Posts from September 2011

Audio MBA Mondays

I've got some great news to share with all of you. MBA Mondays is now available in audio form. The coolest part is how it happened.

A few months ago, I met Tyrone Rubin in a room on turntable.fm. He was DJing and chatting. Because that's what you do on turntable. We got to talking and now we are friends. We haven't met but I'm sure we will at some point.

A few weeks ago, Tyrone emailed me and told me he wanted to do voice recordings of all the MBA Mondays. He has a friend Raph who is an actor and does voice work and they wanted to do it as a "labor of love." I listened to the first few and dug the South African accent. Tyrone and Raph are both South African and live in Cape Town.

So we created a SoundCloud account and they are recording and uploading. The've done 20 so far. They will get all 87 done in a month or two. And then they'll add a new one each week.

So if you are in a car or at the gym and want to listen to MBA Mondays, you can do that now. You'll miss a bit without the images and the links. But I've listened to many of these episodes and I have to say they are a pretty good substitute for reading the blog.

Here's the SoundCloud account. Here's the RSS feed. Here's the podcast on iTunes. You can also get the SoundCloud app for Android or iPhone and listen with that.

I was really impressed with how good of a podcasting platform SoundCloud is. It's a breeze to setup the account and start uploading. Getting an RSS feed and submitting to iTunes is also easy. And since SoundCloud is building out apps for all the popular mobile devices, you can listen pretty much anywhere on anything. Yet another USV portfolio company kicking ass. Well done SoundCloud. And most of all, well done Tyrone and Raph. Thanks for doing this.

Whither Netflix?

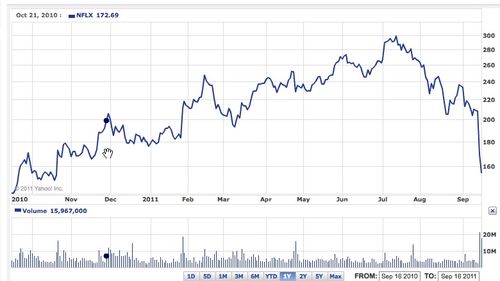

When you see a stock chart like this you have to wonder, what the hell is going on?

Netflix has been one of the hottest stocks out there, rising from $50/share in Feb 2010 to $300/share in July of 2011. That's six times your money in 18 months. And now the stock has given back well over half of those gains in two months and that freefall in the past week seems particularly scary.

But as Dan Frommer points out in this excellent post on Splatf, the street may be overreacting to Netflix's downward guidance. Netflix has pulled off one of the most amazing customer transitions I've seen. They used a dominant position in the physical distribution of DVDs to build a dominant position in the streaming business. That's damn hard to do and it is something you rarely see because it is difficult for most companies to cannibalize a highly profitable franchise.

But that transition isn't always easy and right now, consumers are abandoning DVDs more quickly than they are adopting streaming. And Netflix' recent price increases haven't helped.

But let's go back to Dan's post. Look at this slide:

Netflix told the street that they are now expecting 1mm less subscribers by the end of this year. That's a big miss. But as Dan points out, 80% of that miss is coming from the DVD side of the house. By the end of this year, if the current guidance is correct, Netflix will have 21.8mm streaming customers. That's a huge customer base for the next important film and TV distribution format.

Netflix will produce about $500mm a year of EBTIDA based on a "back of the envelope" calculation I did using Google Finance. With a market cap that is now down to about $8bn, the stock now trades at 16xEBITDA. That's a lot better than 32xEBITDA where it was two months ago.

I don't own Netflix. I don't own any public stocks in my own account these days and haven't since I closed out positions I bought (and blogged about) during the market meltdown in 2008. I do have some managed models on Covestor and some hedge fund interests. They may own Netflix, but I'm not aware of it and if they do, my exposure to Netflix would be minimal. I am not going to go out and buy Netflix after writing this post.

But I do think what we are witnessing here is the speculative forces coming out of a stock in reaction to some bad news. My instinct is that Netflix is still the company to beat in premium streaming video and that they are building a killer franchise in the next important distribution system for film and television shows. And thanks to some excellent analysis by Dan, we can see why that is so.

Disqus Ranks

The community here at AVC has been a testing ground for a new feature that Disqus will be rolling out throughout its network shortly. They call it Disqus Ranks. Anyone who has been in the AVC comments in the past two or three months has seen pieces of the Ranks service coming together.

