The AVC Community Is An Optimistic Bunch

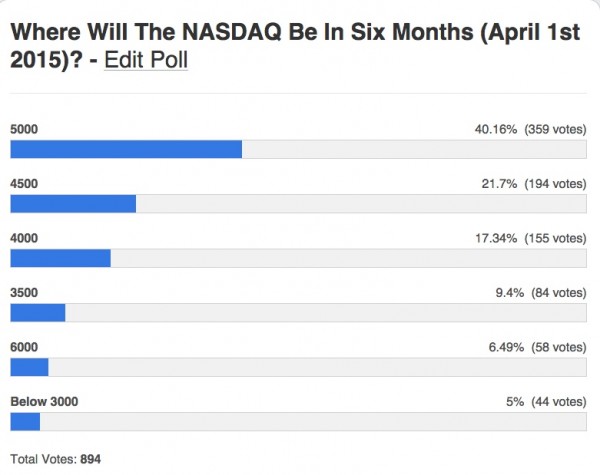

The results of the poll we ran on Friday are interesting:

62% of AVC readers think the NASDAQ will be flat to up 10% in six months. That means continuing the steady march upwards that it has been on for six years.

6.5% of AVC readers think the NASDAQ will be up big (>30% in the next six months). That would be a blowout. Hard to imagine how that could happen but there are some among us who can.

32% of AVC readers think the NASDAQ will be lower in six months with half of them thinking it will be down a bit (10%) and the other half of them thinking it will be down big.

I will say that I’m in the latter camp. I can’t recall if I voted for 4000 or 3500. I did not vote for below 3000. I hope I’m wrong to be honest. We’ve got plenty of assets that are in some way or form tied to the markets and I’d prefer not to see them go down. But I am mentally prepared for it.

Comments (Archived):

Easiest decision was to just project current trend. That’s my theory on why 5000 was most popular.Harder to apply economic and political forces into thinking.

Using the recent past to project the future is not a recipe for success

I tried that when I was 18. Based on past performance, by the time I was 40, I would be very very tall, very very strong, and in incredibly great shape!It didn’t work out that way. 🙁

38″ biceps, riiiiiiight.

Hey, past performance and trends! I just *had* to pick the peak of the “growth market”.

Oh, for sure. I agree. My observation was definitely not a prescription for others.

True for trends and events, yet a personal track record is given credence in professional life.

Using the recent past to project the future is not a recipe for successI think Jim’s comment is an example of the “hey, time to get your toe wet, eh?” that has people getting into the market when there is clear evidence that it is overheated.And it also shows the futility of trying to use rational and logic to predict what people who don’t use rational and logic (they use greed, jealousy and emotion) to make investment decisions. One of the reasons I don’t buy stocks. I can’t think like those people do.

