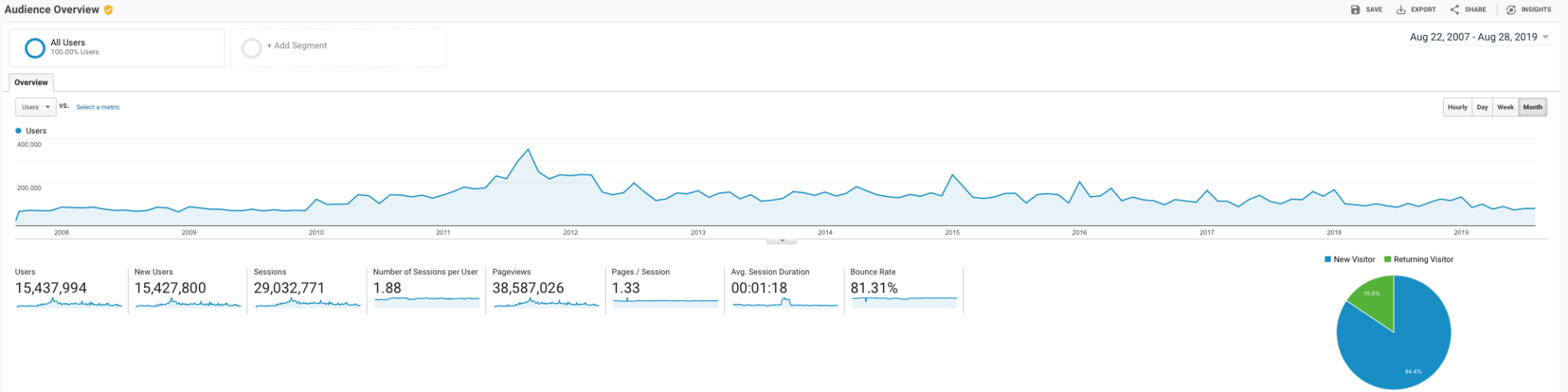

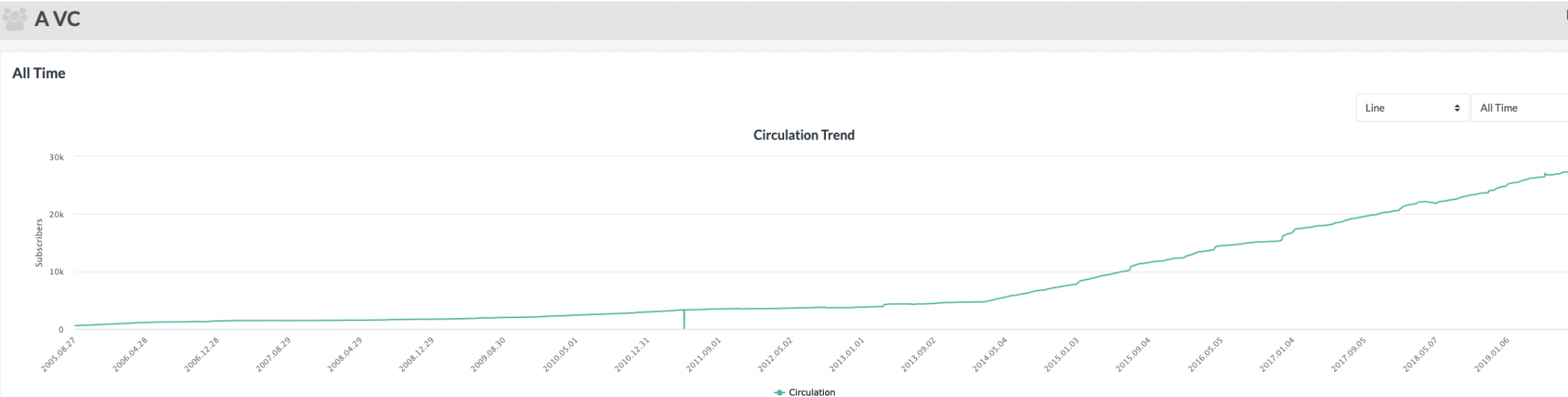

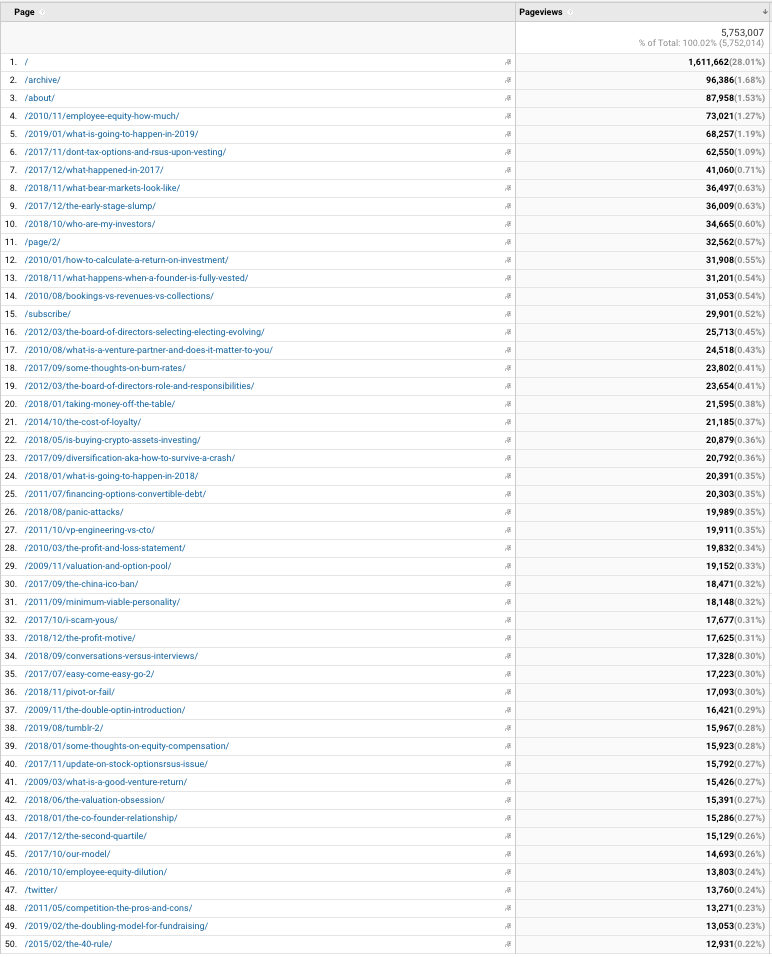

As I’ve been working on a new design and approach to this blog/newsletter, I have been diving into the analytics to understand what all of you are doing with it.

Here are some charts and tables:

1/ The web traffic (desktop and mobile) has risen and fallen over the years, driven by SEO and other factors. MAUs peaked in the 2012/2014 period in the 300k range. It has settled in more recently at 80-100k a month.

2/ The email “newsletter” subscriptions have risen a lot in recent years. For much of AVC’s history, email was not a particularly popular way to read this blog, but in the last four or five years, it has grown a lot, to about 30k active email readers.

The top 50 blog posts of all time are an interesting bunch. Most of them have been written in the last five years, but there are a few that go back to 2009 and 2010.

Clearly there is a lot of value in the archive and I want to flesh that (and search) a lot more in the redesign.

It also want to make the email subscription work better. I have heard from many who read via email that it could be improved. So I will work on that.

Some crypto projects are developed from scratch. Bitcoin, Ethereum, and our portfolio company Algorand are examples of this. The developers have a vision and they go out and build it.

Other crypto projects evolve from something else. Kin and Props, both created by USV portfolio companies, are examples of that.

A particularly interesting example of the latter model is Numerai>Numeraire>Erasure. USV is an investor in Numerai which is a hedge fund that sits on top of the “The hardest data science tournament on the planet”.

Numerai initially developed the crypto token called Numeraire to allow data scientists to stake their predictions in the Numerai tournament and earn more compensation.

But as the Numerai tournament gained scale and the adoption of Numeraire grew, the Numerai team “realized that the primitives Numerai has built could have a wide range of applications beyond the tournament”.