Here is how it works:

1) the blogger and/or publisher uses a nice new tool provided by Disqus to score each community member. it looks like this (note that I will in all likelihood change these settings over time):

2) the blogger and/or publisher can turn on "ranks" in the comment threads. these ranks appear in the header of each comment. this is what we have been seeing here at AVC for the past few months.

3) the blogger and/or publisher can create custom ranks for the community using a range of conditions and metrics. these include absolute leaderboard position or any of the individual items being measure (shown above).

4) i did that yesterday. and i messed it up. i somehow made everyone "welcome back stranger" for most of the day yesterday. sorry about that. the folks at Disqus helped me fix it yesterday afternoon and now we have what I set up working. that is:

me – Bartender

top 10 – The Entourage

top 50 – The Gang

top 100 – The Regulars

top 250 – The Semi-Regulars

top 1000 – Familiar Face

top 2000 – Welcome Back Stranger

first comment – Newcomer

I'd like everyone's feedback on these names and the scores associated with them. I'd also like suggestions for other ranks. We can assign names to all kinds of behavior, first to comment, spam reporting, liking, replying, etc.

You can see that I've been working with a bar theme. I've always seen the AVC community as Cheers, a place people come hang out, have fun, talk about stuff, make and maintain friendships. So for now anyway, I'm going with that.

I think that's it. Let's disqus.

UPDATE: I've been playing around with Ranks as people are discussing them and giving me ideas. When I update the Ranks, they go away for a few minutes and the new ones come back. So you may not see them from time to time. Also, I added a new Rank called instigator for those community members who start conversations. Disqus makes me an instigator. I will try to get the bartender handle back but it is gone for now.

Lean

I've been reading Eric's book which I am very much enjoying. And on wednesday night I spoke to the NYC Lean Startup Meetup with the help of Giff who interviewed me.

Eric and his fellow lean advocate Steve Blank have both written at length about the methodologies associated with the lean startup approach. If you have not read their books (Steve's here), I suggest you do.

But the most interesting part of the discussion on wednesday night for me was when Giff asked me about a comment I had made that "you need more than a lean methodology, you need a lean culture."

To me, lean is a state of mind that a founder and his/her team needs to have across all aspects of the business. The specific product and engineering approaches that are at the core of the lean startup movement are paramount for sure. But if you can apply lean to hiring, sales, marketing, customer service, finance, and everything else, you will be rewarded with a fast, nimble company. That's a winning model, especially when things are moving fast in many dimensions as they are right now.

Later on in our conversation on wednesday night, I got a question about lean and venture capital. To me, USV is a lean VC firm. Brad and I set it up that way because we talked about all the things we didn't like about venture capital firms when we were setting USV up in late 2003.

My prior experience at Flatiron was instructive. In the first two or three years of Flatiron, it was basically just me and Jerry. We were deeply engaged in all of our investments and we had one or two employees other than ourselves. We did very well in that period. In mid 1999, we went on a binge, raised a huge fund ($350mm), moved into a massive office, hired a staff of 25, made investments we weren't engaged in, and got fat. We did poorly in that period. We shuttered Flatiron in 2001 and I took over the entire portfolio with the help of Jerry and Bob. It was basically back to the early model. We did very well in that period.

I do not believe that venture capital scales. I believe you need a small team of highly engaged partners and not much else other than great relationships with entrepreneurs. We do have a small team of non-partners at USV. Dorsey runs the office. Christina runs the investment stuff. Gary runs the portfolio engagement stuff. That's it. It works really well. We've kept USV lean and I believe that has allowed us to focus on what matters most, to react quickly to opportunities, and to be focused externally as opposed to internally. And when I look at most of the VC firms I admire, I see similar lean approaches. It's a winning model.

Jobs, Jobs, Jobs

Jobs seems to be all that Washington wants to talk about right now. And for good reason. A lot of people are out of work. And incumbent Presidents don't often get reelected when 10% of the workforce is out of work. I've said my piece on that whole thing already. I'm not looking for Washington to solve the jobs issue. I'm looking for entrepreneurs to solve it. And they will in time.

