Employee Equity: Appreciation

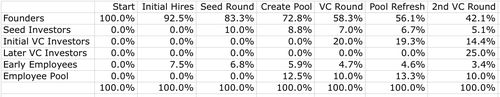

This is the third post in an MBA Mondays series on Employee Equity. Last week I talked about Dilution. This week I am going to talk about the antidote to Dilution which is Appreciation, specifically stock price appreciation.

When you start a company, on day one the stock is basically worthless. There are some exceptions to this rule such as a spinoff company where Newco is getting some valuable assets day one. However in the vast majority of cases, the value of a startup on day one is zero.

One of the objectives of an entrepreneur is to steadily increase the value of the business and the stock price.

At some point, the Company will generate revenues and earnings and can be valued using traditional valuation metrics like discounted cash flow and earnings multiples. But early on in the life of a startup it is trickier to value the stock.

Fortunately we have a marketplace for startup equity. It is called the venture capital business. Every time a startup raises capital, there is a competition between investors and a negotiation beetween the Company and the investors. Those two processes provide a mechanism to determine stock price.

There is a growing trend to finance the ‘seed stage’ of a startup’s life with debt, specifically convertible debt. One of the reasons I am not fond of convertible debt is that it obfuscates the equity pricing process. But that’s a digression.

So between the formation time when the stock price is most likely $0.01 per share (ie zero) and the time of exit at hopefully $100/share or more, there is a progression of price appreciation along the way marked by the progress of the business, financing events, and eventually revenues and earnings which lead to financial analysis.

If you are an entrepreneur or an employee in a startup who has equity as part of your compensation, it behooves you to understand the appreciation in the value if your equity.

One thing that you need to know is that the price doesn’t always rise. There can be setbacks in the business that lead to price declines. There can be setbacks in the capital markets that make all businesses less valuable including startups.

And if course your Company could fail in which case all of the employee equity will be worthless.

In the case of a startup that becomes a successful business, the price will appreciate over time. There can be price declines or long periods of price stagnation, but if you are patient and the business succeeds, the employee equity will appreciate over the long run.

There are some specific issues that require a deeper dive, including the impact of liquidation preferences and the role of a 409a valuation. I will tackle those issues in the comings weeks.