The Range Anxiety Weekend

Electrified cars were greater than 10% of the US market in 2021 and EVs were about 5%. EV sales are growing at nearly 100% YOY and could reach 25% of the US market in a few years. This is good news for the effort to reduce our dependence on fossil fuels. But there are still challenges for the EV market.

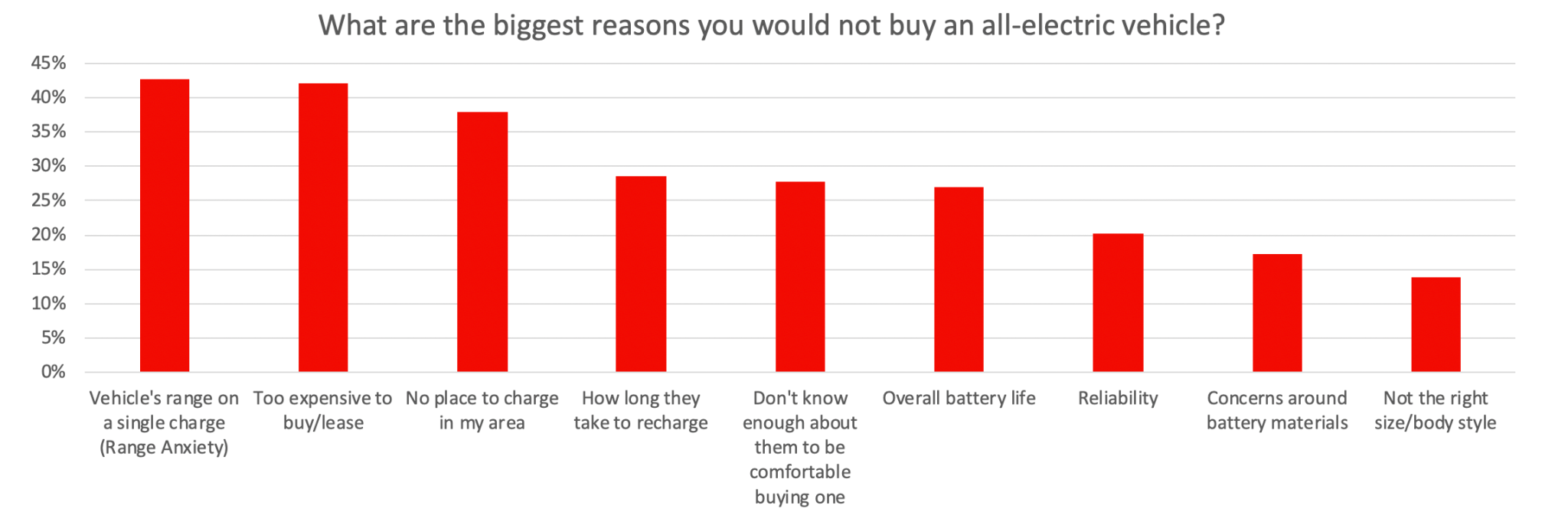

Range anxiety and charge times are among the top reasons that consumers avoid EVs.

The Gotham Gal and I have owned EVs for eight years now and have struggled with a few of these issues. But we continue to buy EVs and prefer them to gas-powered cars.

This past weekend, we took a five-hour road trip with our brother and sister-in-law. We each drove our own cars, both EVs. We drove our eight-year-old original Tesla Model S. They drove a Volvo XC40. We ran into a number of challenges that led us to call this road trip our “range anxiety weekend.”

The first issue that arose is that our destination was slightly beyond the range of both of our cars. We needed about 250-260 miles to get to our destination and we both had about 240 miles of range. So we selected a stop for lunch that had EV charging stations.

Fortunately, when we arrived for lunch, both charging stations were free. They were the only charging stations that we could find in this small town. If either had been taken, we would not have been able to charge during lunch and would have had to go on a charging station hunt after lunch.

We had a leisurely two-hour lunch and when we got back to our cars, we had each gotten another forty miles. That was enough to get to our destination so off we went. We did get to our destination with some spare battery but both of us were below twenty miles when we arrived.

The hotel we stayed out told us they had EV charging stations, but it turns out what they had were two Tesla charging stations and we could not find an adapter to charge the Volvo XC40 on the Tesla charger. So the Gotham Gal and I charged our Tesla both nights at the hotel but our brother and sister-in-law were not able to do that.

The next morning we went on an EV charging station hunt and found an Electrify America fast-charging station which took the Volvo XC 40 from empty to full in about two hours. We left that car charging for most of the day and toured the area in our Tesla.

We charged our Tesla again overnight at our hotel and we both had full batteries for the drive back. We picked another lunch destination halfway home that had charging stations and started the trip back.

While the lunch destination on the way home did have both Tesla and non-Telsa chargers, the charging rate was so slow on them that we were not able to get enough additional mileage over lunch to make it home. So the Gotham Gal and I headed to a Telsa Supercharging Station and in about ten minutes got another fifty miles and then made our way home.

Our brother and sister-in-law had to find a fast charger in town and did but it was not easy. And it took a fair bit longer for them to get the extra fifty miles they needed to get home. But get home they did and the range anxiety weekend ended without any major issues.

But here is what we learned from this trip about the availability of charging stations on the road in California:

- When hotels and restaurants say they have EV chargers, they mostly mean Tesla proprietary charging stations that you need an adapter to use if you are driving something other than a Tesla.

- When you are on the road, you need fast charging stations. The slow variety, which is mostly what is out there, only work for an overnight charge. So they are OK for a hotel but not for anything else.

- Tesla has done an incredible job with their supercharging stations. Range anxiety is a signficantly reduced issue if you drive a Tesla.

- While Electrify America is doing a nice job of buildling out fast charging stations for non Telsa EVs, their charging stations are signficantly slower than Tesla’s superchargers and they are not nearly as prevalent.

Given that range anxiety and charge times are among the top reasons that consumers don’t purchase EVs, it would make sense for the automobile industry to come together and standardize charging outlets and invest heavily in fast (super fast) charging stations. Telsa can likely get away with its own charging network and charging outlets, but everyone else cannot. I don’t understand why this is not a bigger priority for the industry. It needs to be.