Tenacity

One of the things I admire most in companies and their leaders is tenacity. I don’t mean sticking with a failed idea for too long. That is a mistake I see a lot of entrepreneurs make in the Seed and Series A stages. That does nobody any good.

I mean years 5-10, or years 10-15, of building a company. I am talking about the period long past when you find product market fit, long past when you raise your first eight digit round, long past your first revenue check, maybe even long past your first profitable month.

Every successful company I have been involved in has gone through periods where things didn’t work, where something important took too long (a re-architecture project, an important business deal, a fundraising process) and the doubts start to creep in. Employees start to lose faith, the media turns cruel (sometimes deservedly so), and you’ve got to hold it all together. “You” is the founder, CEO, and/or the leading investors and board members.

Most of this holding it together falls on the founder and/or CEO. The investors and directors can help a lot during this period, and, conversely, they can hurt a lot too. An aligned founder, CEO, and board can make these rough periods go a lot easier. A misaligned founder, CEO, and board can be devastating.

So now I’m going to tell some stories to make my point more real.

Yesterday our portfolio company SoundCloud announced that they had finally concluded a licensing deal with the music industry’s largest rights holder, Universal Music Group. In the TechCrunch story about that news Ingrid Lunden noted:

SoundCloud .. inked its first partners deal in August 2014 when it launched On SoundCloud. It announced its first big label deal only in November 2014, with Warner Music. An agreement with Merlin — which represents some 20,000 independent labels — came in June 2015.

What Ingrid didn’t say is that the conversations with the music industry that led to these deals started at least a year earlier at the start of 2013. So SoundCloud has been working with the music industry for over three years to get a license in place to allow them to do things that have never been done before.

Alex Ljung, the CEO of SoundCloud, said this in that TechCrunch piece:

if you look at SoundCloud generally it’s the first time someone has tried to do something of this scale. We have over 100 million tracks on the platform and play over 10 million artists in a given month. We are really trying to create a platform that embraces all kinds of creativity, something that never existed before. There is no off-the-shelf solution for licensing for this. We had to work with the whole music industry to create something that never existed before, and that takes a little bit of time.

A little time? Maybe a very long time would be more accurate.

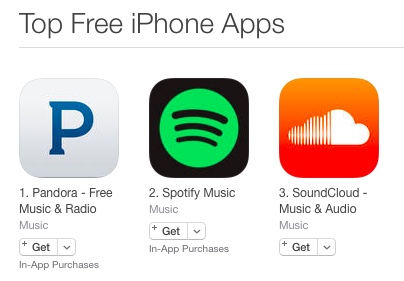

For the past three years the narrative around SoundCloud has been that it was stuck in the mud, that remixes and other derivative content were getting taken down, that labels were forcing artists to take their content off the service. All of which was true, but the real narrative was that SoundCloud was going through a difficult and complicated process of developing a new business model for audio content in partnership with an existing industry that has done things a certain way for a long time. Through all of that period, however, SoundCloud’s user base and listening time grew larger and larger and during that period it became one of the top music apps in the world

Through all of that period, which isn’t entirely over, the leadership of SoundCloud, Alex, his co-founder Eric, and the entire senior team stuck together, kept the business moving forward, built a strong management team, and kept the Board aligned and informed. I believe they have emerged much stronger for the experience.

Another story is Return Path, a company that I have worked with since 2000. Return Path’s founder and CEO Matt Blumberg has started, built, sold off, and built again a number of email services for the enterprise that has become a very large business. Matt has gotten the business profitable three or four times only to choose to incubate and build several new businesses and go back into the red. He has survived at least three of our near death experiences where the company was on fumes and it wasn’t clear how we were going to make it another month. Each time he pulled something off, often with the help of his Board and investors.

It was at Return Path where I learned the value of an engaged and aligned Board. Matt put together a real Board early on, with strong outside directors with operating experience, and he has always leveraged his Board to help him through the tough times. Matt has also built a strong culture inside Return Path which is often cited as one of the best places to work in corporate America.

The lesson from Return Path for me is you can survive the tough times and the near death experiences if you have a team that believes in each other and a Board that is equally engaged and aligned. I doubt Return Path would be around today without both of those things.

Another example is Foursquare. Maybe no USV portfolio company (with the exception of Twitter) has taken it on the chin more for being the “hot company that fell out of favor.” And yet sitting here today, Foursquare has built a very real business that is growing nicely and has a very bright future. They survived a move that almost killed the company (the app splitting decision almost two years ago that is still getting critiqued daily and will certainly be critiqued in this comment thread). Their financing processes have played out in the press with a transparency that few companies could tolerate.

And through all of this the founder Dennis Crowley and his team have taken the hits and kept moving forward. They have built technology for detecting locations that is state of the art. They have a location API that I believe is the most used location API in the business. They have kept improving and evolving the best localized mobile search experience and the most fun local social experience. And they have built a real business that is sustainable and has attractive economics.

You can say what you will about Foursquare, and don’t bother because it most certainly has already been said and not very nicely, but it has survived and is thriving. Very few understand that, but those close to the company do. Which is the hallmark of a tenacious and durable founder and leader and his or her company.

I’m almost done but before I wrap this longish post, I’d like to say something about the now public USV portfolio companies. I can’t and won’t talk specifically about their businesses because they are public and I don’t want to go there. I also own large positions in each and every one of them. Their stock prices are all, without exception, in the dumps. And yet I believe in each and every one of them and their leadership and their prospects. They are all led by tenacious leaders and teams who I believe will keep their heads down and execute and get through the negativity and second guessing that is coming at each and every one of them. I admire these companies more today than ever.

Building and operating a business is not easy. I believe it gets harder, not easier, as the years pile up. That is where tenacity and believing in yourself and your team and your business is required. The leaders who exhibit that have a special place in my heart and my head.

Comments (Archived):

you’ll love angela duckworth’s studies on “grit” … https://www.ted.com/talks/a… .. pete carroll of the nfl seahawks does too

Nothing in this world can take the place of persistence. Talent will not: nothing is more common than unsuccessful men with talent. Genius will not; unrewarded genius is almost a proverb. Education will not: the world is full of educated derelicts. Persistence and determination alone are omnipotent.- Calvin Coolidge

Agreed. The larger rubric is character, of which persistence/tenacity is an integral and essential component.

.My favorite quote of all time. For so many reasons.You know, right?Well played.JLMwww.themusingsofthebigredca…

Thanks!

“”I’d rather be lucky than good.””

Agreed, however I strongly believe that frequently the good make their own luck.The truth of that matters little to me; it’s one tool my box to remind myself why I do what I do from day to day. Sometimes the lucky are just that, lady luck is extremely fickle, often standing you up when some person is relying on it.Then when is lucky really lucky? With the recent ginormous powerball winnings behind us, and the length of time it took before anyone had a winning ticket, we could assume that those three are lucky. However http://brandongaille.com/22… shows that lottery winners are 2X more likely to file bankruptcy than the population at large, and http://www.statisticbrain.c… shows that 44% of lottery winners spend the entire amount in 4 years or less.

Thanks, adding Coolidge to this arsenal …@wmoug:disqus — agree about getting “ahead of your story”.@fredwilson:disqus — Twitter isn’t lacking in leadership talent. It’s just that when there’s market turmoil (per China, per $ oil), there’s a flight to what bankers perceive to be “safe”.As Einstein said: “Many of the things you can count, don’t count …Many of the things you can’t count, really count.”No one said that bankers have a clue on how count the true value of Twitter as both a product and a company.Balance sheet economics is different from the value utility derived by users.

Persistence/tenacity are synonymous to what a startup is about. It’s not easy out there booting-up something out of a starting point of nothing.

The trick lies in how to tell the virtue of perseverance/persistence/tenacity from simple stubbornness, lacking cartography about the world ahead, navigating a brave ocean with a starless sky above. You want people who know of no brakes, but at some point reality checks have to tell you where you really are. If you are really close to the abyss, you want brakes, but most of the time, you want to drive as fast as you possibly can.Imagine all the Virtual Reality startups that went down last century, had they found a way to stay around for a while longer.It also happens that you may be stubbornly right, but everybody else is not ready to believe in you.It’s incredibly tough, a lot tougher than most people realise.There’s no easy answers.

True of course. That’s what Fred implied as well. Good reminder.

Lacking cartography–that’s a good one. Nice.

“When you’re going through hell, keep going” had to take the opportunity to get a Churchill quote in 😉

I like the Rodney Adkins song, “If you’re going through hell keep on going, don’t slow down, if you’re scared don’t show it and you might get out before the devil even knows you are there” :https://www.youtube.com/wat…

Apparently there are two stone lions flanking the entrance to the New York public library, named Patience and Fortitude.In my city the entrance to the Council House (City Hall) is flanked by two stone lions, named Leo and Oscar.I know which names are more inspiring.

Sometimes being out of the public eye is a blessing, if you have work to do. Twitter could use a dose of this.

yes, but that won’t happen. they are the “public eye”

True; they are simultaneously the public eye and the picture that the eye is currently focused on, almost like a camera trying to look/”see” inside itself.

“Their stock prices are all, without exception, in the dumps.”so we can say what the Nasdaq isn’t measuring. five thousand values, but tenacity ain’t one.

I don’t think you can pick on individual stocks as a proxy for an entire market. Cheap money pumped up the Nasdaq (and other stock markets) Financial engineering also pumped it up (buybacks, cutting costs without top line revenue growth). The market got way ahead of itself and it’s getting it’s wings clipped. Where is there economic growth on the globe outside of the US? The US is anemic at 2% or less.

i think that an entire market actually says very little about individual companies.

Random guess – the fuel for this tenacity is not fame, fortune or personal validation.Is it the belief in something larger than the people involved, that the founders believe should exist?

personal validation can absolutely a major driver of tenacity IMO. if you want tenacious descendents, ignore your kids. granted, that will most likely cause irreversible psychological damage, but it might also breed an unyielding desire for validation that was never received at home.

Ah Yes! Spoken as the child of immigrants no doubt…

.There is something to be said for throwing your kids into the deep end and walking away. Not all good, as you point out but if they have your DNA in them, it will work out.JLMwww.themusingsofthebigredca…

you underestimate ones fear of being labled a failure, at any expense. That alone is sufficient motivation to be…tenacious.

Best comment I have read in a while.Yes you need a dose of reality – but only to temper and harden your dream into something you can share

Perseverantia Omnia Vincit.

#truth Fred.Building businesses is no picnic. There are a never ending string of tough days and harder decisions.Experience toughens you to this. Gets you in shape for the long haul.It’s a marathon not a sprint.

I like the marathon runner analogy, its tenacity plus some strategy and fitness that gets you to the finish in one piece. And perhaps some VC bottled water.

YupWas sitting at a bar in Santa Monica last night talking to a contemporary about the icons of the industry we had worked for and our own successes.Tenacity. The ability to function while you are on the ropes. The poise to pace yourself when stuff is down and not be crazy when up is the name of the game.You still lose at times but that is how you stack luck in your favor.

