Board Decks Best Practices

At our portfolio company CEO Summit this spring, the 60 or so leaders in attendance asked us if we could figure out a way to aggregate some insights across our entire portfolio and share the data with them. We said we would see about that.

So this summer, we hired Max Heald for a three month stint after he graduated from college and tasked him with figuring out how to do this. The first constraint was that we were not going to ask our portfolio companies for data. They have businesses to run and they don’t need us dumping a big data request on them.

So we pulled together all the data we already had on our portfolio companies, the spreadsheets, the pitch decks, the board decks, the financial reports, etc and asked Max to comb through it and see if there were insights in the aggregate data.

Of course there was. Here’s an example of something we were able to determine via this effort.

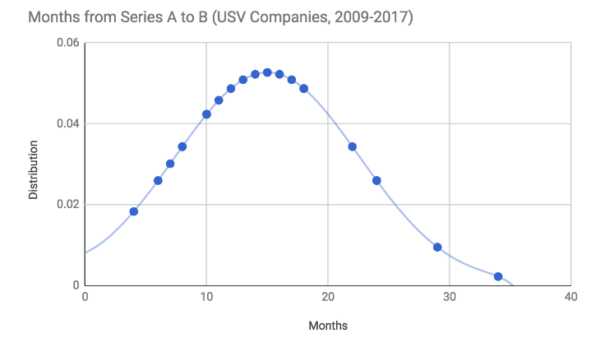

I have been telling the companies I work with to plan on eighteen months of runway from a financing and three to six months to raise the next round for years. But it is nice to see that advice validated in data.

Along the way Max saw a lot of board decks and asked us if he could write a post on the USV blog describing some of the best practices he saw. We encouraged him to do that and he published it today. Check it out.

Comments (Archived):

What an outstanding post – big congrats, Max! (and look forward to what you’ll do next)

I could not agree more. What a great way to get a young person going and and old person (me) looking at fresh ideas.

Damn that’s a lot of companies to keep a relationship going with for such a small firm.You are busting it each and every day.

a little bit off topic. Fred, is this the Tumblr blogging platform you are using? i’ve forgotten.

i use a hosted version of wordpress

Thanks.

Very interesting. I wonder if there is some effect of the advice tou give about fundraising in the data. It would be great to see this same chart for a number of startups that have not received this advice about timing in the fundraising process.

(1) The High Level ViewThe post seemed to permit or even recommend that the company could be jumping from one direction to another at each quarterly Board meeting.Instead, the company should be on a trip to a destination. The destination and how to get there should be, and should long have been, fairly clear.So, in a Board meeting, the board deck should report on the progress on the trip.In more detail, the trip should have been described in serious, relatively stable written descriptions at the first three levels of detail — vision, mission, and strategy (@JLM). Then the board deck should report on progress on each of these three levels.As a Board Member, that’s the information I’d want to get. As a founder, that’s the information I’d want to provide.E.g., for my startup now, everything is on track as planned except for some unpredictable but routine outside interruptions. So, due to some boot partition data corruption from a temperature sensitive motherboard hardware problem, most recently I’ve had to rebuild all the software on the main boot partition of my main development computer. On doing that, I have 5500 lines of notes in a file, and the work is going well, routinely, and is about half done. The extensive notes are making all the details quite explicit, and the notes will help the next time, and there will be many, I need to build a good development or production boot partition. It looks like for boot partition backup I’ll convert from Microsoft’s NTBACKKUP to some of the functionality of Acronis. Done.That was short.(2) MetricsI’d guess that the “metrics” of interest would, should be ones that are obviously (A) important month by month and (B) important over long time intervals. Then for presenting data on the metrics, concentrate on just those that are important in those two ways.Instead it appeared from the post that the metrics were to be selected for each BoD meeting ad hoc, dynamically, opportunistically.(3) GraphsWith metrics, what matters most is just the data. For a metric, the two most important measures of quality are reliability and validity, but the post mentioned neither of these two.A graph is a way to view that data in a way that can help answer some routine questions quickly. Then, for a graph, it is crucial (A) to report what the data is, e.g., at least briefly in the title of the graph, (B) to report what the axes are, mean, e.g., at least in annotation on the axes, e.g., with units used, (C) to have the fonts for the axes as easy to read as possible, e.g., in a bold face, simple font and as large as will fit on the graph, (D) the source and meaning of any lines on the graph, (E) some explicit answers available directly from the graph for the questions the graph is intended to address.A graph is not a work of graphic arts. Lines on the graph are not art, are not “communication, interpretation of human experience, emotion”. Else, if a graph is art, then pick some music to play with the graph, from the Wagner “Siegfried’s Rhine Journey”, to the Strauss “Blue Danube”, the Wagner “The Death of Siegfried”, the Wagner “The Entrance of the Gods into Valhalla”, or Beethoven’s Ninth Symphony or some such as appropriate.In movies we let John Williams, etc. supply such music, e.g., from Star Wars the “Imperial March”.And in both Wagner’s operas and Star Wars, the music is in frequently reoccurring motifs.But, in serious fields of activity, we don’t do that, not in applied math, physical science, not even in social science, not in engineering, not in bio-medical science, and, sure, also not in business, finance, or good work in economics.The content of a board deck is not opera, is not even art.(4) ConfessionalThe post recommends that the “board deck” report the bad with the good and seek advice from the Board.A good rule is, from @JLM.Pro tip: do not seek advice or unburden yourself to someone who can fire you.

This is the money part of this post:”The first constraint was that we were not going to ask our portfolio companies for data. They have businesses to run and they don’t need us dumping a big data request on them.”Thank you!!!I cannot tell you how much that must have been appreciated. It’s the attitude that counts the most.

I’ve seen other VCs make ridiculous demands on their portfolio companies. USV is not going to do that.

I have been on the other side of those requests and when I refused it caused huge friction.You describe it correctly, it comes out as a demand. For first time entrepreneurs they view it that way. For me it is a request. When I didn’t comply I was told that it was my fiduciary responsibility. Nope. That is to keep the books straight, not waste money, serve my customers, and grow the company. Not comply with requests which are not demands.