What Happened In 2020

It is my tradition to end the year looking back and start the year looking forward. So today, I will write about 2020 in the context of tech/startups/VC/crypto.

While it is inarguably the case that 2020 was a terrible year with a global pandemic, racial strife and ugly politics in the US, and an economic downturn that is impacting exactly the people who have already been hurt the most, it was an inflection point for the tech/startup/VC/crypto sectors and a very significant one. These sectors, which had been growing in their global importance over the last twenty years, all of a sudden have emerged as the most important sectors of the global economy.

We are seeing structural declines in the importance of massive sectors like carbon based energy, commercial real estate, retail, and more. And technology based products and services are benefitting from these losses.

Some obvious examples:

1/ Zoom and other video conferencing services gain when employers allow/encourage/require their employees to stop coming to offices leased from the commercial real estate sector.

2/ Electric vehicles/batteries/software gain when fewer and fewer consumers are buying gasoline from the carbon energy sector.

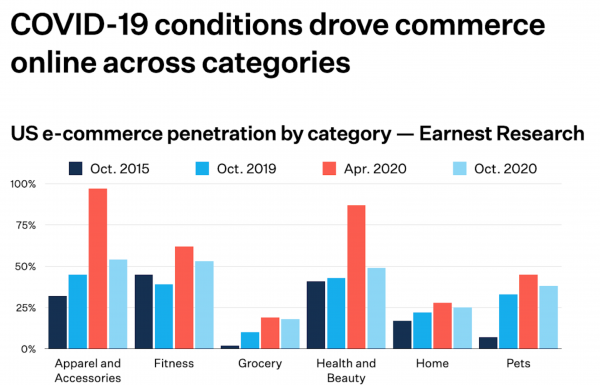

3/ Technology based commerce solutions gain when less people venture into stores to buy groceries, clothes, and other consumer products.

These changes are not temporary, although the velocity of the changes may be. Technology based services have improved significantly this year, rising to the moment when consumers needed them, and they will continue to improve relative to legacy offerings. And consumers have installed the apps, left their cards on file, and adopted different routines. The genie is out of the bottle. It is not going back in.

In USV’s year end review process, we asked our team if there was anything about the work model we adopted in the pandemic they want to keep. What we heard was most people want to be in the office two to three days a week, not five. And that makes sense, particularly in a dense urban region where transportation options are crowded and time consuming. One of the big ahas of 2020 was how much time and productivity is wasted on commuting and how much more productive we have all become without it.

Financial markets, flush with stimulus money that mostly found its way to brokerage accounts instead of the families that actually needed it, understood these changes quickly and we witnessed extraordinary gains in technology stocks and crypto assets. This was largely a speculative affair, driven by people stuck at home trading stocks and crypto for their own accounts or with other people’s money.

But here is the thing about speculative frenzies – they are generally directionally correct but off in their order of magnitude. And they finance the trend that they are directionally correct about. It may be the case that Tesla’s market capitalization is too high, but that allows Tesla to raise $10bn without diluting more than a few percentage points. And that $10bn will go towards accelerating the conversion of the auto industry from carbon-based fuel to renewable energy. And that is a good thing for society.

There is no question that crypto is in yet another speculative bubble, but like I said, it is speculative bubbles that allow emerging technologies to go mainstream and finance themselves. Odd as it may seem, a lot more people want to buy Bitcoin at $28,000 than wanted to buy it at $5000. That’s just how things are. And it is important to understand that.

Startups and the investors who finance them benefit from all of this. 2020 was a great year for early-stage companies and venture capitalists. And some profound changes are afoot that will allow startups to flourish even more in the coming years. We now have virtual capital raising so that startups don’t need to travel to raise capital. This makes it easier to raise money and makes geography matter much less. And we have remote work becoming mainstream which means startups can be located anywhere and hire from anywhere. Capital and talent are the heart and soul of startups and both are now available to a founder from anywhere. It is hard to understate how transformational and important this change is.

So when we look back at 2020 in a few years, we will see that it was the year that everything changed for tech/startups/VC/crypto and set the stage for a decade of transformational change. And god knows that the world needs a lot of that right now. That will be the topic of my post tomorrow.