Back in 2009, I wrote a post called The Venture Capital Math Problem.

I was reminded of it yesterday when I saw this tweet:

In that post, I argued that the venture capital business could not sustain more than $20bn a year of new capital coming into it and continue to produce good returns to the investors in VC funds.

The venture capital business has been raising north of $50bn per year for much of the last decade and so far, the returns continue to look quite good.

So what did I get wrong in my attempt to solve the venture capital math problem?

I think it set the problem up correctly but I got one assumption very wrong and it was this:

And I assume that the biggest exit each year is $5bn. Yes, it is true that some venture investments turn into businesses like Apple, Google, Microsoft that are worth $100bn and more. But it is also true that most VCs are long gone from those deals before the valuations get to that level. So for the sake of solving this problem, I’d assume the largest exit each year is $5bn and then you have a power law distribution of another 999 deals.

……..

I’ll assume that the biggest deal, $5bn, represents 5% of the total value of all 1000 exits and that the total value of all exits is $100bn per year.

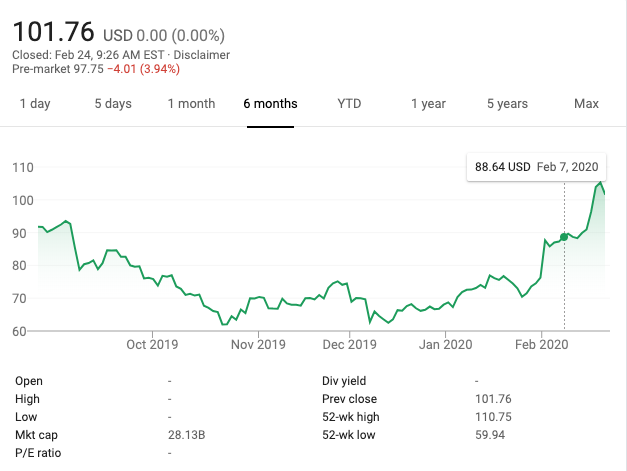

That was off by maybe an order of magnitude or more. Uber IPO’d at $70bn and still trades at north of $50bn. Zoom is now trading at $32bn. Out of the USV portfolio in the last decade we have Twitter at $26bn, Twilio at $16bn, and MongoDB at almost $10bn and a number of high quality public companies trading in the single digit billions.

I suspect that last paragraph that I quoted should read “the biggest deal, $50-100bn, represents 5% of the total value of all exits (likely north of 2000, possibly a lot more) and the total value of all exits is $1-2 trillion per year”

By that math, keeping all other assumptions, formulas, and math the same, the max that can be invested in VC is maybe as much as $100bn per year and we are still well below that level based on the numbers I am seeing.

So what did I learn from this mistake?

I learned that you can’t assume that the past is a predictor of the future. And I learned that it is helpful to ask yourself “what could go right?” instead of “what could go wrong?”

It is also true that the last decade has been one of incredibly low interest rates/cost of capital, and conversely very high PE and revenue multiples on growth stocks. And we have seen companies like Uber, Facebook, etc stay private much longer so the VCs have exited at much higher valuations than was once the case.

We cannot assume that will continue either and it may well be true that the $50bn-$100bn that is going into the venture capital business right now will not get the same returns that the $20bn that was going into the venture capital business in 2009 has gotten.

But regardless, I was dead wrong in that post back in 2009 and I have learned from it. As I have aged, I tend to underwrite to the upside not the downside. That has not been my nature but I have learned that it works better, particularly in the VC business.

Finally, I do not regret writing that post one bit. As I replied to Ben’s tweet when I saw it: