The Founder Resolve

Investing in founder-led businesses is comforting to me. They have the ability to see the forest through the trees and do what is necessary to evolve the business.

Two great examples of this are Microsoft in the mid 90s and Facebook a decade ago.

Microsoft had spent more than a decade competing and winning the desktop software market and then Netscape came along and presented an entirely new market opportunity that had both major upside and major downside for Microsoft. Microsoft reacted by moving aggressively to compete with Netscape by launching Internet Explorer and using its desktop software dominance to establish IE as the dominant browser by the end of the decade.

Facebook had spent about a decade competing and winning the social networking market and then Apple launched the iPhone and new mobile social networks like Instagram emerged that both threatened Facebook’s existing dominance and also presented new large opportunities in social networking. Facebook went on a year-long effort to become a “mobile-first” company and also acquired Instagram that year. This all happened in Facebook’s first year as a public company.

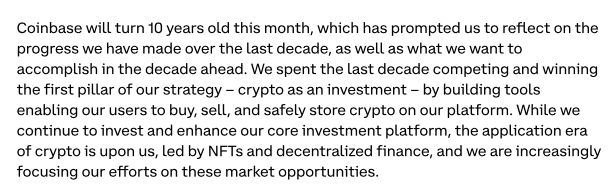

I was thinking about that because as many are wringing their hands about the collapse of crypto prices and stock prices and cutting back costs and playing defense, Coinbase announced yesterday that they are investing heavily in the next wave of web3:

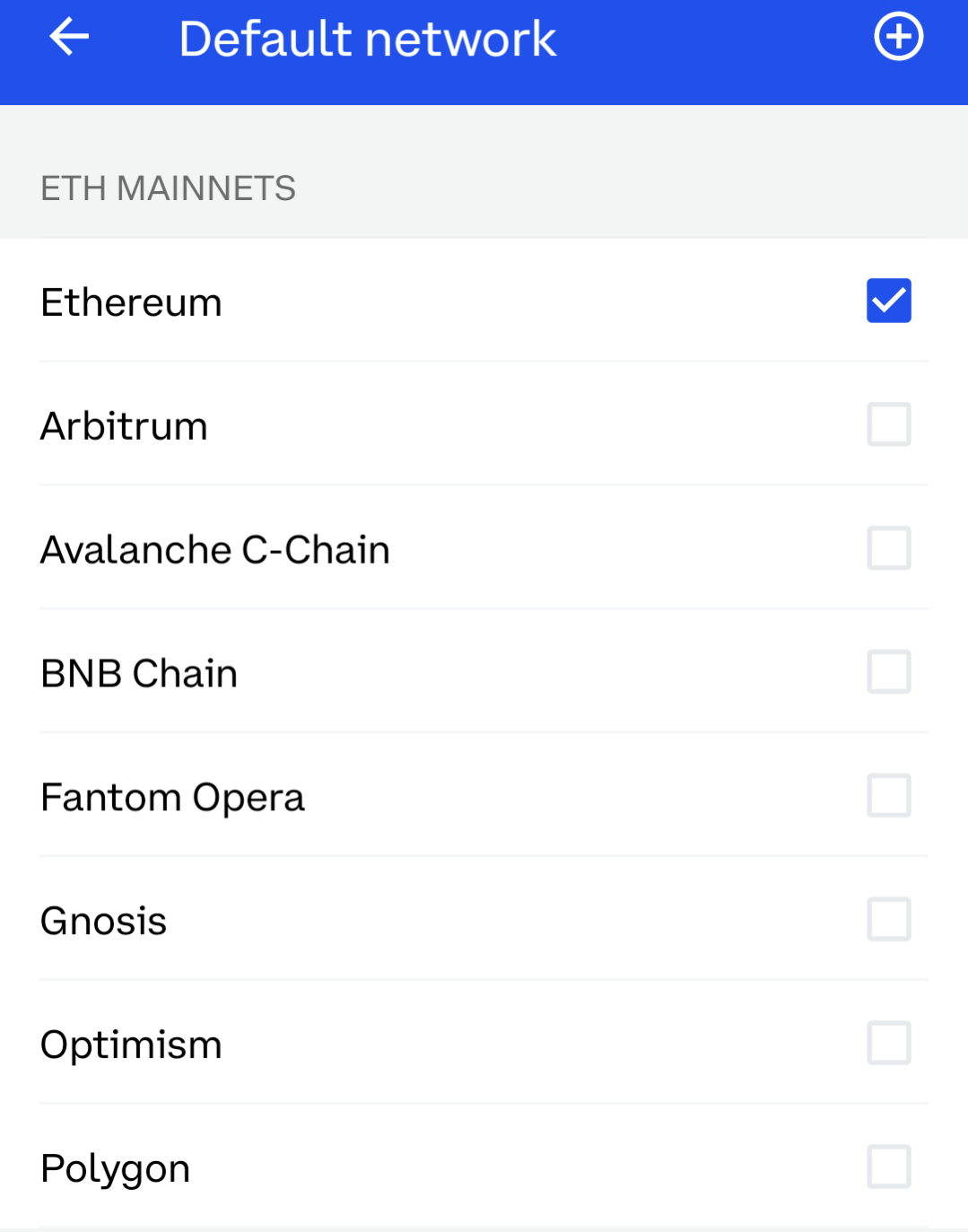

The application era of crypto is upon us and products/companies like Metamask and OpenSea are showing how important and lucrative that market is. Coinbase has reacted by making huge new bets on Coinbase Wallet and Coinbase NFT and is committed to winning in those markets like it did in the investment era of web3.

It is very hard to do this sort of thing when your stock price is under pressure and when the markets are in free fall. And yet that is what leaders must do when new use cases emerge and present themselves as both an opportunity and a threat.

Disclosure: I am a Director of and our family is a large shareholder of Coinbase.