Well said, and very passionately. But I will pick on one thing, in the early part of the post.The responsibility rests with the company to properly communicate that narrative, and pro-actively. Otherwise, the media will make one up for you, and typically it will be wrong, inaccurate, and incomplete. Most media is lazy and will report on the smell of the situation, not its real substance, unless they take the time to investigate with intellectual rigor (which happens, but is rare).Take control of your story by communicating it the way you want to, and by communicating it often, throughout its evolutionary path. Startups that ignore that or that don’t take messaging seriously (or outsource it to a PR agency or only do it when a product feature is out) will be subject to these mis-interpretations, and they will be catching-up to fight these battles of mis-conceptions. You need to get ahead of your story. It’s your story. Let them report on it using your narrative, not their own made-up one.

yes, but many of these companies have done that and continue to do it. you can create and communicate the narrative but it doesn’t mean the media will buy it

We could argue that maybe it wasn’t effectively done then. It’s about consistency as much as clarity which yields buy-in credibility.We often talk about whether engineers/product founders can make the jump to being business minded. And that’s important. But also important is – can they be excellent communicators of their company story?

Communications even by the best of us is invariably not perfect all the time.We react to the market as that is human nature and mostly, the idea that you can be perfect in the face of a audience that is unpredictable is not realistic.I do this for a living. I’m good. But I’m and no one gets it right all the time.

Yes, but the entrepreneurs have to be good at that too, not just the professionals.Steve Jobs was excellent. Travis Kalanick is very good. There are other examples of course. Marketing communications is not well appreciated, because some entrepreneurs think it’s a concocted PR spin. But in reality, it’s authentic messaging about your company. When the CEO is a natural at it, or has worked on it, it shows. When they wing it or wake-up to it when it’s needed, it shows too.

Jobs was excellent for the same reason Trump is excellent. Because he is creatively able to stretch the truth and knows how to manipulate the media. [1] Neither are corporate pussies. Not cover your ass people which @pointsnfigures:disqus speaks of. Kalanick does the same governments. Takes risks.Also in both cases (and there are more of these out there) both of these guys (one corporate, one not) weren’t/aren’t worried about losing their jobs. Very very important factor.I get away with a great deal of shit because I don’t report to anyone and nobody that gives me money is so important that I can’t take risks. If I did the same thing and was paid by someone else (in a job setting) there is no question it would impact my performance. [2] Read that again since I realize this. I don’t even report to my wife.[1] Latest crack the bat, Ted Cruz the Canadian.[2] And in fact back in the day I got on the front page of the WSJ for some literally made up publicity stunt (by manipulating the press). Nothing to lose (didn’t report to anyone) everything to gain so give it a shot. Take enough shots and something sticks. (And then again multiple times..)

“I don’t even report to my wife.”Tough guy.https://www.youtube.com/wat…

Yeah it was baked into and negotiated subtly when we were dating and prior to any “contract signing”.

of course.but it is so so easy to sit here and tell companies and entrepreneurs what to do.truth be told when i look back at the startups I’ve been involved with–20 years of them–the ones that won all hit the wall.we-and no one is good at everything–but we and all that do win is really good at some one thing.that drive it to a point then you fix what is broken.i’d rather work with a flawed and inspired, single functioned and tenacious person and drive it to a point than a text book definition of a well rounded winner.there just ain’t none.i wasn’t. nor were you.i’m have more rounded edges now but still driven and lean on my strengths and hire to my weaknesses.and certainly not perfect. although cognizant about it.

Communications is a skill that must be acquired. That’s all I’m saying. You don’t just communicate by releasing the product and assuming the user/customer or market/media will do it all for you. You have to communicate yourself. In my experience dealing with many startups, some do it better than others, while others neglect it. It makes a difference if they are not passive, but it must be done well.I’ll bet you 9 out of 10 startups won’t have an internal messaging document that’s explicit, detailed and clear, and that evolves with their evolution.Confusion happens in the absence of clarity.

couldn’t agree more.just stepping back and realizing–as you and all of us should–that in the trenches its a damn battle.and you don’t have to be perfect to win. focused and tenacious and inspired and lucky.

Just stumbled on this excellent post by Brian Halligan CEO of HubSpot on their scaling-up, and he says CEO = Chief Explanation Officer. I loved that analogy.https://readthink.com/scale…

cool–checking it out.

Haters gonna hate.

Companies don’t tell the media and the peanut gallery the complete story because they can’t.

True, but you can get ahead of your story, instead of behind it. It’s your story. No one should own it except you. You can say things without saying things.I’m being a bit dogmatic here because I’d like to see more entrepreneurs become better at communicating their narrative, especially after product-market fit when it gets really interesting and they are growing.

I wonder if from your experience you see any difference between engineering types and business (particularly sales types) and the ability to “get ahead of your story”. My guess is that the engineering types have an intuitive hard time with this.Also anyone raised in a particular way (strict values for lack of a better way to put it) would have a hard time as well. In particular my theory that all good con men didn’t have smart parents that held their feet to the flames so they developed the skills early on by never being taken to task (I’ve actually tracked this a bit..) In other words the con man learned early on how to take advantage of his parents or perhaps was even encouraged by them if the parents were smart toward certain behavior.

It’s not about twisting or spinning. It’s just about being clear, pro-active and handling objections before they occur. Don’t let ideas fester in the media’s minds because they will, if they don’t have clarity from you.

Agree. But “being clear” doesn’t always create compelling link bait content or headlines. Nothing wrong with spinning things. Spinning just means putting out an interesting perspective and stretching means leaving out info that would cast doubt not necessarily making things up. It’s a craft in itself. The media doesn’t mind this… what I have observed over many years. It helps them sell their product which is what their job is. They like when you do their job.You know back in the day I remember when Sam Walton was featured in some business magazine (may have been Fortune). There was a picture of him showing that he “drinks cup of coffee each morning in local shop and drives a pickup” (iirc). The narrative was that he did it every morning (not just 3 times a year). The image of a billionaire (which at that time was a big deal) driving a pickup and drinking with the regular folk was the link bait (whatever it was called back then..)

“Ethical spinning”.

Tenaciousness is hard to compare across industries because the development cycle length of products vary considerably, 3 years in biotech / Pharma and things are just warming up.Tenacity meet insanity, insanity meet tenacity.

Really good point.

