MBA Mondays: The Revenue Model Hackpad

The idea of peer producing a comprehensive web/mobile revenue model list was a success. The hackpad I created and linked to last week got a ton of contributions. I took the time this morning to clean it up a good deal. I will outline the high level changes I made in a bit. But since that hackpad is still wide open, I also made a final version and I have made it invitation only so I can control the edits this one gets. There may be a way in hackpad for the initial author to lock down a hackpad but I couldn't find it, so I did it this way.

So what edits did I make to the wide open hackpad? Well first, I tried to clean up the examples and make them as definitive as I could. The more well known a company/service is, the better example it is. I also took out many of the multiple examples. I think one is generally sufficient. I also took out the revenue models I thought were duplicative or slight variants of other revenue models. And there were a number of sections at the end that I would call "business models" as opposed to revenue models. So I took them out. Finally, there were a few entrepreneurs who were using this hackpad as a way to promote their companies. In effect, they were spamming the hackpad. I took out everything that felt like spam to me.

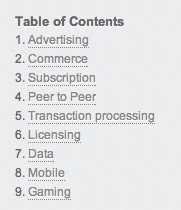

We are left with nine categories:

I think six of them are truly definitive revenue model categories (advertising, commerce, subscription, transactions, licensing, and data). The other three (peer to peer, mobile, and gaming) could be folded into the first six since they mostly map to existing models (mobile ads are ads). But these three categoris are unique in many ways and so I felt like leaving them in even though it's not as clean this way.

The "final" hackpad still needs work. There are some entries that are missing examples. I noted them with (??). There also may still be important or emerging business models we are missing. If you would like an invite to help fix the final version, please leave a comment to this post and I will invite you if I think your edit is useful.

My hope is by next week, we will have a truly definitive list of mobile and web revenue models and then I can use the list as a template for the MBA Mondays series on Revenue Models. Thanks for everyone's help on this.