One thing entrepreneurs can do is to make it easier for people to find a job. And we have a company in our portfolio that does exactly that. It is called Indeed and is located in Austin, TX and the Stamford, CT. We've been investors in Indeed for five or six years now. And it is one of our best investments by any metric you'd want to use. We love the Indeed team, the Indeed product, and the Indeed mission, which is to make it easier for people to find jobs.

Indeed's job search is used by between 30mm and 40mm people worldwide every month according to comScore. That's a lot of people looking for work. If you haven't used Indeed's job search, you should check it out. It's by far the most popular job search in the world.

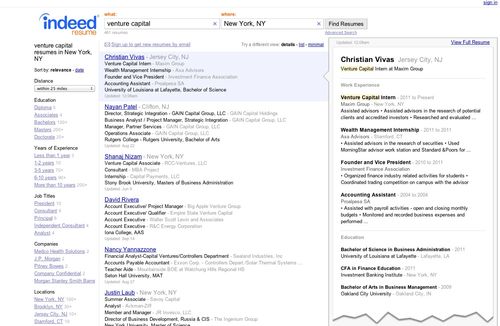

Today, Indeed is launching a new service called Indeed Resume. They posted about it on their blog. It works just like Indeed job search. What and Where. That's it. But it returns resumes instead of jobs. So it's search built for employers instead of employees. I really like the way they showcase the resume in the right rail when you hover over a search result, like this:

If you'd like your resume to show up in Indeed Resume, post your resume here.

We can sit around arguing about how to solve the jobs issue in this country or we can do something about it. I'm happy to see some entrepreneurs doing something about it. And making money along the way. That's the way out of this jobs mess.

Six Slides, Three Slides, or No Slides

I read a blog post (via Hacker News) this morning that suggested three slides is enough.

I've written that six slides is what got it done for us.

And the best presenations I've seen lately used no slides, but started with a live demo of a working web app and went from there.

Nothing beats a demo in my book. It allows the founder(s) to talk about what they built, why they built it, and where it is going "in situ."

So think about ditching the pitch deck and using your app as the backdrop for your fundraising meetings. I am confident you'll like the results.

Turntable.fm

We finally got around to announcing our investment in Turntable.fm. I wrote this on the USV blog today:

Sometimes you end up loving something you don't want to.

When turntable.fm launched, I wanted to avoid it. There was the Facebook login button that I didn't want to use. There was another music service I didn't want to add to my already-exhaustive collection. And then there was the matter of Seth and Billy, who may have the distinction of getting more "no thanks" from me than any other pair of entrepreneurs in the world. Seth got the first one from me in 1996 I believe, and they got the most recent one from me less than a year ago.

But the service kept coming after me. It was showing up in my twitter stream, my facebook feed, my tumblr dashboard. My friends were on it and loving it. Our office was on it and loving it.

So one day in late June or early July, I finally hit that Facebook login and took a tour of turntable. What I found was people, lots of them, they were playing music, they were listening to music, they were talking to each other, they were dancing, they were having fun. And I was too. I was sold in about five minutes. I called up Seth and Billy and said "let's talk."

One of the worst kept secrets in startupland is that Union Square Ventures has led a round of financing for turntable.fm. We've been joined in this financing by Polaris, First Round and Chris Sacca and will also be joined by a collection of strategic angels who will close later this month. Billy has the news up on the turntable blog.

Billy Chasen is one of the most talented web entrepreneurs I've met. He makes software that looks different, feels different, and is different. His Chartbeat service is the most elegant and beautiful analytics product ever created. I've wanted to work with Billy for years. But we never found the right project to work together on. Now we have. I'm very excited about that.

Seth Goldstein is one of the first web entrepreneurs I ever met, back in NYC in the mid 90s. I've been his friend since, and we were colleagues at Flatiron where Seth built a killer mobile web portfolio a decade before its time. We both learned a lot from that. I've been trying to work with Seth again for a decade and now it has happened. A homecoming of sorts.

But the thing that has made all of this is possible is turntable.fm. I'm in the service now as I'm writing this, in my regular early morning hang, the indie while you work room. You'll find me there most mornings between 5am and 7am eastern. If you like to listen to indie music while you work, and if you are an early riser like me, maybe we can listen to some music together, chat about whatever, and maybe even jump on the stage and spin some tracks.

It is this form of socializing together across physical distance that makes the web special. As Dave Weinberger said,

On the Web, however, strangers are the source of everything worthwhile. Strangers and their utterances are the stuff of the Web. They are what give the Web its matter, its shape, its value.

