The "Doubling Model" For Fundraising

I was talking to a friend this past week who is looking at an early stage company and trying to figure out how to value it.

He pointed to a similar company that has a public market cap of $250mm.

I asked him how many rounds of financing or how many major milestones does this early stage business need to accomplish before it can get to the same place the similar publicly traded company is at.

He said he thought it was going to take three big steps after this financing to get there.

So I said, “it is worth roughly $30mm after this round.”

He said “how did you determine that?”

I said “If you assume the value will double from round to round or milestone to milestone, and after three more of those it will be worth $250mm, then it should be worth $30mm after this one.”

I then said “work back from $250mm, to $125mm, to $62mm to $31mm.”

I call this the doubling model and I’ve used it as a framework for thinking about value appreciation in startup financing for over thirty years.

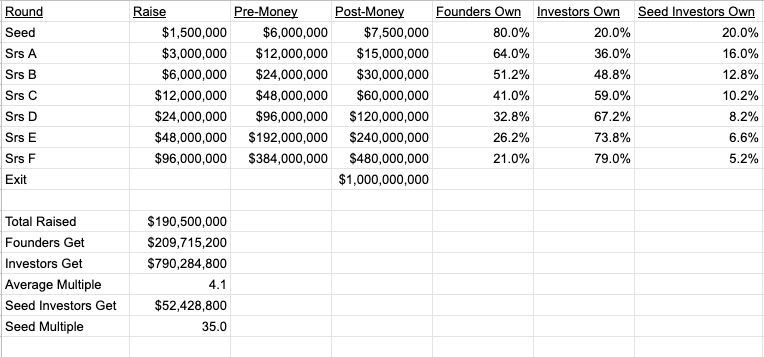

Here is a simple spreadsheet that shows how this works. It does not include the impact of employee equity grants in it so the numbers would change a bit if I added that. Assume the employees would own 20% of the company at exit.

This is just a framework, nothing more.

But I find it is very helpful in thinking about what is fair and reasonable at various stages of a companies development.

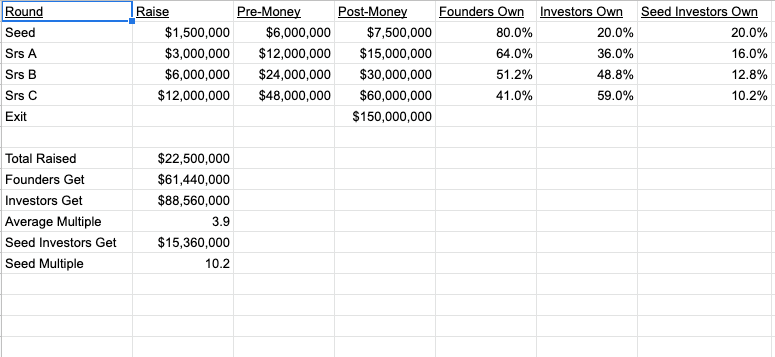

You can also scale this back. If a company only needs ~$20mm to get to positive cash flow, but only has $150mm of potential value at exit, you would get something like this:

The two big assumptions that drive this framework is that a company should always target to double valuation round to round and never dilute more than 20% per round. That minimizes dilution and also gives the existing investors the comfort and confidence that things are going roughly to plan.

If things are going great, you can take valuation up more than that from round to round, but in my experience that often catches up to you and the next round is flat as a result, which is not a great thing for anyone.

And everything is ultimately governed by the total size of the opportunity (TAM), how the market will value that at time of exit, and the capital requirements to get there. Those are the fundamental drivers of value in startup land and this framework attempts to respect them.

Comments (Archived):

also helps funds figure out how much to invest at each stage to have enough ownership percentage to make money for LPs.

Yupppppp

Can you walk us through that?

Remember Fred’s post of a bit ago where he showed VC math? It’s unforgiving. Think of this equation: % equity owned * Exit value/amount invested. Now, think about being a micro VC. How much do I need to invest at seed to own enough at exit to pay my LPs a return, plus make a little for myself? The Seed investor is not that much different than the entrepreneur once they make the investment. I try to factor in 60-70% dilution over time. Hence, if I have a $10MM fund, I need to invest $500k at seed where the valuation is less than $8MM pre; and have the company exit at $225MM to pay back the fund. I need to do that a minimum of 3 to 3.5 times to cover fees and get a good return for LPs. This is why I don’t understand the fund model that invests $100k in deals….LPs won’t make any money. Better off being an angel, investing less in a seed and getting pro-rata rights and pressing winners.

All that and more should drop out, be confirmed, and maybe refined via myhttps://avc.com/2019/02/the…

Want to make some decisions? Okay. See my first post here today athttps://avc.com/2019/02/the…

Is an IPO still the preferred exit?