Can predict what emotional people will do? Sure: Revlon? Chanel? Hollywood? P&G? Do such prediction by assuming that the people are fully rational? I don’t think so!While I try to be rational, I can pursue an emotional side: Or, for the girls and women I’ve known, there wasn’t much else but just the emotional side. Last night I was an example of a prediction of emotions by early 20th century composer R. Strauss (not the same as J. Strauss who was famous for writing waltzes). Early in his career R. Strauss wrote the orchestral piece Ein Heldenleben (from Bach, Mozart, Mendelssohn, J. Brahms, R. Wagner, J. Strauss, R. Strauss and more, one way and another Germany/Austria long was the leading candidate for being the best in classical music — not everything from Germany/Austria was so good), that is, a hero’s life. Some people can really like that music; I do, and now much more than when I first heard it. So, R. Strauss’s prediction about emotions was correct: Some people would like his music. It’s programmatic music, that is, has a program or specific story. Setting aside the grandiose title, might call the story about an everyman. So, there is a man, and he is introduced at the beginning. Seems an okay guy, somewhat interesting. Then hear about his adversaries, bad guys, nasty situation. Then hear from a girl; he gets interested, but she gives him a really tough time. Then there is a battle, and our hero mostly wins, but the bad guys do return a little, off and on. Easier to appreciate the music if have had and won a few battles; that Strauss wrote this music early in his career shows that he was a bright guy. Then the guy gets back to the girl and, finally, wins her. Nice music! I don’t know if the two of them are in a fancy restaurant, him on his knees with a ring, holding hands on a high cliff looking out over the ocean, in bed, on the bow of a large yacht, or where, but it’s nice music about success in romance. After having been through a few romances, can appreciate the music better — R. Strauss was a bright guy. Then the guy and girl have an interesting life but that leads to some music of grand triumph. Nice music. Anyone would be happy with that triumph. She turned out to be a darned good wife. I wish I knew if that was realistic — that she gave him such a hard time at the beginning but turned out to be very good to him. Strauss was a bright guy. Nice music. Good men’s music! But, yes, mostly just emotions, or how it feels to be a man, face some bad guys, see a girl, win against the bad guys, win the girl, have a great life. Possible to do such a thing with just music and no words at all? I wouldn’t be too sure, but listen for yourself! I have the von Karajan recording and like how he played it.Possible to make money in a stock market with a lot of emotional people? I’m not trying, but J. Simons did; W. Buffett has; maybe most of the index funds have.Given the emotionalism, that the index funds work, supposedly based on the quite rational, carefully probabilistic, W. Sharpe work on risk and expected gain, i.e., beta and alpha, is curious. So, for a justification, maybe write off the Sharpe work and just assume that the effects of the emotional players mostly just cancel each other out. But, you mentioned essentially the emotions that lead to bubbles — what Simons and the index funds do about that, say, March of 2000 it was? — I don’t know.If my project works and I have funds to invest, what will I do? Don’t know. Cross that bridge when I come to it. For now, I like my project because so far, in the technical work and the selection of a problem (solution with the technical work not yet quite live), I know what I’m doing and am in control.Somehow Gates was willing to sell off his Microsoft stock and still get impressive gains year by year.

If simple trends were good short term predictors, with maybe an exception for trends over, say, a minute or less, then lots of people would notice that, extract the money, and make simple trends no longer good short term predictors, and likely that is what has happened. Similarly for predicting in the short term for a security based on the past price data for that security.So, first cut, since for security X can’t do good short term predictions of the prices of X from the past history of prices for X, the change in the price of X over the short term looks, in probability, independent of the past.Okay: Of course, the price change over the next, say, 60 days is the sum of the price changes for each of the 60 days. So, the price change over 60 days is the sum of 60 independent random variables. First cut, we can assume that these 60 random variables have the same distribution. So, by the central limit theorem, the price change over the 60 days has to be about Gaussian distributed. So, Gaussian distributed with independent increments — right, presto, Brownian motion. And that’s, first cut, why such math starts with Brownian motion.But this does not mean that the prices are Brownian motion conditioned on additional information. So, if can dig up some good, additional information, then the distribution of the increments given the additional information need not be independent or Gaussian; the stochastic process need not be Brownian motion; and might make some money.So, net, there’s a role, possibly important, for additional information. In that case, can mostly just f’get about the central limit theorem and Brownian motion! And, indeed, might make some money with relatively short term predictions. Maybe! The Brownian motion math doesn’t say not.

Words to the wise. In fact this helps me with a decision I am making right now.

Ah, but it is a self-selecting bunch. Most people in this community have some direct or indirect involvement with the startup sector, which does much better when equity markets are up and rising than down and sinking. We have a strong vested interest in it rising, so we assume it will be.

Wishful thinking?

I guess so. Now, if there was enough influence in this group to make it come true, *that* would be pretty interesting.In the end, the market isn’t about the value of equity. It is about the perceived value.

Don’t you think the very fact that we are involved in the startup sector, to some extent [1], in itself, indicates we are an optimistic bunch?[1] either directly or indirectly[2] couldn’t resist the LE effect

I personally think many of the clicks were just random clicking so I’m not sure the “garbage out” even matters at all.But if I had to support what you are saying I would offer that if you believe the age group of readers is young (and therefore people taking the survey is young) (as opposed to the age group of those who comment which may differ and be older) then those people would tend to be more optimistic and less cynical because of life experiences and have more optimism.

I have often wondered about young vs old. The stereotype of young is idealistic and believing they can conquer the world (or at least change it), and of the old is that they are jaded and cynical, but I wonder if it is just a stereotype.