I will say this because I have experience which is the result of bad judgement.Have somebody, I don’t care who, board member, partner, senior person, listen in when you talk to the media. Somebody who is respected at your company.Then when that crazy comment that everybody is freaking out about comes out you will have a huge supporter who says WHAT????

A lot of those companies and their Comms people could learn from your communication style and tenacity, by the way.

The media reports on things they allege to be newsworthy, which very often isn’t aligned w/ a company’s desires and PR objectives. There’s also a tendency in today’s media world to capitalize on corporate negativity and a “gotcha” moment, while overly positive coverage can be perceived as a fluff or shill piece, but nonetheless obv still quite beneficial. Balanced coverage is most desirable but not easily attained. The public narrative is often frustratingly difficult to manage and control.

.It is not enough to “communicate” that narrative, you have to live it. Live it.You have to move it with your own muscles.The best CEOs are the ones who don’t have to tell you what you or they are supposed to be doing — cause you just have to watch what they are doing.When they shoot, move, communicate — you shoot, move, communicate.This was why Geo Washington was such a stud. He lived it.JLMwww.themusingsofthebigredca…

Right. But when there is ambiguity and you’re still manoeuvring, you’ve got to communicate clarity so the skeptics ask less questions, because you have disarmed them before they get a chance to take a shot.

.The genius is to make the ambiguity disappear, again, with action not words. One of Washington’s bits of genius was the ability to be at the critical spot in any battle and to make that one spot work right.When the critical spot was sorted out, the rest took care of itself.The southern crossing at the Battle of Trenton failed. Washington was with the northern crossing.He drove the northern pincer ever forward, under horrific weather conditions, and won. The Americans hadn’t won a single battle thus far in the Revolution and the Hessians hadn’t lost one.Until Geo Washington showed up and smote their butts.On the road to Princeton when it looked like the Brits might engage and destroy the Americans, Geo W leaps a fence on horseback (he was known as the best horseman in the Colonies, wow!) and rallies the troops — green Colonials v seasoned Brits — to victory by saying, “Steady, lads.”But he was exposed to enemy fire when he said it.It is not the totality of the words. It is the few words at the critical instant in time which makes people engage.”Engage, God damn it, Maverick!”JLMwww.themusingsofthebigredca…

Ok. but while you’re trying to make the ambiguity go away (it takes time), you need to manage the market’s expectations via communications. Maybe this applies more to business than the military case.

.One has the Janus effect — one face outward and one face inward. One face toward the marketplace, one face toward the company.Skillfully communications realistic expectations is important regardless of which direction one is facing.JLMwww.themusingsofthebigredca…

Baller post.

thanks Kirk. it’s something that’s been building up inside me for months and i needed to get it out

It was obvious that the feeling came over you like a tidal wave.(Meatloaf, Paradise by the dashboard light)..https://youtu.be/tIzY-ewRiU…

At the risk of accusations of pandering, these kinds of posts remind me once again of the unique opportunity we enjoy (at zero cost) to gain insight from people with long perspectives and vast experiences. When in history have such opportunities even been conceived, let alone made available to any beneficiary willing to simply log in, partake, and add to his or her own understanding?One can only wonder at the prospects of the “additive mindshare”effect on the world.

Works both ways. When Steve Ballmer declared the impending infant death of the iPhone, many bowed at the altar of the establishment and went long on Windows.

With respect, that went right over my head (not at all difficult to do, or even rare, mind you).In his criticism of a competitor’s product, I don’t recall Ballmer offering the wealth of his experiences as a basis for his negative assessment and providing specific examples based on foundational principles by which he claimed insight as to the reasons for the imminent demise of Apple’s phone offering.Maybe my original comment was poorly worded, also not a rare event. I was simply stating (the likely obvious) point that we are in an age when valuable keys based on hard-won experience from the most successful among us are freely available to anyone willing to consider and apply it… unlike any other time in history.

As CEO of the world’s largest technology company (at the time), he said that he did not see any reason for mass adoption of a $500 dollar keyboard-less, copy-paste lacking, 2G cell phone, by anyone other than the top two percent. And he was not alone, quite a few people at the time were non-committal on its prospects http://avc.com/2007/06/.I was simply saying that, yes, we currently have the opportunity to listen to many people of vast experience, although you need to decide whether to go short like a Ballmer, or long like a Gates http://www.lettersofnote.co… .

It shows. It’s 6:24 EST; this post has been in my head all day. Something about it that felt very visceral on your part. I love when that happens with people.

Thanks for posting this today.

you are welcome Eric

Rock on!

Do you, as an elite VC, get any criticism (from your investors), when one of USV’s (still private) investments appears to be struggling?

yes and also from the media and folks on twitter and elsewhere. maybe this post is about that too.

Media analysts should be forced to retype NYT’s 1985 denunciation of the laptop prior to every article, http://www.nytimes.com/1985…, just to remind themselves that they probably have no clue about what the future holds!

Also, read McKinsey’s analysis of the cell phone industry from the 1980s.

I am guessing that McKinsey got that one wrong. But I am also guessing that they have a good average of what they get right (for clients who pay their most likely exhorbitant fees) or they wouldn’t be an organization with 8 billion in revenue and 17,000 employees and 109 offices.

I am sure they get their share of stuff right. I find corporations and large govt agencies hire massive consulting agencies not for the actual knowledge but to cover their asses.

Reduces pain points and makes it easier to restructure and cut, the universal solution.

And the current day criticism of that article is bullshit.I bought computers in the 80’s and used them for business. I remember very clearly the Compaq luggable for example as I am sure other here do as well. I spent a great deal of money on computers (my own money not investor money) and saw exactly and precisely the utility of them at the time.What do you expect someone to write about laptops when the weight, price and utility is what it was back then? That if the price drops and it gets to weigh less it might then be popular? You know what I just did I bought an 11″ laptop for around $200 (just to be able to monitor security cameras), that’s all it will be doing (it drives a 27″ monitor that I bought for around $200 as well (HP overstock really nice). Who could have imagined that back in 1985? Of course if the price and utility gets better the product will sell.As far as “no clue about what the future holds” you know back in I think the 30’s (on the other side of this) it was predicted that we would have cars flying all over the place. Also cars that could be boats. That never happened (even though tech is to the point where it could). So what is someone supposed to write and by the way what is the timetable for “the future”? Is it 5 years or 50 years or 100 years? Saying in deal making “You can name the price if I can name the terms”.