And so they built the Erasure protocol which allows anyone to publish data and stake capital based on the accuracy of that information. This post explains some of the ideas behind the Erasure protocol.

The Erasure protocol is now live on the Ethereum Mainnet and you can build things on it. The Numerai team has already built two applications on Erasure:

Erasure Quantis a tournament used to crowdsource data on the Russell 3000 index. Participants submit daily price predictions on US stocks and are rewarded for contributing while building an immutable track record. Erasure Quant is a template that can be used by others to build their own tournaments.

ErasureBay is an open marketplace for information of any kind. It can be used to create credible signals over possession of local knowledge and attract a buyer willing to pay for it.

These crypto projects that evolve from something else are more focused and benefit from a real use case and market need. That does not make them more likely to succeed or more valuable. In the current market, almost all of the most valuable crypto projects are ones that started from scratch.

But I don’t think that will always be the case. Many of the most important technologies evolved from something else and I think that will be the case in crypto as well.

I have always felt that every investment in a venture fund should be able to return the fund.

That doesn’t mean that they all will.

In fact, for many funds I have worked on, only one or two investments work out well enough that each of them can return the fund.

So if you have a $100mm fund, you need to look at each and every investment and ask yourself if the company delivers on everything they are seeking to do will that return $100mm to your fund.

It’s a tall order and doesn’t happen that frequently.

But if it never happens, you won’t be in the venture capital business for long.

Five and a half years ago, I moved AVC from Typepad to WordPress and rolled out the design that we now have. It has worked incredibly well. It is low maintenance, easy on the eyes, and minimalist, all things I have come to appreciate in a blog.