I see many entrepreneurs 50+ who are taking on game changing, world changing challenges around causes they believe in.Pragmatic optimism in the hands of an experienced expert with huge trust based network is a force to be reckoned with.

Yes, quite. If I ran a VC fund, I would be heavily biased towards entrepreneurs in their 40s and above with at least 10 years experience in corporates and another 10 in startups or consulting (but real stuff, not “empty suit” stuff). Of course, that may also reflect how ignorantly I thought I knew things in my 20s….

I think biasing by age is in almost all cases a bad idea.

I didn’t say I would hire by age. But you are probably right. Still, it would be really interesting to see probabilities of viable exit by age of entrepreneur.

While bias is thought to never be good there are clear cases where bias makes a difference and is ok.My daughter was recently hired for a job right out of college. She has no family, no other responsibilities, a small need for money and probably won’t be walking in demanding a raise anytime soon. No question if she were older, had kids and a family she wouldn’t be able to travel and do the job the way she can “right out of college”. Most likely wouldn’t even be able to work for what they are paying. (Assumption is additional knowledge and experience wouldn’t be helpful).Other biases: Hey I’ve heard my own wife tell her boss “no I can’t because of the kids” or similar. For that matter her ex husband can’t do certain things for his work “on his kids weekends”. I think that’s the reality obviously for each person the exact circumstances determine whether the bias is accurate or not.

I would be heavily biased towards entrepreneurs in their 40s and above with at least 10 years experience in corporates and another 10 in startups or consultingMany of the best people though have golden handcuffs or golden lifestyles that they can’t afford to leave. Also since doing a startup is, under the best or circumstances, speculative it would be foolish in many cases to take that chance.Guess what. Are there many cases of VC’s leaving VC to join a “typical” startup? My guess is no. Not only that but you find many people who have hit the lottery deciding to go into angel or VC instead of starting another company. They either see what they have achieved as being lucky or have decided that it’s better not to have all their eggs in one basket.As was said on “The Right Stuff” it takes a special man to volunteer for a suicide mission.

I think once you have had some life experience you see how hard things can be in certain areas. And that would tend to make you jaded and cynical. Of course if you’ve had a great deal of luck and things are easy maybe you are less likely to be jaded and cynical. And issue all sorts of caveats before you go on a speculative path. [1]For example when I started a company out of college I had no clue how difficult it was to hire and retain good employees. And one Saturday early on I bought everyone pizza thinking it was a good idea that would boost morale since they came in on the weekend (and got paid 1.5x) that they would be appreciative. I quickly discovered that it was literally money down the drain (in this particular circumstance at least). [2] And you learn from all of those experiences. THOUSANDS OF THEM. And it definitely changes your future decision making. Things that work you continue to do things that don’t you avoid. Generally.After I sold that first business things changed because “I knew to much” and that prevented me from trying things that I felt had very little chance of success. Things should have been easier because of what I knew but in a way they were much harder. Because I didn’t want to take as many chances. (Also 2nd time around you have something to lose as well obviously).[1] This is why young people in a business can be great. They don’t know what they don’t know. And as I say if you get enough young people trying different things someone will be the lucky sperm and be right vs. the jaded cynicism of “the old man”. (Separate from people just being different of course which also changes the reason why some things work for some people and not others..)[2] How? Because I observed their collective reaction to it. I could see in their face what it meant to them. And also figured out that if I continued to do it it would no longer be special and just be what they expected.

Yep. Idealistic might be a stronger word…

Yeah, that too. Guilty.But tempered with time. Which probably speaks to your point below.

Well, it was a bunch of idealistic people who founded the US and gave it its individual character, and most of them were quite old by that day’s standards at the time, so idealism can work.

” The greater fool is actually an economic term. Its a patsy……Most people spend their life trying not to be the greater fool; we toss him the hot potato, we dive for his seat when the music stops.The greater fool is someone with the perfect blend of self-delusion and ego to think that he can succeed where others have failed. This whole country was made by greater fools.” – Sloan Sabbith. Newsroom. The Greater Fool.

Great line.

Most people in this community have some direct or indirect involvement with the startup sectorThink there are also a fair amount of liberal dreamers as well. Click your heals and wish and hope for the best outcome types.

