How To Be In Business Forever: Week Two

First we'll take care of some logistics and then we'll get to the post of the week in my Skillshare Class on sustainability in business.

Office hours will take place at 6pm eastern today. The link to the hangout is here. I don't like the way office hours worked last week and so I am changing them up. I will start by asking people to post questions in this discussions section. Then I will review a few business model canvas projects live for everyone to see. Then I'll finish up the 30 minute session by answering as many questions as possible while time lasts.

There are roughly 80 business model canvas projects posted so far. You can see them here. Since I will only be able to review a few of them today in office hours, it would be great for anyone who is taking this class to stop by and pick a few to give comments on.

If you are looking for a web-based tool to build and share your business model canvas, this thread mentions several of them.

OK. Now that we are done with the logistics, I will move on to my second post in this series.

—————————————————————————————

Last week we talked about long term thinking vs short term thinking. But sometimes, no matter how long term you are thinking, things happen that you didn't plan for and they can impact your business. Actually, this always happens. And that is when you need to adapt.

You will not stay in business forever if you don't adapt to changing market conditions. This doesn't mean adopting the "business model of the hour" model and this doesn't mean pivoting either. What I am talking about is the once every few years "oh shit moment" when you realize that the path you are on isn't going to work in a year or two and that you need to make some changes.

This is a frustrating realization. I have a good friend who has been running a business for more than a decade. He told me a few weeks ago that he thinks the market he has been operating in is changing and it is starting to impact his business. And just when he had everything firing on all cylinders.

That's how it is in business. Just as you are taking the victory lap for the kickass execution you and the team have delivered, the track takes a tilt and things start getting harder. Businesses don't operate in a vacuum. They operate in a dynamic ever changing market that is going to make things difficult for you, especially if you want to be in business forever.

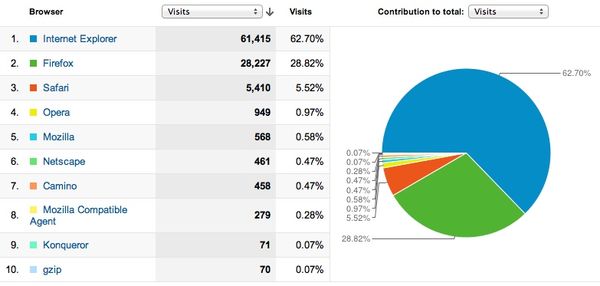

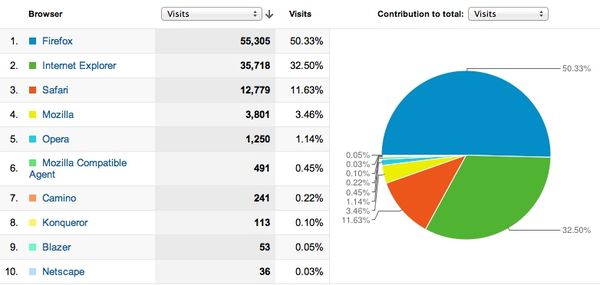

I think some examples will help. The one that comes to mind front and center is Microsoft. By the middle of the 1990s, Microsoft had it all. They had a dominant share in desktop operating systems and a dominant share in desktop apps. They were literally printing money. Then the commerical internet happened. Netscape showed up. And Microsoft's market changed, forever.

Microsoft did adapt. They built Internet Explorer in reaction to Netscape and then used their desktop dominance to push it into the market, hurting Netscape so badly that it had to sell to AOL. That got Microsoft into trouble with the Justice Department and they were investigated as a result.

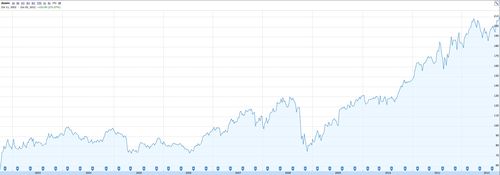

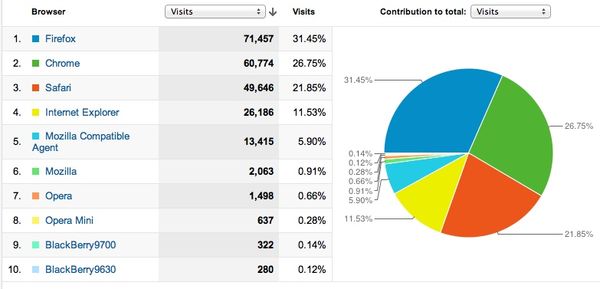

But what Microsoft didn't see in 1995 was Google because it didn't exist. And they didn't see the emergence of cloud based productivity apps because they didn't exist. In hindsight, it is pretty easy to see how fundamentally transformed Microsoft's business has been by the Internet and it is also pretty easy to see that they have not been able to adapt sufficiently to maintain any semblance of the dominance they had in the mid 90s. This stock chart tells you everything you need to know about what the Internet did to Microsoft. They may be surviving but they are certainly not thriving.

Another great example is RIM. I don't even need to tell this story. Everyone knows that the dismissive tone and stance that RIM's management took toward the iPhone and what it represented was essentially the death knell of a great company. I suspect they wish their stock chart looked like Microsoft's.

But let's look at a more positive example. As Ron Ashkenas points out in this HBR article, IBM saw that the hardware market was changing and their competitive position in it was changing with it. They sold their PC hardware business in 2005 to Lenovo and doubled down on consulting and related services. Their stock chart tells the rest of this story.

Adapting doesn't always mean exiting a business that you decide has issues. You can also retool, reshape, and refocus the business. A company that I've worked with for more than a decade saw the industry it services go through some painful transitions in the 2008/2009 downturn. They built an entirely new line of products that service the growth part of the industry while working to maintain the older products through an orderly and gradual decline. It's been a difficult transition because it has meant that the company's top line hasn't grown during this transition. But the company is still in business and the new products are growing quite nicely.

Every situation is different and I don't have some "silver bullet" to help you all think about how to figure out when to adapt and when to stay the course. But I do have some observations. The comfort of a strong balance sheet (and a nice looking stock chart) is often your enemy not your friend in these situations. The most agressive CEOs I've seen in these situations are often the ones with less than a year of cash in the bank and survival instinct in full on mode.

Another observation is that getting your organization to adapt is harder than you might think. Organizations have inertia. The bigger they are the more inertia they have. If you think you need to adapt your business quickly, you will need to figure who is in the boat with you and who is not and make the changes you need, particularly on your senior team, to align the team with mission and get going.

Finally, you cannot be in adaptation mode all the time. If you map out long living successful businesses, you will see they go through periods of great stability followed by periods of great change and then move back into stability mode. You have to know when to get into which mode and you need to see each one through to its logical conclusion.

Given how hard all of this is, you might wonder if you really want to stay in business forever. The answer may be no. But even if it is no, you had better plan for and act like you do. Because I am certain that if you don't, you won't.