I was emailing with my friend Harry this past week and we started talking about crypto and the inevitability of a massive crash. I am certain the big crash will happen. I don’t know when it will happen and I think it may be some time before it does. But better safe than sorry. So I’m going to write some thoughts about how to survive it.

I told Harry my personal story of having 90% of our net worth go up in smoke in the dot com bubble and crash.

The only reason it was not 100% was that we owned two significant pieces of real estate that were about 10% of our net worth before the crash and became our entire net worth after the crash.

We were not diversified. We had all of our money in venture capital and internet stocks and had ridden that wave all the way up. Before Flatiron Partners (the venture firm I co-founded at the start of the Internet boom), we had no net worth. So everything we had, we made in the 1996-2000 period. And we essentially lost it all when the bubble burst.

Had we not sold Yahoo! and other stocks to purchase the real estate and pay the taxes on the gains, we would have been wiped out completely.

You might think “you could have sold when things went south” and that is a good point. But when things blow up, your first instinct is that they will come back. They didn’t this time. The selling just continued. A few companies we owned a lot of went bankrupt. These were public stocks that went all the way to zero. So, while it is true that we could have and should gotten out when the bubble burst, we did not, and in some cases could not.

So selling when a market blows up is not the best way to protect yourself from a crash. Selling long before it blows up and diversifying your assets is a much better way. Like we did with real estate, but with a lot more than that.

I like a mix of cash (t-bills, money market funds, etc), blue chips stocks (Amazon, Google, etc), real estate (income producing with little to no leverage), and a risk bucket (venture capital, crypto, etc). I think 25% in each would be a good mix. We have more in the risk bucket but I am in the VC business professionally and have been for 30+ years. 25% in each is where I’d like to get to in time.

I have advocated many times on this blog that people should have some percentage of their net worth in crypto. I have suggested as much as 10% or even 20% for people who are young or who are true believers. I continue to believe that and advocate for that.

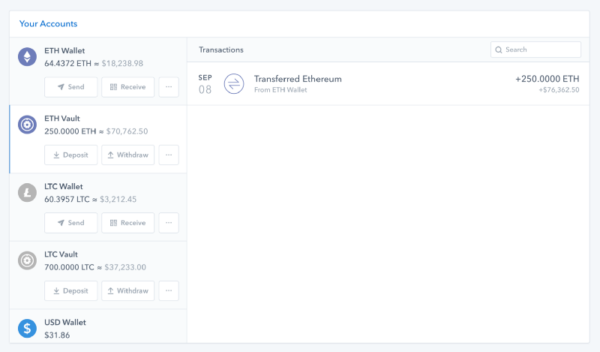

But we don’t have that much of our net worth in crypto. We probably have around 5% between direct holdings and indirect holdings through USV and other crypto funds. I think that’s a prudent number for a portfolio like ours.

I know a lot of people who are true believers in crypto and have made fortunes in it. They are “all in” on crypto and have much of their net worth (all in some cases) invested in this sector. I worry about them and this post is aimed at them and others like them. It is fine to be a true believer and being all in on crypto has made them a lot of money. But preservation of capital is about diversification and I think and hope that they will take some money off the table, pay the taxes, and invest it elsewhere.

That is the smart and prudent thing to do. I wish I had done it during the internet boom. I did not, but the next time we made a bunch of money, I did. I learned the hard way. I share my story so that others don’t have to.