Do you actually think liberals are more optimistic than conservatives?

I think they are. And now I’ve hand picked something that I just found to back up my point!:http://savannahnow.com/bluf…

I’m glad you said “backs up ” and not proves. I do believe that there are different reasons for optimism. Some are more hopeful that external events will be favorable. Some more confident of their ability to withstand regardless. I tend to be the latter type of optimist. Does that make me liberal or conservative?

My guess: You are conservative.

If we were really more optimistic we’d probably quit trying to diddle with various government regulatory schemes and just trust that it’d work out.

Do you mean traditional liberals or late-20th-century / early-21st-century progressives?

I don’t have an answer for that. I don’t consider myself a student of politics (or writings about it) I’m more a person who draws conclusions from my observations of human nature. I get what I think from general gut feeling more than something that a pundit might say or might be written in an article in, say, the NYT.Along those lines my wording “liberal dreamers” is drawn from my take on comments by some people on this blog.

I guess the stupid question is do we have more expertise though?

I would like to think yes, but I have a vested interest in it being so. 🙂

We are a bunch of self-fulfilling prophets! The Pygmalion effect. [1][1] The effect is named after the Greek myth of Pygmalion. Pygmalion was a sculptor who fell in love with a statue he had carved.

New writing style for William I see.

Footnotes? Where?

I added it later.

It’s the LE effect :)I promise I won’t do it again.

Hey–whatever makes you happy;)

I do that because I think it’s a more efficient and clear way to convey information. It helps me crystallize the points that I am trying to make.With respect to comments here it also takes the onus off the reader to know what I am saying or what I am referring to and provides added and expanded information. [1]I also use footnotes also in emails [2] and from my experience it works and I’ve been doing it for a long long time. When I say “works” I mean “helps to close deals” as a yardstick for “works”. I also use it when forwarding things to my wife and making jokes.[1] While I could look up “Pygmalion Effect” a summary in the comments means I don’t have to. It’s also quicker and generally more readable than wrapping the same information into the comment body and draws attention to info that might be glossed over.[2] I also number points that I am making in emails (and sometimes comments) as I’ve found it makes it easier for people to understand what I am saying and makes them more likely to get the points and the gist of what I am trying to say.

I agree with you! Arnold is giving us a tough time :)Clarity in communications is a good thing.

Of course.

Footnotes permit including more supporting info for readers who want it or at least are pleased that it is there and without making the main body of text larger.

I even gave it a try based on your influence. Was not as satisfying as I had hoped.

why not? it was good.

It’s an acquired taste. Probably the reason more people don’t do it (not including people who don’t agree or see the value..)For example NYC is an acquired taste. As opposed to Malibu (where you live?) which anyone landing there can immediately realize “hey this is a nice place to live”.

training for book writing

I hope you write a book, I really hope you rethink footnotes,I’ll take a bold opinion with a linked reference rather than old school boring annotations to prove the validity of an idea anytime.

of course. in this case, just wanted to spare readers from googling “pygmalion effect.”.

Googling is hard.

ooops. i should have said DDGing. Freudian slip.

Footnotes in books and “white papers” are not the same as footnotes in comments or footnotes in emails.I don’t like heavily footnoted books because they are located “somewhere else” which means I have to turn pages to see the info or what is being referred to. To me that’s annoying and time consuming or both. Plus the footnotes aren’t dynamic and generally don’t contain enough extra info (just a reference). And if they do contain extra info it takes you away from the “reading zone” you were in when you encountered the footnote. As a general rule I don’t like “callouts” either.With comments everything appears within the comment block and to me that difference makes it worthwhile using them. [1][1] Extensively.

Are you ghost writing Fred’s autobiography?

nooooo

1st April 2015 – inauspicious.