Flying cars.. that was scheduled for Jan 1, 2001. I remember looking out the window and up to the sky that day and feeling very disappointed.

I’ll quote the author.”Because no matter how inexpensive the machines become, and no matter how sophisticated their software, I still can’t imagine the average user taking one along when going fishing.”There is nothing wrong with not knowing, the issue is the fact that people are quick to write off someone else’s vision of the future based on their narrow perspective of the current.

Not really. The counter (to make him wrong about this statement) would be, say, a smartphone and defining that as “a computer”.However the definition of “a computer” that he was talking about was something with a keyboard and a reasonable sized screen. Not an iphone and not an ipad. And not a raspberry pi either. And not something iplanted in your brain. It depends (as Clinton would say) what your definition of “it” is.There isn’t a market for a laptop with a keyboard that consumers take along when fishing. Sure there is a niche where people need laptops on fishing vessels but not what he was talking about “going fishing” where he meant “sixpack Joe”.

He wasn’t too worried about the keyboard, as he pointed out earlier on, “The limitations come from what people actually do with computers, as opposed to what the marketers expect them to do.” He goes on about how laptops are not suitable for word processing and spreadsheets. He points out that why use a computer when you could just read a newspaper.There’s nothing wrong with not being able to predict the future, but as history has shown time and time again, there will be those who go long on technology, and those who insist that it is best to focus on building a sturdier horse.

Inspiring post. From a user perspective, I ran out of tenacity with Soundcloud and Foursquare when i deleted them from my phone. Time to give them a second go, perhaps.

Yup. Important point on aligning your board as a founder. Boards are there to support you, not fuck with you. I have seen too many board members get emotional and they screw up a company more than the strategic path of the company.At seed, it’s often hard to find out if a person is tenacious or not. One way to tell is ask them their hobbies, how they grew up etc.

“Boards are there to support you, not fuck with you”that is a great job description and i know a number of investors who ought to consult that before signing up for the job

One way to tell is ask them their hobbiesI agree. But otoh sounds a bit like college applications nowadays where they want certain activies to appear and someone to be well rounded.My angle is typically not to ask question but to tell stories. When you tell stories you can then gauge reactions to those stories and glean plenty of valuable intel by both verbal and physical cues. Much harder to game that type of thing and know the right answer.

Hobbies are a sign of what they are passionate about. How they go about their hobby might give you a clue as to how they go about their business.

There are some people that are just passionate about business and it consumes them.Sure maybe Henry Kravitz collects art and maybe Buffet plays bridge and maybe Ellison sails and maybe Gates [1] (what does he do?) and Steve Cohen, well, maybe he golfs who knows or has a boat. But for some people business is their hobby and it’s 24×7. Don’t think Trump had any “hobbies” in the traditional sense. If you like business you like business. It is your hobby even if you aren’t a multimillionaire. It is a game even if it’s a game on a small scale.Now perhaps that doesn’t fit in with investor perspective but that may very well be because they don’t understand it.My “hobby” in high school and college was photography. I enjoyed that greatly. The reason I enjoyed it was I was able to make money doing it. If I wasn’t able to earn money I don’t think I would have enjoyed it anywhere near as much just hearing people say “nice picture” or “good game” wasn’t as rewarding as getting a check in the mail for taking pictures.[1] Don’t recall what he did until he went out to pasture but I am guessing he didn’t have a hobby that he was passionate about.

I don’t worry about tenacity until I believe that there is first Chemistry and Competence. When I get to tenacity, or Commitment as I call it when using the 3C evaluation methodology, I gauge it in candidates by using stories to describe how hard the job is, asking the candidate if they are really sure they can handle it, discuss all the potential negative aspects of the position and see if they still want it. If they still want to go for it, I’m inclined to let them. The best part of it is that no one has ever been able to come back to me and say that they didn’t know the position could be whatever it is in the worst of times.

.The victors write the histories. The bad behavior of boards is never adequately written about. There is no ant colony in business that is more self-absorbed and destructive than a bad board.JLMwww.themusingsofthebigredca…

When you are waging war (on the market) and the going is tough, the morale of your troops (employees) is going to suffer. It’s hard to deal with both. But if you get your supply line (investors) and politicians (board members) against you, the ability and as importantly desire to continue wanes very quickly.It’s easy to think put in a new general but that rarely works.

Which hobbies suggest tenacity? Are you also looking for level of accomplishment in those hobbies?

Level of accomplishment-meaning did they earn a medal or are they one of the tops at the hobby? No. But, did they stick to it. How did they learn it? What did they do to immerse themselves in it and how are they learning new things? Why are they jazzed about it? Doesn’t really matter what it is.

Much respect, good post. Good VC.

Getting filed under one of my favorite posts ever. This week needed a pep talk like this.

Ditto.

Not much to add, as a founder you admire people who are resilient enough to get over harsh time. Happy to see that (some) investors stick with their founders!

Informative, thoughtful post. But figuring out whether the senior team has that kind of tenacity when you are making a decision on an early investment is an art. What are the clues?

I used to believe anyone could be tenacious. I also believed that being persistent is a decision we make when it is easier to give up. But I think what I’m realizing is that survival is instinctive and those instincts usually come from either past experiences or a healthy paranoia of what can fail.

Seth Godin’s easy read, “The Dip,” is a great resource that speaks to this topic – and specifically understanding when to be tenacious vs. when to quit.

