CS Education Week

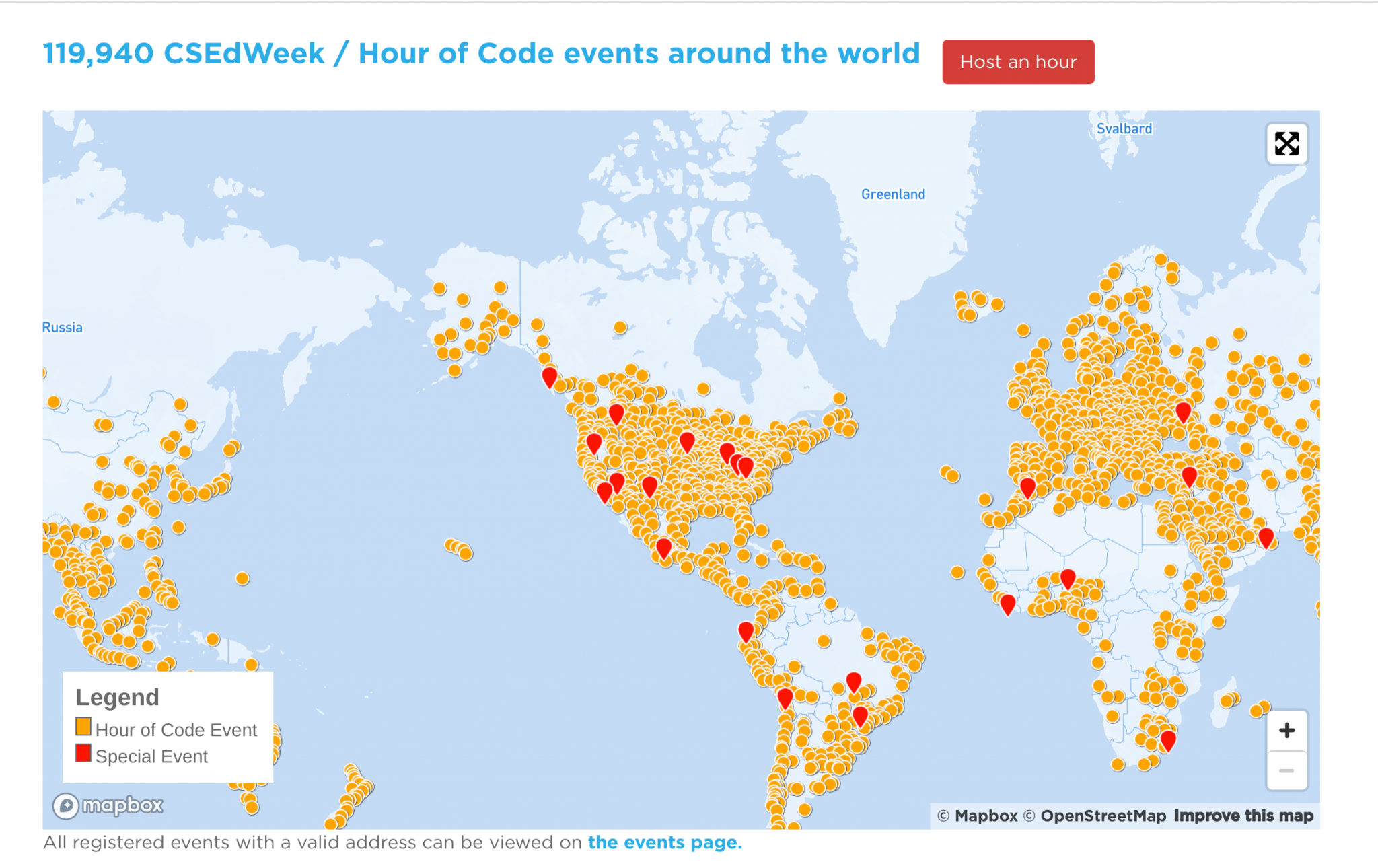

This week is CS Education Week. There are CS Education week events all around the world, mostly in schools where students will do an hour of coding.

In NYC, where I do most of my CS Education work, there are CS Education week events in many/most of the public school buildings this week.

As I could not be in NYC this week, I went onto Twitter this morning to see what is going on and saw this:

Hopscotch Coding at PS 306 @techstrodinaire #CSForAllNYC, #CSEdWeek, @CSForAllNYC pic.twitter.com/icY0MvNNS6

— Lucy (@Lucy64747316) December 9, 2019

I love Hopscotch Coding. Young students deconstruct the game of Hopscotch into the various moves and then lay out the code next to the Hopscotch game to show how they played it. This teaches students so many important skills at a very young age and doesn’t even require a computer.

Students from 196WBMS had a great start to Computer Science for all Week! We had the opportunity to code with Spencer Dinwiddie from the Brooklyn Nets! @NYCSchools @DOEChancellor @CSforAllNYC @MicrosoftEDU @BKNorthNYCDOE @SDinwiddie_25 @SuptWinnickiD14 @ExecSuptKWatts pic.twitter.com/qTUTYEeUNd

— P.S. 196 K (@196WBMS) December 10, 2019

Spencer Dinwiddie, the point guard from the Brooklyn Nets, went to PS 196 in Williamsburg and did an Hour Of Code with the students.

We started off our CS Week with a bang ✨ Our computer scientists collaborated together in plugged and unplugged stations integrating ELA, Math, and Science. #csforallnyc #HourOfCode #csedweek @CSforAllNYC @PS94DavidPorter pic.twitter.com/H1Os8kDhd7

— Elizabeth Kyrou (@KyrouMrs) December 9, 2019

Students at this school in Little Neck Queens did coding exercises in English, Math, and Science. One of the great things about CS is that it integrates so well into many different disciplines.

Celebrating CS Education Week in your school or your child’s school is a great thing to do and I encourage everyone to celebrate CS Education week by doing that this week.