BillGuard

I love it when entrepreneurs take a trick from one market and apply it to another. The founders of BillGuard have done that with credit card fraud. They took the lessons from the anti-virus and anti-spam markets and apply it to your credit cards.

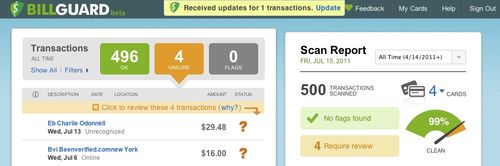

I just signed up for BillGuard and put four credit cards on the service. They asked me for my credit card website logins, I provided them, and they took down all the transactions and showed me this screen:

They list all the transactions that they think could be problematic. Clearly the $29.86 charge by Charlie O'Donnell is problematic. I'll have to look into that one!

But on a more serious note, I see this recurring $16 transaction for Been Verified. I am sure I signed up for that service at some point to check it out for some reason. But at this point, I'm not using it and I should turn it off.

BillGuard is great for exactly this kind of thing. And it may also help with truly fraudulent transactions. I haven't run into any of them yet on my four cards.

BillGuard is taking a number of tricks from the anti-virus and anti-spam markets and applying them to credit cards. They have a database of merchants and know which ones have a bad reputation. They also take all the data from the users interacting with the service and use it to build enhanced reputation data. That is exactly how they do it in the ant-spam market.

The more users BillGuard gets, the better their data gets, and the better the service gets. That's why I encouraged BillGuard's CEO Yaron Samid to make the service free for all the cards you put on the service onstage at TechCrunch Disrupt. Turns out they took that advice and will monetize the service in other ways. I think that's great for users and great for BillGuard too.

If you worry that you are paying recurring charges on your credit cards that you don't need and that you may have fraudelent charges on your cards you don't know about, then BillGuard is for you. Check it out.