Giving Tuesday

I’m not much for the shopping mania that happens on Black Friday and Cyber Monday, but I do like the idea of taking a day at this time of year to give back. Today is that day.

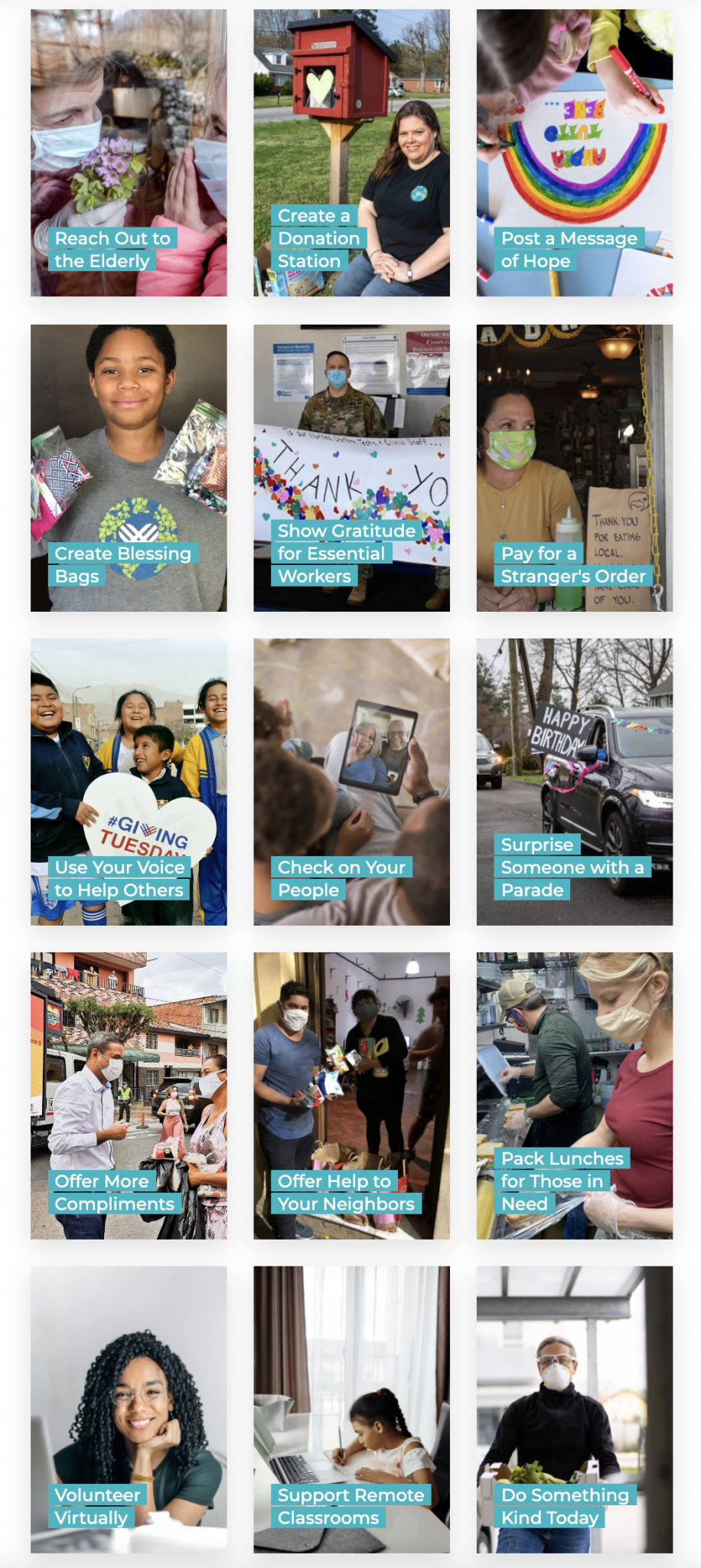

This year is a particularly hard year for so many and so giving back, if you can, is even more important. The Giving Tuesday website suggests things like offering help to your neighbors, supporting a virtual classroom, reaching out to the elderly, and many more ideas that don’t require a financial donation.

If you do want to make a financial gift, there are many places to go online, including our portfolio company GoFundMe.

For those of us who have even more to give, I strongly encourage creating a family foundation and making giving back something you institutionalize in your life. Many of us in tech, startups, and venture capital find ourselves with large stock positions with very low cost basis. One of the very best things one can do with highly appreciated stock is to donate it to a family foundation and use those funds to support causes that matter to you and your family. We were encouraged to do that over twenty years ago and we did it and it has been a source of great joy and discovery and learning for us.

So no matter what level of giving you are able to do today, I encourage you to do something. It will help others and it will also do some good for you too. We are in a very difficult moment and giving back is a great way to lighten your load just a little bit.