.I think the Republicans are going to do very well in the upcoming elections. If so, there will be a honeymoon of gargantuan proportions. The country will think the Obama administration–the wrong way crowd–is over. The Senate will begin to take up the hundreds of House bills sitting under Harry Reid’s desk. This is the six month view only.While I am ambivalent on the repeal of Obamacare, the country will think it is a possibility and consumer sentiment will soar. Not because of the reality of it but because of the possibility of it.If you think Obama has been MIA recently wait until after the elections. There is a real chance he could get impeached except for the reality of Biden. Biden is the biggest impediment to Obama’s impeachment.While the recent unemployment numbers are essentially crap–the labor force participation rate is the truth serum–the dollar is very strong and all the notion there is a better economy to be invested in other than the US economy has run its course. We are the real deal, warts and all.Federal receipts are at record levels and if there is only a small improvement in the level of spending, the deficit will disappear.The big things to watch are going to be Ebola, ISIS, the Russians, the Iranians and the Chinese. Ebola is going to be a real mess in the US. The Iranians are almost at the nuclear bomb right now. They will renege on everything and the Israelis will face a huge test. We have already sold them out and are prepared to accept a nuclear Iran.We will have a very good six months and then the chickens are coming home to roost.JLM.

I’ll take the other side of this bet JLM.Prize is breakfast at Balthazar.

.Done. I will even give you 2:1 odds as long as I can gloat.Stay well.JLM.

Cool.Let’s move it to chacuterie with a bottle of wine at Racines and invite Fred then.

.Only if he puts some skin in the game. Done.Though we do owe Fred some hospitality from last time.JLM.

I vote you for President of the USA, JLM. Then, all that Republican vs. Democrat stuff won’t matter, because you will be the first Independent President.

.I was most recently the President of my neighborhood association — 640 fat cat homes in a single neighborhood. I was elected with a huge margin but I made a lot of “enemies.” I am cured of elected politics. Now I am my voting District Republican potentate. I get to watch the voting on Election Day.JLM.

Ah…got it.But as an independent, look at the bright side: you will most probably get Arnold’s and Fred’s vote (not likely as a Republican), and since we’re dreaming, you will also get my Canadian vote, since cross-border voting will be allowed when 2 countries interdepend on each other so much.

I am in on this one. Will take Arnie’s side. Loser has to wear a Elect Hillary or Elect Scott Walker shirt for a day.

.What is the difference between lawyers and lab rats?There is actually some stuff that a lab rat WON’T do.I would burst into flames if I wore an Elect Hillary shirt. Can’t do it, amigo.How about something less embarrassing like pushing a peanut up Congress Avenue with my nose while nekkid?Big win Ole Miss!JLM.

Fred as running mate? Now we’re talking!

ah, maybe you’re pushing it now 🙂

I listend to the Chief Market Strategist from Russel Investments describe the USA as ‘the least ugly boy at the dance’ when explaining his international allocations.I think he is right, even though it was not inspiring.

There is a real chance he could get impeached except for the reality of Biden. Biden is the biggest impediment to Obama’s impeachment.To me the bigger impediment to Obama getting impeached is that it’s the nuclear option. Obama getting impeached would just create future payback in the opposite direction from those that oppose. Whatever he has done or hasn’t done in no way is worth that possibility.For example the impasse in congress is at least party as a result of payback from Obama shoving Obamacare down everyone’s throats on a fast track. People react predictably and spitefully when they are pushed into a corner.I think that’s the whole thing that Obama missed about politics. It’s the art of compromise and negotiation. And in order to get deals done (in the future) you aren’t going to be able to get everything you want if the other side thinks they are getting a raw deal. Apparently Obama didn’t realize he might need his back scratched in the future.

There is zero chance of impeachment. Republicans are pretty stupid, but I don’t think they are that stupid. I also don’t think there is a honeymoon. The Fed is as political as anyone and it’s a Keynesian org. I predict they raise rates in March by .25%

I believe that inside the Obama administration, except for a few true believers, ObamaCare was always just a head fake, pie in the sky, pushed as something for people who wanted to dream about it and where nearly everyone close to the situation could see that it wouldn’t work and would be shrunk and then repealed.Obama’s politics on ObamaCare were just to slow down the end of ObamaCare until he no longer needed it politically, say, after 11/2014, and then just let it flop and blame Congress or whomever.I doubt that the Republicans will go to the trouble or make themselves less popular with any Reagan Democrats actually to bring impeachment proceedings against Obama.Part of my take is that Obama likes at times saying things that sound like he is about to do something that might be impeachable. This way he gets some headlines that please some of his base. But later, after the headlines change to something else, he doesn’t actually much cross the line to a seriously impeachable offense.Net, in spite of some of the things he has said he intended to do, I doubt that the impeachable things he has actually done, and mere headlines don’t count, will be enough for the Republicans actually to bring a case.Or, instead of the serriously impeachable things, he just worked on his golf game and jump shot, and those aren’t impeachable either.