Thanks, this will keep some people moving ahead today.

Love it. I’ve come to expect and depend on great value from you. You’re a treasure.

Great post to read for the entrepreneurs out there. You must be in a difficult position as “success” in your job is not about building sustainable, modestly successful businesses, it’s about big returns. I think what you’re saying is that you take pride in building those sustainable businesses that for the most part, won’t generate the type of returns that make you a successful VC. Good to hear.

If you want to generate some time (to enable to keep your head down on your project or business) stop reading the tech and business press. So many narratives about how easy it is for the other person, or how they’re “succeeding,” are less than helpful.

Here is a dilemma and a question that connects today’s topic with one covered yesterday. What does one do if brought on board by the CEO to restructure the company. However, all indicators are, the idea is a failed one. With potential of someone else (another company) taking it over and making it into something bigger? Maybe. Long shot. At the same time, the CEO is persistent in taking it to the next step. Board is divided and not supportive. Funding is tight almost non existent. Leaving will definitely burn the bridges with the CEO.

all this other than the public companies…cant happen without investors. Most VC’s say they are in it for the long haul. Most are not. Many panic well before the founder…so to get it all right is a miracle. To do it over and over again is magical.

“Many panic well before the founder.” well said, and that could become the kiss of death, sadly.

I am going to save this to read on the dark days. I feel certain that kind of loyalty, support and respect have served your portfolio companies well during those times and now beyond. Kudos to all. Excelsior!

Hope the companies you invest in realize how lucky they are to have you. Wouldn’t be fair to call it unconditional support, but a helluva closer than most would venture. Steady Freddie. It’s David Bowie week in my brain and this lyric comes to mind:”Oh no, not me…I never lost control”–The Man Who Sold The World

January marks my 19th anniversary running Infinity Softworks. I’ve reinvented the company four times now, and am attempting a fifth. Many people have told me to quit over the years and move on. Maybe they were right. But I still believe in what we are doing and believe that the timing or product or market hasn’t been quite right in the past. Hopefully this new transformation will be spot on.

This is going on my AVC all-time favorites list. Thanks, Fred.Sometimes I wish I was a little less tenacious. There is an art to knowing when to quit.But if I have to err I’d rather err on the side of perseverance.

The art is knowing when to take a nap so you don’t have to quit 🙂

.It is amazing what an “overnight” success you can become if you’re willing to work ten or twelve years at it.JLMwww.themusingsofthebigredca…

I think the hardest thing about being a young person today is this: As a result of the dearth of information and help that is freely available (which wasn’t previously the case as you know) the game has been shifted to taking advantage of the best opportunity and not tying yourself up chasing a dream with less of a chance of success than another dream. [1]So the other side to Fred’s “stick it out” is simply maybe that actually isn’t the best thing to do because once you are older (and have obligations and there is age bias) the entire game changes and everything gets harder and risks are more dangerous. I really think this has to be factored in.[1] Ditto for dating. With online dating and social networks dating is not like the slim pickings days of the past. And likewise tying yourself up in a relationship that won’t lead to marriage (assumes that is what you want) is not a good thing the years are gone and it gets harder to nail it.

.The average young person thinks they look good in skinny jeans. The advice that Fred is offering is really for the C suite, no?There are very few young persons who are really entrepreneurial. OTOH, if you are an entrepreneur you can’t live any other way.When I got out of the Army, I realized something critical — I was the lousiest employee on the planet because I had spent the previous 5 years in charge of shit. I didn’t know any other way.JLMwww.themusingsofthebigredca…

The advice that Fred is offering is really for the C suite, no?Fred talking his game which is smart. What would anyone expect Fred to say? As a commander of men what would you tell them? What would Jack Nicholson do? Vested interest means hard to not be biased.

Be honest about the skinny jeans JLM, older people don’t use them because they are so damn hard to put on and take off.You would look awesome in skinny jeans and texan boots getting out of the BRC.

.Lawrence, Lawrence, Lawrence — you wear “boot cut” jeans to show off your Lucchese goat ropers and high heeled boots. Sort of straightish legs but just slightly flared at the bottom and very long to make them gather on the top of your boots.Goat ropers for dancing and high heeled boots for riding. You can wear them for Texas Formal — black boots, black jeans, tuxedo jacket (preferably double breasted) and tuxedo shirt. It’s a look that’s not for everybody.I’ve had these black boots for longer than most of the people on this blog have been alive.Once you get them broken in right, you don’t ever sell them like owning a damn good vintage convertible.JLMwww.themusingsofthebigredca…

Ha, ha.. but.. you could tug the skinny jeans into the boots. Well, forget it, it is actually not not a good idea. Just visited the Duchesse site, awesome. I remember once visiting the Patagonia I saw a guy in a restaurant wearing some awesome black leather boots with silvery metal tips, a work of art. I thought I would like to have a pair of those, but I don’t know if I have the personality to actually use them, probably in Texas no one would notice. In Argentina you can still get luxurious hand made shoes and boots.

.A man doesn’t wear the boots, the boots present the man. In Texas, you could go to church in your boots. The best is the cute girls with their short skirts and their boots.Argentina is like Texas.JLMwww.themusingsofthebigredca…

omg JLM your quotes are too good. This will find it’s way into a presentation for a big Corporation here in Canada one day 🙂 “The average young person thinks they look good in skinny jeans”

I was reading before posting and this was going to be my exact quote. I have been involved with three successful companies. None took less than a decade to build. But when the press reported on their success it was an “overnight” success.

.Great minds and similar experiences.JLMwww.themusingsofthebigredca…

I call them turbulence pilots.They not only have experience piloting high fliers off the ground, but have also taken their planes off auto-pilot at cruising altitude (product/market fit) to work through difficult conditions and/or re-route to new destinations.That’s a remarkable trait and all entrepreneurs should seek out a turbulence pilot as a co-pilot (board member, adviser, etc.) on their crew.Marc Andreessen once tweeted how Growth CEOs tend be overly praised while Turnaround CEOs are overly criticized: https://twitter.com/pmarca/…I think there’s a lot of truth to that.

I love this post. I love it. What I’d be extremely interested in hearing more about is whether or not Fred looked at the founders of Soundcloud, Foursquare, etc. before USV’s initial investment and thought to himself, “these founders are super tenacious”…I have to believe he did as it’s not always in years 5-10 that founders develop the muscle memory or characteristic around tenacity, but earlier startup experiences…probably in years 1-5 where the founders may have been tested – long before raising 8 figure rounds and generating tens of millions in revenue – and gave early evidence to Fred and his partners that tenacity was in full effect.

Years ago, I attended an art-appreciation lecture at the High Museum in Atlanta, and the lecturer talked about how to look at a work of art. He boiled the requirements to really get the most out of a creative work down to five principles:- (1) Persistence- (2) Imagination- (3) Explanations backed up by (4) Evidence- (5) ResourcefulnessSince that time, I’ve found that these five principles are applicable to many different endeavors, such as building a product. Leading an emerging company also seems to require these things, with Persistence (tenacity) at the top.

Great write up about Foursquare, brilliant product.

Tenacity implies a tension.Whether you correctly regard as ill-advised the startups who are ahead of their time is moot.The wisdom of tenacity is binary. If you are ahead, you may need to simplify, tone down, or find smaller stepping stones on your path to success. BUT if (as a founder) you can show to the satisfaction of the people who believe in you that you should not quit, you should also remember that they are probably less aware. With tenacity comes experience, and networks, and with experience and awareness opportunity.You can be sure if you quit that it wont happen – So the judgement call is not for the investor that says no to make – it is for those who take the risk to double-down and change things.When, and only when that is not the best path forward then it may be time to quit – not when a naysayer rejects you.Any other view is defeatist.

Your tenacity came through on the post. There should be a word for, as you describe in the opening, someone who is persistent but also doesn’t aimlessly waste time.

FourSquare: What Has Become Of You http://technbiz.blogspot.co… Reading Up On FourSquare http://technbiz.blogspot.co…

Thank you for writing this, Fred!

Foursquare has been one of the most incredible turnarounds. I was never fully bought into the checking in mechanism. Over the past 6 months, Foursquare has completely replaced my use of Yelp. This is a trend I’ve been seeing with many of my friends as well. The recommendations are just so much more on point and it is a much more intuitive way to quickly get the answers I’m looking for.

I own and operate an environmental trade school (Stormwater ONE) and we have been grinding it out for 8-years. The one thing that drives our tenacity is our mission. We fuel every initiative with the goal of making a true positive impact on water quality. For us, our success is being driven by the “why.”

A great reminder to entrepreneurs and aspiring start-up entrepreneurs as to the level of grit and ability to “chew glass repeatedly” required to be successful in start-ups

Fred offers insightful perspective on the topic of tenacity, especially with specific examples. Clearly tenacity is key for successful founders and entrepreneurs.But with tenacity must come focus. If you’re not properly focused, I don’tbelieve tenacity can be all that valuable. Check out what world-class tech investorslike Reid Hoffman, Bill Gross and Fred say about focus at a newly-launchedon-line resource for startups and entrepreneurs called VCEssence ® at http://www.vcessence.com. [https://stacey-wernick.squa…] [See Focustopic under the pull down folders Fundamentals and People.]Fred also discusses the critical issue of [interest] alignment. Check out what tech investors like Chris Dixon, Josh Kopelman and Fred say about interest alignment. Specifically see what Kopelman of First Round Capital says on topic at a post called ‘HighValuations Can Limit Exit Opportunities’ [https://stacey-wernick.squa…]. [See Interest Alignment topic under the pull down folders Raising Capital and Start-Up Issues.]Given that these topics lead to how entrepreneurs achieve success, check out what techinvestors like Marc Andreessen, Reid Hoffman and Peter Thiel say on the topic of how to increase success at http://www.vcessence.com. [https://stacey-wernick.squa…] [See How to Increase Success topic under the pull down folders Fundamentals and Start-Up Issues.]VCEssence’s ® content addresses over 50 topics vital to entrepreneurs from some 30 of today’s most successful, savvy and influential technology investors – among the world’s best, Fred Wilson of course included.VCEssence ® is the ‘must-visit’ solution that enables entrepreneurs to make more informed decisions, thereby helping them build breakthrough companies and technologies. What startup wouldn’t want to know what the greatest investors think of all things startup, and use that knowledge to increase the odds of success and reduce the risk of failure?Stacey WernickFounder & CEO VCEssence ®

This has been a fun discussion today, however I see some glaringly obvious missing. While Fred did mention that tenacity is not good when it comes to sticking with a bad or failed idea too long, tenacity with continuous learning is just a bulldog hanging on.

“I don’t mean sticking with a failed idea for too long” needs some explanation. If tenacity is good but grinding through an obvious failure is bad, what is the criteria by which we judge failure? Is failure when you run out of money? When everyone around you says its a bad idea? When customers leave in droves? Foursquare could be considered a failure by some of those accounts but you, Dennis, the team and their core users believe otherwise. How is that different than early stage founders grinding through when things look bleak? Other than no traction/no money binary definers, the line between foolishness and tenacity is thin at any stage. I’ve got my own thoughts but as an early stage founder I’d love to know how you define a failed idea, and by extension, when tenacity becomes foolery.

Great post. A lot of truth in here. Thanks for sharing.

Foursquare predicts my next move in a way that nothing else does, The new management needs to find a way to monetize that Here’s my post: http://www.cmswire.com/cust…

There is a fine line between tenacity and insanity. 🙂

I think most founders dont actually realize how very hard the world of start up will be. I dont think they are mentally prepared for the horrific and thrilling ups and downs of building a successful company. I know I wasn’t. Now after 2 years, I am finding out what real grit looks like and Im actually loving it.

