When markets are in turmoil, like they have been for most of this year, I like to have a buy-and-hold mindset when it comes to making new investments. It is hard to know when you’ve reached the bottom and can start buying again, but if you think about a ten or twenty-year hold, then it becomes a bit easier.

The Gotham Gal and I buy and build a fair bit of real estate on the side and we generally use a “cap rate” of between 5 and 10 when we acquire and develop real estate. That means we want to generate an annual yield on our total investment (acquisition cost plus construction cost) of between 5% and 10%. If you think of those numbers as price/earnings ratios, then we are paying a PE of between 10 and 20 times earnings.

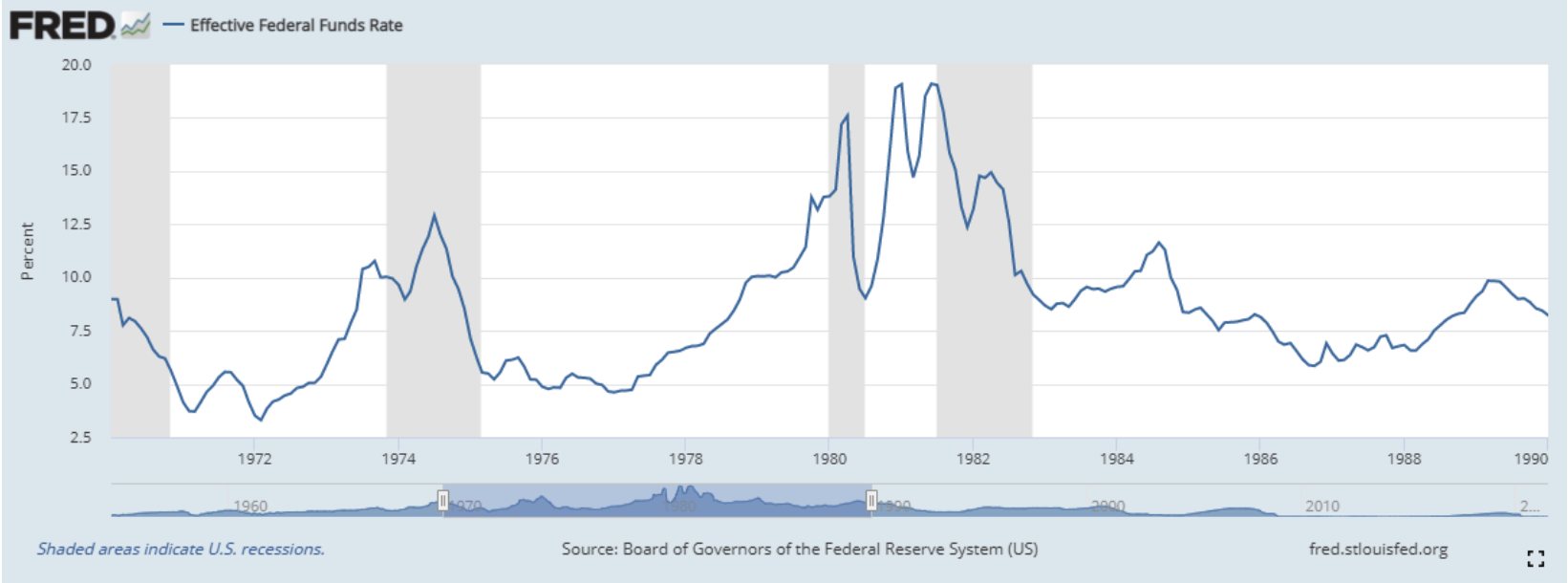

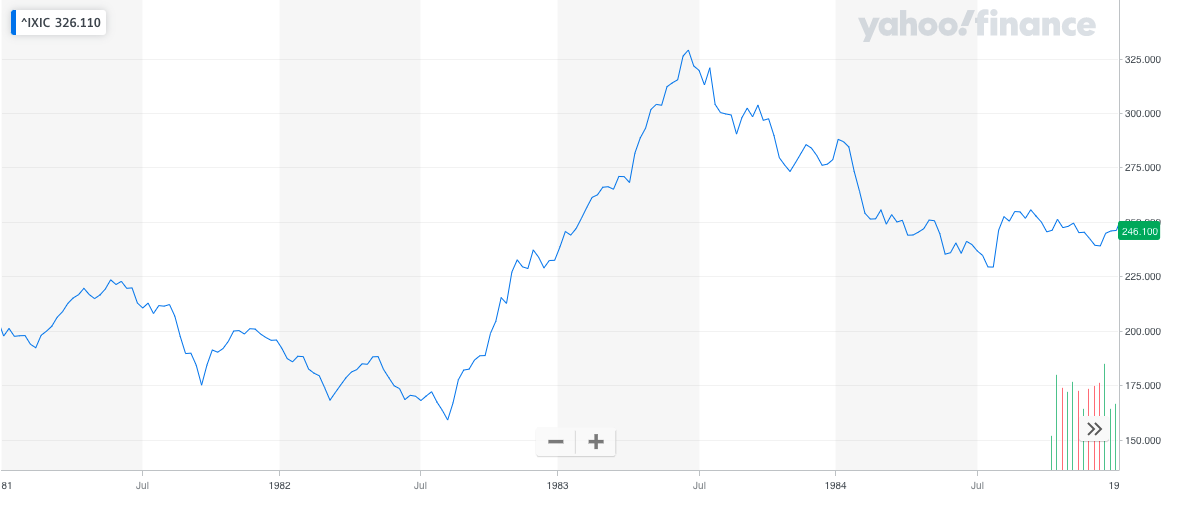

It is true that PEs and cap rates and most other “investment ratios” are impacted by current interest rates. When rates go up, like they have been for the last year, the value of capital assets goes down. That’s what we have been seeing this year, among other things.