Part of my take is that Obama likes at times saying things that sound like he is about to do something that might be impeachable. This way he gets some headlines that please some of his base. But later, after the headlines change to something else, he doesn’t actually much cross the line to a seriously impeachable offense.Floats an idea in order to get a reaction and/or to make it less shocking when and if he decides to go forward.Similar technique to leaked information rather than official statements. Plausible deniability. Fred does this [1] (for the right reasons btw) with things he sometimes writes about on this blog. He never says “I’m thinking of investing in X what do you think” he floats a subject and sees the reaction.[1] My opinion.

At least you are correct; maybe we both are: Where I’m different is that I see a difference in both degree and kind. That is, my view is that what he is doing sometimes is way beyond the usual and old test the waters or trial balloon.I’d say that the biggest example is ObamaCare: I don’t think he ever thought it would actually stick, partly because when he campaigned for it he was not prepared and not serious, e.g., his badly wrong remarks about the costs of amputations that got the American College of Surgeons to give him a big slap down — “misinformed, uninformed, dangerous,” etc.There was a shooting in MA or some such, the Marathon or at school or some such, maybe more than one (I’m not looking these up) where he got some headlines saying he was going to do something about gun control or some such. Nope — it’s off the headlines now. Fine with me.Then there was Iraq where he was determined to leave. Oops, that is, now that the headlines have changed, until he decides to go back in. Then he wasn’t going to help the rebels in Syria, until he decided to bomb the AQ operations there. Then he wasn’t going to attack ISIS until he did. Should be possible to find some more.My view is that on such statements Obama is different in kind and degree. But, I’m no expert on politics.Besides, my software is dropping some data. I put in some log statements and last night found the problem right away. Now to fix it.

Okay, just saw one: Athttp://www.express.co.uk/ne…attributed (without reference) to Obama about global warming is:”that will define the contours of this century more dramatically than any other”For this I would say, Obama doesn’t know or care about global warming but knows that a lot of his base care so just says such stuff, to him, just stuff.And there’s another special point: Obama doesn’t care aboutlater being shown that he was wrong or didn’t do what he said. Why? Because such rebuttals won’t much make the headlines, and even if they do he has a lot of power to change headlines. And, his base doesn’t read much past the headlines.I regard this version of presidential discourse as new and different. But, again, I don’t know about poltics.

.Actually I think his golf game might be impeachable.JLM.

It’s really that bad? What’s his handicap?

.He admits to being a “22” which means he is probably a “30”. His form is very weak even on TV.He needs to practice and play more. Might get a lesson or two.Did I really just say that?JLM.

Thanks for cheering us all up 🙂

i guess there is a doomsday scenario. i had not considered it. i’m going to cash as fast as i can!!!

.I didn’t mean to suggest this is a doomsday scenario. I may have been a bit gloomy. I meant to suggest that there are problems which CAN be solved that we have to solve in order to inject a little calm into the world.The challenge is that the administration — only because they happen to be in charge — doesn’t like the solution.Take Iran — they are jerking us around on the negotiations because they don’t intend to make a deal. This Charlie Brown, Lucy and the football. We knew it two years ago. Every day those centrifuges spin, they are a step closer.Militarily it isn’t a tough call — knock out the power supplies to the centrifuges. You don’t have to hit the facilities. You can knock out the power and those centrifuges are scrap.Takes balls to solve some of these problems but they are all solvable.JLM.

your scenario of the republicans taking the senate and the resulting honeymoon is my doomsday scenario.

.Let the doom reign. It’s likely to happen.JLM.

The Senate will begin to take up the hundreds of House bills sitting under Harry Reid’s desk. This is the six month view only.The idea that if one party controls things it’s smooth sailing is like thinking that everyone from the same family automatically agrees and also comes to identical conclusions.When there is an opposing party then they become the enemy. [1] When it’s your same party the enemy is the other guy in the party who you will still wrestle with to get what you want. The game becomes different and easier but it’s not a shoe in by any means.[1] All bond together for a common cause. With out the need to bond against an enemy things change a bit and people tend to be less agreeable and less loyal. I can’t quantify that of course.