My experience is that VCs and growth equity rank private acquisitions as perferrable to IPO. I think the brain damage of fulfilling IPO requirements pushes them to prefer a private sale.

The liquidity of the public markets is tough to beat.

Completely agree. It’s an interesting contradiction. Prior to selling my last company, I bid out an A Round and I said my goal, under the raise multiple rounds scenario, was to IPO. IPO was a four letter word.Maybe the transparency of public markets plus hassle of IPO process make companies think IPO is riskier than private sales.

It is a much harsher environment. You can get hammered for good results. Also, for saying you’re investing for the future. Tough call.

SARBOX sucks. Anyone in PE would prefer a sale to another PE fund or a strategic. Anyone.

I will take liquidity where ever I can get the best ROI including the costs to exit. If it’s IPO, fine. If another entity wants to buy it, fine.

For me, yes if the company can be a solid public company. Then everyone gets to time their exits individually

Fred, totally off-topic, but is that USV widget (the box containing other USV posts) available?

I will find out and report back

Thank you Fred, I appreciate it.

Do you want to broadcast our posts somewhere else or use the tech to do the same thing we are doing?

I’d love to find the tech to do what you are doing below each post – where blog posts (on other team members’ sites) can be shared like you have done in a clean display. That is excellent!

Sometimes, entrepreneurs want to defy these growth-to-valuation practices by thinking they are different, and therefore this conventional wisdom doesn’t apply to them. It would be interesting to line up a few examples of real companies against this model, then it would drive this reality even further.

Sure: For more, see myhttps://avc.com/2019/02/the…

One clarification that could be helpful: that amount “owned” by founders also includes the options pool for employees. So really founders need to subtract 20% from their stake.

Not quite. Because investors and founders share in that dilution after the initial pool is set up

* existing investors

But the flip to investor “voting control”, which is often a point of focus for founders, is impacted by the option pool expansion at each round and therefore, in your example, would probably happen between Series A and B, no?

Posts like these are gold – super helpful to understand how you think about these things and why.

Thanks Fred! This is great and I love the simplicity. I will plan to benchmark against our own internal model.

The hard part of VC is that it has to forecast market rates of return from Operations and excess returns from goodwill.Yet, one rarely if ever seees the goodwill discussed.businesses are worth far more than net tangible assets if they can be produce earnings on such assets in excess of market rates of return. The capitalized value of this excess return is economic goodwill.

All of us should have a good income and a decent office . But in real what we get , lengthy office time period and bosses very long issues as well as perks and rewards which are not really really worth . It is a time for fix , change the method you work . What about on-line work which gives you independence as well as time freedom , you are able to Dedicate more time with your family members also earning. There are plain a set of rules , perform each day for very few hours constantly , be your own personal boss , and make approximately $33000 weekly . This sounds fictitious ! well, it is not , it really is an excellent chance to raise your salary , and fulfill almost all your aspirations . What are you waiting for , Go and check it out>>> http://cummins.pt/eA

“Doubling model”. “A framework.” Sounds like it was obtained from experience, intuition, and observation, likely with some good examples that really did fit the model closely. Okay.Let’s see if we can do more: Just in recent and maybe comparable years there have been some thousands of fundings that for size, timing, etc. are within the framework, are candidates for the model.So, in terms of stochastic processes (something that varies over time, usually with some randomness), we have a lot of sample paths, that is, if you will, samples essentially as in elementary statistics and paths since the subject varies over time. E.g., other sample paths are the flights of bumblebees, the path of a grand slam baseball, the nightly paths of a male cat or raccoon, the paths for the last year of some investment portfolios, etc.Point: The concept of sample path is general enough for the situation.Then use those thousands of sample paths as basically all the possible samples and apply the reference I mentioned in my post of yesterday athttps://avc.com/2019/02/vid…and in particular the D. Bertsekas lecture athttp://disq.us/url?url=http…Disclosure: Bertsekas has some terrific applied math here, but none of it is related to the applied math in my startup.

Thank you. Founders and employees get sooo diluted in this deal. Am i missing something? Bring the ico wave back.

So do the seed investors. Capital costs something!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Any thoughts on whether this applies to pre-seed?(I’m thinking that pre seed would then be half of the seed, ie 750 000 USD. But that doesn’t mathematically align with for ex Y Combinator’s 150 000 USD for 7 %, which would imply 21% for 450 000 USD, not 750 000.)

Super interesting thoughts. Would you say you try to always use this framework, or have you faced many exceptions for which you needed to use other valuation methods?

Fred, good post and makes sense. Do many seed round investors follow the logic you presented or is this fairly exclusive thinking to USV?

I kind of wanted to do that but didn’t want to work hard enough to figure out how