But I am in the mood to change things up. Maybe it is the arrival of fall weather in the northeast, or watching my daughter and my colleagues at USV do redesigns and some envy as a result. Or maybe it is just time.

Here are the things I would like to achieve with the redesign:

I am not sure how long it will take for me to roll this out. I could get it done in a month. Or it could take me many months.

But it is on my mind and on my to do list too.

I remember when my son came home one day in high school and told me he wanted to “day trade” along with some friends who were doing it. We opened a TD Ameritrade account and staked him with a small amount of money, enough to trade but not enough that if he lost it all it would be an issue. And off he went.

A few weeks later he asked me “Dad, what is a PE ratio?” So I said to him “you know that deli that you stop in every morning and get a bacon egg and cheese on the way to school?” He said “yes”. I said “let’s say tomorrow the owner says to you, I’m selling the business, do you want to buy it? We make $1mm a year in profits and have for the last thirty years.” Then I said, “how much would you pay him for it?” My son thought about it and said “Four to five million dollars.” I asked him why. He said, “Because I would get my money back in four to five years and then make a million dollars a year after that.” I said, “you offered to pay a PE of 4 to 5.” And he said, “Oh, I get it.”

I like to call that kind of valuation “real value”. You pay $4-5mm for a business and you get your money back after a few years and then cash flow after that. While nothing in life is guaranteed, real value is tangible. You can see your way to realizing it. It’s right there in front of you.

Then there is what happens in early-stage investing. We offer $1mm for 20-25% of a company and value it at the same $4-5mm. But there is no cash flow. There is no revenue. There are no customers. There is no product. Just a few people and an idea. That is hypothetical value. We think “if this becomes worth a billion dollars, we might hold onto half of our initial ownership and end up with $100 million or more”. And we plunk down the money and go.

Here is the thing. A startup becomes a company and eventually, that company gets valued on real value metrics. Someday it will have customers, and revenue, and profits. And investors will think “how many years of profits will I be willing to pay for that company?” A PE ratio will be applied and it will be valued on the business fundamentals and not what can or could be.

Venture capitalists and seed funds and angel investors make or lose money on the journey from hypothetical value to real value. And when the spread between the two narrows, the money we make is less. When the spread increases, the money we make is more.

It is easier to drink your own Kool-Aid in the world of hypothetical values. You handicap the odds of winning more aggressively. You trade ownership for capital at work. You accept the new normal.

Real value doesn’t move so fast. Because it is right in front of you. You can see it. So it is not prone to flights of fancy.

I try to keep this framework front and center in my brain as we meet with founders and work to find transactions that work for everyone. I find it to be a stabilizing force in an unstable market.

Our portfolio company Sofar Sounds facilitates intimate live music experiences all over the world.

This video gives you a glimpse of what a Sofar is like:

You can go to a Sofar in your community, or you can go to one when you are traveling in a foreign country. Both are great experiences.

You can find a Sofar to go to here.

My friend Holly showed me this Kickstarter for a project she’s been working on for a while now.

POSITIVE EXPOSURE, founded in 1998, utilizes the arts, film and narratives to present the humanity and dignity of individuals living with genetic, physical, behavioral and intellectual differences.

And they are opening an art gallery in Harlem NYC to showcase works that celebrate these individuals.

I backed the project earlier this week and I am sharing it in case you want to back it too.

Our portfolio company Duolingo is known for their super popular language learning app. According to Wikipedia over 300mm people all over the world have used Duolingo.

Back in May 2014, Duolingo launched something called the Duolingo Test Center. The idea was to compete with expensive and inconvenient foreign language tests like TOEFL.

It makes sense. If you are in the business of helping people learn a foreign language, you might as well be in the business of helping people demonstrate their mastery of a foreign language.

But there is a “chicken and egg” problem in the foriegn language testing market. If you don’t have a lot of test takers, it is hard to get your test accepted by educational institutions and corporations. But if you aren’t accepted by educational institutions and corporations, it is hard to get anyone to take your test.

Duolingo has been patient, largely because they have a primary business that is doing incredibly well. Slowly but surely they have gotten institutions to accept their test.

I saw this tweet this morning from Luis, Duolingo’s founder and CEO:

Super proud that the Duolingo English Test (@DuolingoENTest) is now fully accepted as a proof of English proficiency at 10 of the top 20 US universities according to US News.

— Luis von Ahn (@LuisvonAhn) August 21, 2019

That is the kind of adoption that Duolingo’s tests need to become a standard.

And once you become a standard, you have a fantastic business, largely because it is so hard to accomplish that.

Many companies would have given up on a project like this. The payoff is too long and the effort too high.

But Luis has a personal interest in this offering. You can read about it in the blog post when he announced the service.

That is the power of founders on a mission. They can be patient and see things through that big companies never will.

There is a virtue in patience. You don’t see it that much in business. But it is powerful in the right hands.