But if you think about holding an asset over a very long time, like a building, then you will likely hold it through a number of different interest rate environments. And so what I like to think about is what a reasonable return is for a very long-term hold. And in real estate, that is between 5% and 10% per year in my view.

Riskier assets, like venture capital investments, would require a much higher return than 5 to 10% a year. At USV, we generally underwrite to at least 10x our investment if the company is successful and drop down to maybe 5x on more mature companies where we have a much better line of sight to an exit. A 10x return over ten years is roughly a 26% annual return compounded. A 5x return over ten years is around 17.5% compounded. So riskier assets command higher expected returns.

But if you are looking at a tech stock that is mature, like Google or Apple or Amazon, or even something a bit less mature like Etsy (where I am Chairman and own a lot of stock), or Shopify, or Airbnb, I believe it is appropriate to think about that investment more like real estate than venture capital.

Let’s look at Google. It is down about 30% in the last year to a market cap of about 1.25 Trillion. It generates about $70bn of net income a year (that’s what it generated in the last year). It generates about $80bn of cash flow from operations. So if you think of Google like a building, it is trading at a cap rate of 6.4% and a PE of about 18x. Google’s business is not quite as resilient as a building, which is a hard business to mess up, but it also could potentially grow its earnings significantly over the next decade or two, which is a bit harder to do with buildings.

Would you rather buy Google at a cap rate of 6.4% or an apartment building in your neighborhood for a 6.4 cap rate. I think it’s a tossup. At least it is to me.

Now let’s look at Airbnb. Airbnb’s stock is down 46% in the last year. It is valued at $62bn. In the quarter that ended in September 2022, it generated $2.9bn of revenue and $1.2bn of EBITDA and Net Income. I am not sure why Net Income and EBITDA are the same. Maybe Airbnb is not paying taxes yet. It could be using up loss carryforwards or something like that. But a fully taxed Airbnb would be generating Net Income of more like $1bn or maybe even a bit less per quarter. On an annual basis, Airbnb is likely to be generating about $5bn of EBITDA and maybe $4bn of net income. Airbnb’s cash flow from operations over the last four quarters is approaching $3.5bn. So if you think of Airbnb like a building, it is trading at a cap rate of 5.6% and a PE of 15.5x.

These ratios and numbers are all “back of the envelope.” What I mean by that is there is a much more rigorous analysis that could be done here. I am just trying to use some real companies as examples of what I am writing about today.

My point is that if you think Airbnb and Google will be around for the next twenty years and their businesses will be stable and/or growing, then the prices at which they trade in the market resemble what a real estate owner might pay for them if they were buildings.

And if you, like a real estate owner, want to own these assets for a long period of time and generate an annual return of between 5% and 10% on them, compounded over ten to twenty years, then today’s prices look pretty reasonable to me.

A 6.4% annual return compounded over ten years is about a double on your investment. A 6.4% investment compounded over twenty years is about 3.5x your money. So if you are saving for a retirement or college expenses or something else, you have a long-term opportunity and so thinking long-term can be very helpful.

To be perfectly clear, I am not recommending Airbnb or Google stock here. I like both companies very much and think they are dominant in their sectors (travel and search) and likely will continue that dominance for the foreseeable future. But all businesses are at risk of poor management, new competitors, changing market structures and technologies, and many other things. Return comes with risks. Buildings can be risky too. Neighborhoods can change. Tax and other laws can change.

What I am saying, however, is that many of the top tech companies have seen their stocks tumble between 30% and 80% in the last year. Shopify is down 75% in the last year. Twilio is down 83%. Cloudflare is down 75%. These are companies I am quite familiar with, know the CEOs, and admire. Again, I am not recommending these stocks. I am just saying that prices have come down a lot in the last year and fundamental analysis, at least on some, suggests they are in the range where a long-term buy and hold could make a lot of sense.

Does that mean the stock market has bottomed? Absolutely not. It may have. It may not have. But if you are investing for a very long time horizon, you may not want to think about trying to time the bottom, which is very hard to do anyway, and just think if investments you make now and hold for a long time make sense. And on that measure, I feel that the answer is starting to be yes.

If markets continue to tumble into next year, then we will have opportunities to buy great companies at even lower PE ratios and higher cap rates. And there is some chance that will be the case.

So another thing I like to think about is taking a long-term approach to making investments. If you decide to invest $100,000 into the stock market because you agree with my reasoning in this post, then it would make a lot more sense to invest $10,000 a month over the next ten months than invest all of the $100,000 this month. The markets may move up on you making the later investments more expensive. But they could also move down on your making the later investments more attractive.

Since we don’t know which way markets will move, it is best not to try to time them and just average into a position over a reasonably long time period.

Markets are not rational in the short run. They become overheated at times and those are excellent times to sell some of your investments and move to cash for a while. They also become overly beaten up at times and those are excellent times to deploy that cash back into the markets. Knowing when you are in which situation is critical and fundamental analysis using cap rates and PE ratios and expected returns can be very helpful in determining that.