Video Of The Week: Rutger Bregman on Basic Income

A lot of people were buzzing about Rutger Bregman‘s talk on Basic Income at this year’s TED. While that talk is not yet online, here is Rutger’s talk from a TEDx a couple years ago.

A lot of people were buzzing about Rutger Bregman‘s talk on Basic Income at this year’s TED. While that talk is not yet online, here is Rutger’s talk from a TEDx a couple years ago.

Mankind has been inventing new ways to organize and govern since we showed up on planet earth. Our history is a gradual evolution of these organization and governance systems. Much of what we are using right now was invented in ancient Greece and perfected in western Europe in the 17th, 18th, and 19th centuries.

I have been thinking for some time that we are on the cusp of something new. I don’t know exactly what it will be but I think it will be inspired by the big technological innovations of the late 20th century and early 21st century and it will be based on decentralized and self-organizing systems.

The Internet is, at its core, a scaled decentralized system. Its design has been a resounding success. It has scaled elegantly and gradually to well over 2bn users over fifty years. No central entity controls the Internet and it upgrades itself and scales itself slowly over time.

Open source software development communities are also an important development of the past fifty years. These communities come together to create and maintain new software systems and are not financed or governed by traditional corporate models. The goals of these communities are largely based on delivering new capabilities to the market and they don’t have capitalist based incentive systems and they have shown that in many instances they work better than traditional corporate models, Linux being the best example.

And, for the past decade or so, we have seen that modern cryptography and some important computer science innovations have led to decentralized blockchain systems, most notably Bitcoin and Ethereum. But there are many more to study and learn from. These blockchain systems are pushing forward our understanding of economic models, governance models, and security models.

I think it is high time that political scientists, philosophers, economists, and historians turn their attention to these new self-organizing and self-governing systems. Maybe they have and I am not familiar with the work. If so, please point me to it. If not, maybe this post and others like it will be an inspiration for the liberal arts to catch up to the computer scientists and mathematicians or at least work closely with them to figure out what is next, to articulate it and put it in the context of other governance and economic systems. From that work can come progress that mankind needs to move beyond the current systems, which work, but have many flaws and are becoming stale and in need of an upgrade.

Watching Amazon take home two Oscars last night brought home the point that they are a juggernaut, a massive business capable of throwing its weight behind all sorts of new businesses.

It turns out these superstar firms, not robots, may be the most important economic issue right now.

This piece from the Economist argues that taxing robots is a bad idea but figuring out how to deal with these superstar firms who are accumulating much of the profits in our economy is a good idea. Here’s the money quote:

A new working paper by Simcha Barkai, of the University of Chicago, concludes that, although the share of income flowing to workers has declined in recent decades, the share flowing to capital (ie, including robots) has shrunk faster. What has grown is the markup firms can charge over their production costs, ie, their profits. Similarly, an NBER working paper published in January argues that the decline in the labour share is linked to the rise of “superstar firms”. A growing number of markets are “winner takes most”, in which the dominant firm earns hefty profits.

Something to ponder.

In my work to prepare for the Future of Labor conversation we had at NewCo Shift a few weeks ago, I talked to a number of experts who are studying job losses due to automation and thinking about what might be done about it. Two ideas that came up a number of times were the “robot tax” and the “basic income.”

The ideas are complementary and one might fund the other.

At its simplest, a “robot tax” is a tax on companies that choose to use automation to replace human jobs. There are obviously many variants of this idea and to my knowledge, no country or other taxing authority has implemented a robot tax yet.

A “basic income” is the idea that everyone receives enough money from the government to pay for their basic needs; housing, food, clothing so that as automation puts people out of work we don’t see millions of people being put out on the street.

What is interesting about these two ideas is that some of the biggest proponents of them are technology entrepreneurs and investors, the very people who are building and funding the automation technologies that have the potential to displace many jobs.

It is certainly true that we don’t know that automation will lead to a jobs crisis. Other technological revolutions like farming and factories produced as many new jobs as they wiped out and incomes increased from these changes. Automation could well do the same.

But smart people are wondering, both privately and publicly, if this time may be different. And so ideas like the robot tax and the basic income are getting traction and are being studied and promoted.

The latest proponent of a robot tax is Bill Gates who said this about it:

You ought to be willing to raise the tax level and even slow down the speed. That’s because the technology and business cases for replacing humans in a wide range of jobs are arriving simultaneously, and it’s important to be able to manage that displacement. You cross the threshold of job replacement of certain activities all sort of at once.

