Read Write Own

Chris Dixon, who leads the A16Z crypto fund, and has been an entrepreneur, VC, and friend of mine for over twenty years, has written a book called Read Write Own that is available for pre-order now and will start shipping at the end of the month. Chris gave me a copy right before the holidays and I read it over the last week.

I asked Chris why he wrote the book and he had two answers, one personal and one practical. The personal one is “I have focused my career on investing in blockchain networks. During the recent downturn, I felt a need to rearticulate to myself why I am doing that.” The practical one is “I want to explain blockchain networks to young adults who are thinking about where to start their careers, to the mother of the software engineer at Coinbase who wants to understand what her child is working on, and to lawmakers and regulators in DC who need to understand why they are important.”

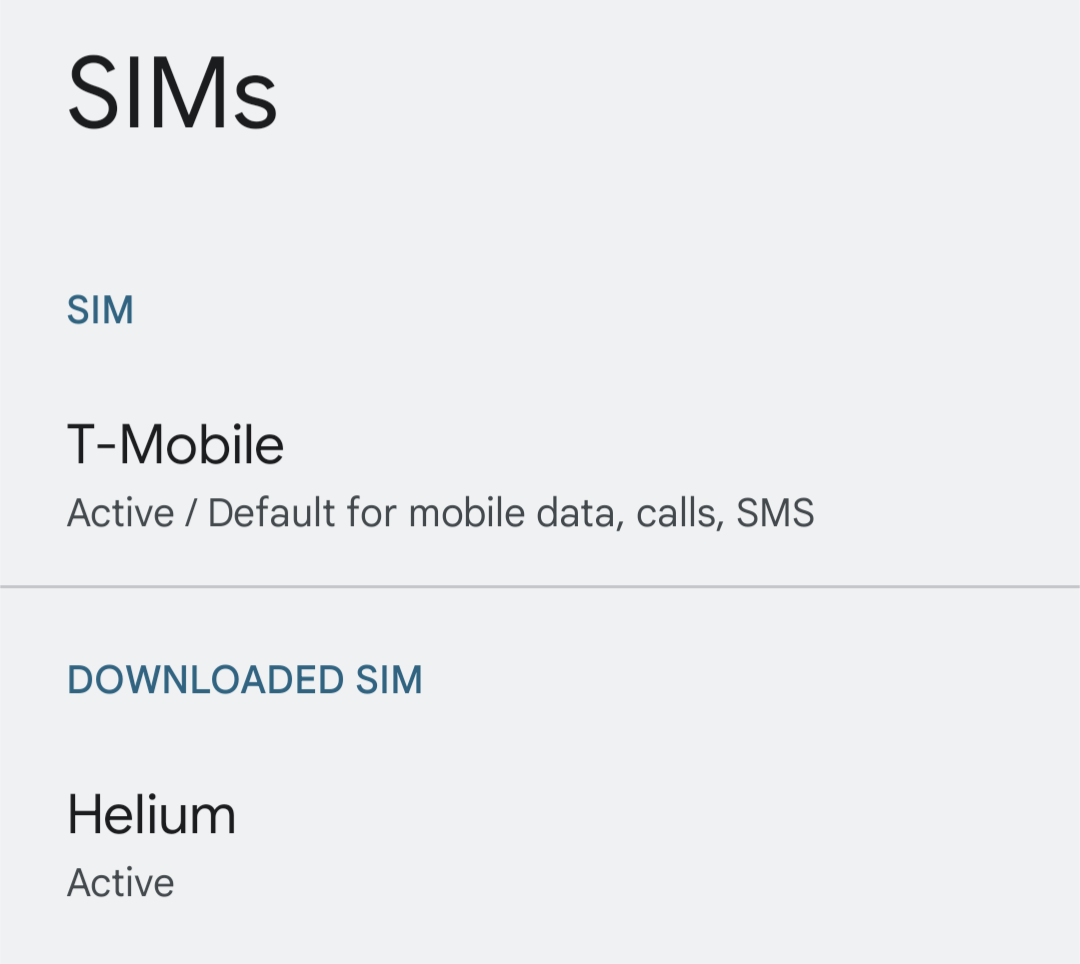

What Chris calls Blockchain Networks, I call Web3. The term Web3 is important to me because my investing career first took meaning during the initial phase of the web, which I think of as Web1. It took off during the second phase of my career which many call Web2. And I’ve spent the last decade of my career imagining what a better version could be, which I call Web3.

Chris takes the same journey but he calls these phases Read, Write, and Own. The initial phase of the web, when the web browser arrived, was mostly a reading experience. Then in the early 2000s, the web became two-way and we could Read and Write. What Blockchain Networks have unlocked is the ability to own things on the web. You can own your identity. You can own your social media posts. You can own your money. You can own your art. You can own your music. And so on and so forth.

Chris’s book has three parts. The first part is a history of the web and how we got to where we are right now. The second part is a detailed description of what makes Blockchain Networks work and why they are important and powerful. The third and final part is a series of descriptions of new kinds of applications that are being built on Blockchain Networks.

While I enjoyed all three parts of the book, I was energized by the final section. Chris imagines a future that is very different from where we are today. It is one I very much want to see emerge. I think you will too.

You can pre-order Read Write Own here.I encourage you to do that. I expect you will turn that last page and be excited, like I am, about what is coming now that we can own the Internet instead of it owning us.