Turntable is where strangers play music they love to each other, talk, and in time become friends. It happens to me most mornings and it is a special experience and I'd encourage you to experience it yourself.

EBITDA

Last week's post on valuation brought a couple questions about EBITDA. The first of which is how do you pronounce that acronym? The answer to that question is e-bit-dah. The second of which is what does it mean? The answer to that is Earnings Before Interest Taxes Depreciation and Amortization.

The way I like to think about EBITDA is the pre-tax cash earning power of the business. It is not much different than the notion of Operating Income which is revenue minus cost of goods sold and operating expenses. But it takes out the two big non-cash items in an income statement, depreciation and amortization.

EBITDA originated in the buyout world where you use a significant amount of debt to buy a company. Since interest costs are tax deductible, you can load a company up with debt and not pay taxes. If you want to figure out how much you can borrow, you look at EBITDA and that is the amount of interest you can pay to wipe out all of your taxes.

Let's use an example. Let's say you have a business with no debt that does $100mm in revenue, has $20mm in cost of goods sold, and another $60mm in operating expenses. Let's say that you have no amortization and $5mm of depreciation. Then your Operating Income is 100-20-60 or $20mm. If your tax rate is 40%, then you will pay $8mm in taxes. Your Net Income is $12mm (20-8). And your EBITDA is 20 + 5 or $25mm. You can also get to EBITDA by taking the Net Income and adding back Interest, Taxes, Depreciation and Amortization. In that method EBITDA = 12 + 0 + 8 + 5 + 0 = $25mm.

If interest rates are 5% and you can borrow interest only, then you can borrow $500mm of debt, pay annual interest of $25mm per year, and no taxes because your interest costs wipe out your net income. After doing that your Net Income goes to 100-20-60+5-25 = 0.

So that is where EBITDA comes from. But there are a bunch of problems with EBITDA. First is that even though depreciation is a non-cash expense, it is the accountants way of estimating how much capital investment you must make in your business every year. If you don't have any money left to continue to invest in your business infrastructure, you'll be in trouble. That's why a lot of people prefer EBIT to EBITDA.

It is also true that if you borrow so much that you have no margin for error, you are likely to run into a problem and go bankrupt. So buyout investors don't load up on so much debt that they use up all of EBITDA paying interest. What they do instead is value a business as a multiple of EBITDA. And that multiple is usually in the single digits (5, 6, 7, maybe 8). In our scenario, the business we talked about would be worth $150mm at 6xEBITDA. That's a very big difference from the $500mm you could borrow if you were willing to apply every penny of cash flow to paying interest. And a 5% interest only loan is not particularly common in a buyout scenario either.

But in any case, this is not really a post about buyouts. I'm not an expert in that topic. If the MBA Mondays audience is interest in a post or two about buyouts, I have some friends who can provide that. This was just an attempt to explain EBTIDA and give you all some context for where the measurement comes from and why. I hope it did that.

Remembering 9/11

Every year I write about 9/11 on the anniversary. It's my way of remembering that day.

I like what Michael Roth, President of Wesleyan University, has to say about the value of remembering:

But on this 10th anniversary of 9/11 let us also simply acknowledge the claim that our painful memories still have on us. Let us recognize with piety that we still carry the traces of those traumatic events with us, and that we acknowledge their importance to us without trying to use them.

I'm watching the television coverage of the 9/11 services at the World Trade Memorial as I write this. Seeing the young men and women talking about the parents they lost that day reminds me that a decade is a long time. Like them, our kids were children on 9/11 and they are young adults now. The Gotham Gal wrote this today:

Going on the subway the day after the towers came down because I thought it was important that we didn't let this event change the way we live in our city. There were tons of cops down there. Josh went up to one of them and asked if they caught the bad guys yet. He answered, not yet son but we will, we will.

Josh was five then. He's fifteen now. And the policeman in the subway was right. We did "catch the bad guys." For me, that fact is a bit of necessary closure.

And the beautiful memorial at ground zero is also a bit of necessary closure. The hole in the ground lasted a decade. And now it is filled and will be a memorial forever more.

I'm feeling less pain and a more closure this day. Time heals all wounds it seems. But it should not fade the memories and remembering is one way to make sure it doesn't.