There is a lot of economic surplus that could come from automation. Let’s look at ride sharing. Today I pay something like $15 to go from my home to my office in the morning. Something like $10 of that ride is going to the driver. If the ride is automated, either the price goes to $5, saving me $10 a ride which then is surplus to me, or the profit that Uber is making goes up significantly, which is surplus to them. Some of both is likely to happen. This surplus could be taxed, either at the company level or the individual level, so that the cost of the ride doesn’t go down nearly as much and the driver can continue to compete with the robot or the driver can collect some basic income, funded by the robot tax, while they find a new line of work.

At least that is the idea.

I would not characterize myself as a proponent of a robot tax or a basic income. But I find these ideas interesting and worth studying, debating, discussing, and testing at a small scale to understand their impacts. We should absolutely be doing that.

Happy New Year Everyone. Yesterday we focused on the past, today we are going to focus on the future, specifically this year we are now in. Here’s what I expect to happen this year:

These are my big predictions for 2017. If my prior track record is any indication, I will be wrong about more of this than I am right. The beauty of the VC business is you don’t have to be right that often, as long as you are right about something big. Which leads to going out on a limb and taking risks. And I think that strategy will pay dividends in 2017. Here’s to a new year and new challenges to overcome.

I am bothered by the ongoing discussion about how the US has allowed China (and other lower cost countries) take our manufacturing jobs. That is true, of course. But it does not address the larger context which is that manufacturing is becoming more and more automated and many of these jobs will not exist at all anywhere in a few more decades.

We are now well into a transition from an industrial economy to an information economy. It seems to me that part of that transition was the move of industrial jobs to lower and lower cost regions in an ongoing march to reduce costs. But that march may end with massive automation and very little labor in the manufacturing process. That means that these low cost regions that “stole our jobs” will also lose these jobs eventually.

The US and a number of other countries around the world are building new information based economies. That is the long term winning strategy.

So while we can critique our leaders (business and political) for giving up on the manufacturing sector a bit too early, I think the US has largely played this game correctly and will be much better off than the parts of the world that have taken the low cost manufacturing jobs from us.

But we don’t hear any of our political leaders explaining this. I wish they would.

My partner Albert talked about the future of work at the DLD conference last week. Here’s the video of it.

Last year in my What Just Happened post, I said:

the social media phase of the Internet ended

I think we can go further than that now and say that sometime in the past year or two the consumer internet/social/mobile gold rush ended.

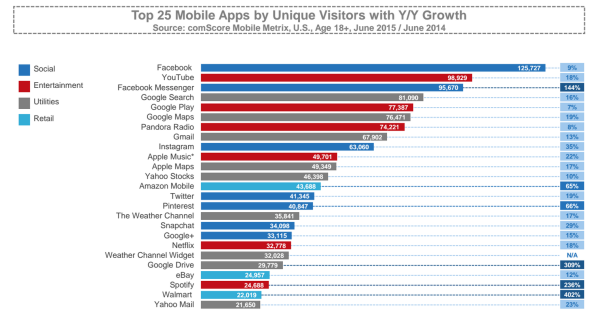

Look at the top 25 apps in the US:

The top 6 mobile apps and 8 of the top 9 are owned by Facebook and Google. 10 of the top 12 mobile apps are owned by Apple, Facebook, and Google.

There isn’t a single “startup” on that list and the youngest company on that list is Snapchat which is now over four years old.

We are now well into a consolidation phase where the strong are getting stronger and it is harder than ever to build a large consumer user base. It is reminiscent of the late 80s/early 90s after Windows emerged as the dominant desktop environment and Microsoft started to use that dominant market position to move up the stack and take share in all of the important application categories. Apple and Google are doing that now in mobile, along with Facebook which figured out how to be as critical on your phone as your operating system.

I am certain that something will come along, like the Internet did in the mid 90s, to bust up this oligopoly (which is way better than a monopoly). But it is not yet clear what that thing is.

2015 saw some of the candidates for the next big thing underwhelm. VR is having a hard time getting out of the gates. Wearables and IoT have yet to go mainstream. Bitcoin and the Blockchain have yet to give us a killer app. AI/machine learning has great potential but also gives incumbents with large data sets (Facebook and Google) scale advantages over newcomers.