This is also about tech media’s obsession with the tired either/or of an overnight unicorn or complete failure. Watching this happen with Peach and comparisons to Ello, as though after the tired and BS “Facebook-killer” meme spun by the usual laziness, Ello just died. Instead CEO Paul Budnitz and his co-founders have quietly built a growing, positive and amazing community out of the spotlight.

Where does the thin line between tenacity and sunk cost fallacy lie? An article on that would be interesting.

Very true. Thanks for a very nice post!

I’ve been in music streaming for a while. Having a deal with majors is not a big deal. The big deal is to have it on good terms that allow for proper unit economics. Outwardly, the Soundcloud deal may equally be a long-fought contract with good terms, or a leap of faith that will lead to loosing money.

Hello allBest Business in the w0rldHacker Service Available cheap and safe money making for your future before we business deal watch live workno lotto 100% pure money no risk..Wire Bank Transfer (350 for 3000)Western Union, (500 for 6000)Money Gram (800 for 10,000)SSNAir TicketHotel BookingHacking stuffShipping productserious peoples do contact :email——-> [email protected] —–> r0n_o99

Fred, is this a reason USV usually doesn’t do seed deals and likes to spend time with founders for several months? To see how they deal with the twists and turns of hitting product market fit? Conversely, is it a false indicator to a VC if a company hits product market hit too early that there are not enough examples to assess the founders’ tenacity?

I don’t know. There is danger to pushing people beyond their actual limits. To me that is actually a problem in society today (version of keeping up with the Jones which has gotten worse post Internet). I am noting all of your gray hair. I don’t push beyond my natural limits. I don’t know that you do and apologize in advance for speculating what I don’t know for sure based on your comment. I just don’t buy into all of that “push” especially when someone else is left to clean up the mess that has been created (alcohol abuse, drugs, sleeping pills and so on).You know I started to give my wife advice on her career (when I met her) and opportunities that I thought she should/could take advantage of. After a bit I realized that it wasn’t good for her. It wasn’t what she wanted she was happy in her existing corner of the world.I remember when I dated a girl who had some “problems”. I picked her up at the train one day filled with some ideas that she could do. She was exhausted just from taking the train down from NYC to meet me.

I’ll be more specific. Meddling by gossiping (talking to each other outside of board meetings) or thinking they (or someone else) could do a better job without true knowledge are the worst.

They do, and they do, and they do and continue doing. It’s embarrassingly frequent with Seed & Series A boards where the founders/CEO has a pair of directors appointed for them.From first hand experience, it can be interesting having the person who negotiated the deal from the lead investor side, poked his nose into everything during Due Diligence, where you produced whatever the person wanted, and now this person is on your board. Once they are accustomed to assigning tasks to the CEO or senior management, the CEO must establish leadership and take control of the situation, however in such as way that it feels natural. It can become a power struggle. This is where having a phenomenal Independent Director is worth multiples of their weight in platinum (or Latinum for Star Trek fans or unobtainium for Science Fiction trope fans).One parting word about Independent Directors, since I just praised them so highly–aim super high, go for the moon and don’t settle for just anyone. This person will either potentially get you out of hell or send/keep you there.

.Boards are notoriously negligent in evaluating and appraising CEO performance. When they do, it is usually informal and mealy mouthed.I would be willing to grade most companies on the professionalism of their CEO – Board relationship. Not how they get along, how they manage and administer it.A smart CEO has an Employment Agreement and it calls for an annual performance appraisal by a date certain. It also calls for annual objectives that can be objectively reviewed as a measure of success.This requires an adult relationship between a CEO and her board. Make it so. It is like a physical when the doc checks your prostate. Yeah, that’s a little awkward, no?A smart board has a compensation committee that handles this, produces a written document, and presents it to the CEO no later than 5 Jan each new year. Makes the entire board sign off on it after — AFTER — visiting with the CEO for her input.If a board does not diligently appraise CEO performance, they cannot find fault with it at some future date. A smart CEO insists on this and makes the board toe the line.JLMwww.themusingsofthebigredca…

no meetings before ‘the meeting’

This is great advice. It works for all levels. You are right, if you don’t manage the situation don’t cry when it goes wrong.

This is one of the rare times when I wish I could just keep pressing the ^ on a Discuss comment. I’d say more, but I feel funny talking to a car.

most times, you don’t know your limit

.The Big Red Car hangs over “there” you know where. This is ME. Look into my eyes. You are getting sleepy.Think how odd it is to own the damn car. SOB is always whining about something. If I hear one more time that he needs a freakin’ paint job, I’m going to slash his damn tires.I painted him just 25 years ago.JLMwww.themusingsofthebigredca…

Unfortunately, genetics doesn’t fit nicely into my narrative or my rhetoric.

I agree so much. Others do not. In my mind the cause of all politics

Leaving everything to be decided at the board meeting itself can be contentious too. I treat part of it like politics, meaning that I like to have a good feel for the result of a vote before I bring something up for vote.For example, if I want to launch a new product line, and I believe I have a decent business case for it, even with getting the board package a week or more in advance, not all members will understand it, understand the nuances, understand your passion for it, etc. I believe it’s better for the CEO to make a few phone calls before the board meeting to ensure most are up to speed. Otherwise you board meeting may get bogged down discussing protocols or other things that are too far into the weeds and miss the forest for the trees. I know of at least one large public company and market leader where they company almost died because of issues such as this and not maintaining the company vision and managing the business.This is actually pretty relevant to me right now. I have a board meeting in a couple weeks where we are going to discuss launching a product into an adjacent space, and the complete business case for it. I sending out the board package soon and I’ve already had conversations about what’s in the package and whether there was any consideration of the proposal before including it. Ugh, that does sound like politics…