The Sun down in Austin has reaped havoc with your brain.

What asset class do you find is the best hedge against tech cyclicality?

i like cash for liquidity and unlevered real estate for solidity

The text in the FT articlehttp://www.nationaljournal….looks nicely informative. Their video, apparently trying to be easier to understand, to me seems less good.That the other broadband providers thought that the Verizon suit opened a can of worms seems to be a good explanation. I always get the impression that the descendants of Bell have it in their DNA or culture or some such to keep clawing for more power by pushing on regulators, laws, etc. like they did for so long as Bell with no concern for the larger market, where Bell had no real competition.Somehow suddenly since October 1st, I got e-mail messages from both NY US Senators and also a US Congressman from NY. Apparently they were responding to something I clicked on here at AVC a few weeks ago.Schumer was the most definite: He came down on putting Internet access under Title II, that is, drawing from the FT article, a regulated monopoly like the last mile of the old plain old telephone. Gillibrand acknowledged getting “my” e-mail and said that she would have a position and respond soon. The Congressman, actually not mine, went on and on about how great the Internet is, was not very definite about what the FCC should do, but, still, clearly heard the big cry for Net Neutrality.I’m beginning to see how Verizon, Time-Warner, Comcast, etc. might be able to take the current situation of the last mile of the Internet and do some things that I would not like and that would be ruled out by a Title II treatment and, maybe, even some anti-trust actions. E.g., they could have their own streaming movie and old TV show service, run their own ads, and slow, throttle, block, or charge competitive services. Actually, a guess is that the mud wrestling is mostly about streaming video and not just some simple Web pages in HTML and CSS with text boxes and buttons.Or, more simply, and maybe with less risk of anti-trust fights, just go to various video steaming services and cut a deal, say, “Look, we own the last mile of Internet access for X million people and are looking for streaming services that want to reach our users. Let us know how much you want to reach our users, in dollars per user per day.” or some such. So, it’d be a case of pay to play.Or to be more clear, “The X million users whose last mile connections we own really like streaming video, especially sports and movies. They have great demographics and are just glued to their screens. And, to not be too unclear, we’ve got our users by, say, the short hair where we see a lot of revenue possibilities. Want to get to our users? Really want to? Okay, then, let us know how much you care!”Or, if own some last mile connections, then move also to own, or cut deals with, some Web sites, e.g., for video streaming, get paid for ads on the Web sites, and use various means to discourage own users from using competitive streaming sites and, thus, capture all or most of the ad revenue from the user’s streaming. I’m not a lawyer, but that’s got to be close to an anti-trust violation somewhere.Sounds like some of the less bright last mile owners need to calm down or the Giant Network Neutrality Title II Robot Dinosaur will bite them in the back side. Or the greedy, too simple minded, short sighted last mile owners need to remember “Can shear a sheep many times but can fleece it only once.”.

Wholeheartedly agree that our success is a function of that optimism.Consider asking the same question for 12 or 18 months… You might get a different distribution.

If it had been 60%, I’d be selling

I think this also has a little to do with Friday’s positive jobs report and the market rally.

I can’t recall if I voted for 4000 or 3500I’ve found that with pricing, estimating or guessing it usually pays to give a range.With estimating or guessing the reasons are obvious with pricing not so obvious. With pricing giving a range instead of an exact price allows you leeway to get the most $$ for whatever you are selling. If you pay attention (and you should) it will be obvious in the reaction of the other party [1] where they are at in the range in their mind. You can then use that against them [2] to your benefit. If you say “$175” it allows you to sell for $200 but possibly lose a sale or have to allow a price reduction which could lead to further pricing “erosion”. If you say $150 to $250 it allows you to get $250 or $150 depending on how the buyer reacts to the range. Some people might say “well maybe $150 but no way I’m paying $200” or close to that. Could be words. Could be facial expression that says “aghast”.[1] Unless they know their stuff and counter that. [3] But of course you’ve already figured that part out in advance of going down this path.[2] Because you know, it’s a game.[3] What I call “be prepared to nod your head ‘no’ no matter what the number thrown out is”. (This is advice specific to buying a car but it holds true in other cases as well).