The most exciting things that have happened in tech in 2015 are happening in verticals like transportation, hospitality, education, healthcare, and maybe more than anything else, finance, where the lessons and playbooks of the consumer gold rush are being used with great effectiveness to disrupt incumbents and shake up industries.

The same is true of the enterprise which also had a great year in 2015. Slack, and Dropbox before it, shows how powerful a consumerish approach to the enterprise can be. But there aren’t many broad horizontal plays in the enterprise and verticals seems to be where most of the action was in 2015.

I’m hopeful that 2015 will also go down as the year we buried the Unicorn. The whole notion that getting a billion dollar price tag on your company was something necessary to matter, to be able to recruit, to be able to get press, etc, etc, is worshiping a false god. And we all know what happens to those who do that.

As I look back over 2014 and 2015, I feel like these two years were an inflection point, where the underlying fundamentals of opportunity in tech slowed down but the capital rushing to get invested in tech did not. That resulted in the Unicorn phase, which if it indeed is over, will be followed by an unwinding phase where the capital flows will need to line up more tightly to the opportunity curve.

I’m now moving into “What Will Happen” which is for tomorrow, so I will end this post now by saying goodbye to 2015 and hopefully to much of the nonsense that came with it.

I did not touch on the many important things that happened outside of tech in 2015, like the rise of terrorism in the western world, and the reaction of the body politic to it, particularly here in the US with the 2016 Presidential campaign getting into full swing. That certainly touches the world of tech and will touch it even more in the future. Again, something to talk about tomorrow.

I wish everyone a happy and healthy new year and we will talk about the future, not the past, tomorrow.

Last year, I ended 2014 with What Just Happened and started 2015 with What Is Going To Happen.

I’ll do the same tomorrow and friday, but today I’d like to talk about What Didn’t Happen, specifically which of my predictions in What Is Going To Happen did not come to be.

Here’s a shot of the app store a couple days after the kids got new phones for Christmas.

Here’s a shot of the app store a couple days after the kids got new phones for Christmas.So I got four out of eleven dead wrong.

Here’s what I got right:

Here’s what is less clear:

So, I feel like I hit .500 for the year. Not bad, but not particularly impressive either. But when you are investing, batting .500 is great because you can double down on your winners and stop out your losers. That’s why it is important to have a point of view, ideally one that is not shared by others, and to put money where your mouth is.

When one looks back over the history of the development of the modern economy from the agricultural age, to the industrial age, to the information age, the development of a strong labor movement has to be one of the signature events. Capitalism, taken to its excesses, does not allocate economic value fairly to all participants in the economic system. The workers, slaving away to build the railroad, the skyscraper, etc, provide real and substantial value to the overall system and yet, because they are commodified and interchangeable parts, they don’t always get their fair share of the economic value they help to create. So the labor movement provides the market power that each worker individually cannot provide.

The emergence of the middle class in the developed world in the 19th and 20th centuries has as much to do with the emergence of a labor movement as it has to do with anything. And a growing middle class in turn drove economic development as the obtained earning power was spent on needs like homes, cars, education, etc.

I am a fan of the idea that labor needs a mechanism to obtain market power as a counterbalance to the excesses of markets and capitalism. I think we can look back and see all the good that has come from a strong labor movement in the US over the past 150 years.

However, like all bureaucratic institutions, the “Union” mechanism appears anachronistic sitting here in the second decade of the 21st century. We are witnessing the sustained unwinding of 19th and 20th century institutions that were built at a time when transaction and communications costs were high and the overhead of bureaucracy and institutional inertia were costs that were unavoidable.

One has to think “if I were constructing a labor movement from scratch in 2015, how would I do it?” My colleague Nick Grossman coined the term “Union 2.0” inside our firm to talk about all the organizing tools coming to market to assist workers in the “gig economy.” But I think Union 2.0 is way bigger than the gig economy. The NY Times has a piece today on workers in a carwash in Santa Fe organizing outside of the traditional union system. One can imagine leveraging technology, communications, and marketplaces to allow such a thing on a much larger scale.

I don’t know how much the traditional union system taxes workers to provide the market power they need. But if its like any other hierarchical system that we are seeing replaced by networks and markets, the take rates are in the 20-40% range and could be lowered to sub 5% with technology.

That’s a big deal. And I suspect we will see just that happen in my lifetime. I sure hope so.