Mobile Is Where The Growth Is

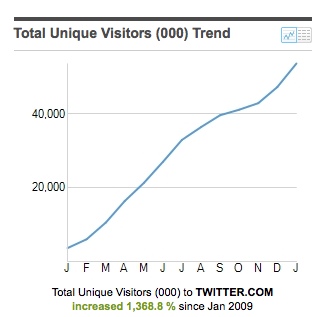

If you look at any of the top web properties on comScore, Quantcast, Alexa or any other third party reporting service you will see that they all have been fairly flat over the first half of the year. You might think that all these big web services are flatlining.

We have seen this in our portfolio too. From board meeting to board meeting, we are seeing a similar pattern. Web is flattish. But mobile is growing like a weed.

I alluded to this in a post last week where I wished for an aggregated audience measurement service across mobile and web.

There is a significant shift going on this year, much more significant than we saw last year, from web to mobile. It is most noticeable in games, social networking, music, and news, but it is happening across the board and it presents both great opportunity and great challenges.

Mobile native services like Foursquare & Instagram have the most to gain from this transition. Big feature rich web apps like Facebook and Google have the most to lose from this transition.

Mobile does not reward feature richness. It rewards small, application specific, feature light services. I have said this before but I will say it again. The phone is the equivalent of the web application and the mobile apps you have on your home screen(s) are the features.

That is why Facebook should (and it looks like will) break its big monolithic web app into a bunch of small mobile apps. Messenger, Instagram (not yet owned by Facebook), and Camera are the model for Facebook on mobile.

User experience is not the only big change/challenge for companies trying to navigate this transition. Monetization is different too.

Approaches like display advertising don't work as well on mobile as they do on the web. And they don't work that well on the web. ARPUs (avg revenue per user) on mobile are lower for display based revenue models on mobile across the board.

On the other hand, commerce works great on mobile if you have a well integrated (one click) purchase experience. The freemium model (whether it is virtual goods in games, in app upgrades, or something else) works very well on mobile.

If you are going to operate a media model on mobile, look at Twitter's model for inspiration. The ads are the default content object (the tweet) and are delivered right in the primary user experience (the feed/timeline). It's not surprising that more than half of Twitter's ad revenue is coming from mobile.

All of this is good news for entrepreneurs since they are in the best position to take advantage of all of these changing dynamics. It is not as good news for those who find themselves operating a big Internet business started more than five years ago. You are going to need to make a hard right turn super fast without flipping over the car.

In the past fifteen years, we have seen Microsoft go from being an unstoppable force to being a non-factor in many important new markets, we have seen Google go from being an unstoppable force to being a non-factor in many important new markets, and I suspect we are going to see Facebook struggle with the same thing. RIM is dying quickly now. Yahoo! is a question mark.

In technology the more things change, the more the stay the same. You cannot ever rest. Because the big change that is going to upset your nice apple cart is right around the corner. Today that is mobile. Tomorrow, who knows? I am trying like hell to figure out what that will be and jump on it. Because that's how you play this game.