More importantly I was in The Grove at Ole Miss yesterday. It was wild. Great upset day in college football. Kids tore down the goalposts and ran them through the Square in town!

.Great game and great tradition. SEC is a circus.JLM.

I’m with you, Fred. Nobody knows the timing of the correction but it will come. It’s going to be a very tough time for the “robo advisors” when it happens. They are built for bull markets and have no idea what their client risk tolerance truly is.

.[High soft one coming, watch for it. Shameless.]I wonder how an investor could evaluate their own risk tolerance and their portfolio, Aaron? Any ideas?JLM.

🙂 Well frankly, we’re only offering our technology through advisors right now, but we learned a lot from our foray into consumers and we’ve got a few great ideas for how to solve that problem.

I didn’t vote in this poll but the money I use to invest in stocks currently sits as cash if that’s a vote.In general I think that many of the interesting companies that are public (TSLA) are overvalued at the moment and bound to return to reality. The less interesting companies will continue to inch up but not enough to make-up the drop. Ultimately I am not an expert in business or investing. However a few macro trends stick out as big red flags to me:1. The disproportionate compensation paid to people at the top levels of companies versus those in the middle or bottom. This is less of an issue in technology companies where programmers are often well compensated, but it is difficult for me to believe as a first principle that paying the extra several million dollars for a super-star CEO will impact the company as much as using that money to buy above-average line employees. This is not to say that CEOs should not be well compensated, but rather in any customer focused business I have a hard time seeing those with lower quality line employees beating those with higher quality employees in the long run. A secondary effect of this is that the potential market for consumer goods contracts as people lack discretionary dollars to spend on things like your new image editing software or trips on Uber or AirBNB.2. Climate change will continue to have impact on existing companies with spillover effects. I don’t know when it’ll hurt the oil and gas sector but when a hurricane knocks down a whole lot of copper wire Comcast or its insurer has to find the money somewhere, lest it lose a customer base. When fixed cost of water rises as a result of lack of supply the cost of coca-cola is going to have to be impacted somewhere and/or they’ll have to pay to move the plant to a place where it’s cheaper.3. Year over year rising healthcare costs will continue to be a drag on the economy as a whole. I think the ACA stopped some of the bleeding here but we still have some ways to go to reverse our economy-wide high amount of spending on healthcare.4. Public pension issues continue to plague many states and cities. Many governments are now changing their spending mix to pay for the deferred promises of the past and not investing in the future. Look no farther than investments in state universities (education being a valuable public good http://www.theatlantic.com/….5. Student loan debt. While all things being equal economists suggest that future Matt is going to make more money than present Matt and it is desirable for present Matt to borrow from future Matt to improve his quality of life, psychology creates a different dynamic. Borrowers want to remove the albatross of debt as soon as possible (more so when they feel less certain about the future) and it is much easier to forgo cable, prime rib dinners, and a new car when you are not used to having and paying for those things.

I tend to be an optimist but I have also lived through a few cycles. I came to AVC on the brink of the recession and the picture was pretty dismal. Amazing what is happening right now. But is it built on a strong foundation or borrowed time?The Great Recession was an opportunity to learn valuable and painful lessons. I will never be the same. But I don’t know if we as a society took those lessons to heart to the point of being transformative. And that concerns me.

watch the price of oil

Is there a mercy rule in pro football? Maybe Rex should stay in SD?

I have very low expectations so it doesn’t upset me

I am glad to see Fred making some polls on his blog. He has just verified his position as someone well in my target market.My company is all about creating detailed polls with easy access.Our mission is maximum insight per interaction for all users.what do you guys think about the current polling tools? I know for a fact there is a great improvement right around the corner.

Hi Fred,late comment to this post, but since you published the original one I have been thinking quite a lot about it. Taking a long term view, I have tried to apply Carlota Perez’s framework to your question. According to that, should we read this market as “frenzy” or “deployment”?I wrote a long post here http://blog.founders.as/pos… , would love comments on it but to summarise just the conclusion I think it all depends on our ability to adapt our fundamental structures and institutions to the new world we live in.Compared to the 1999 bubble we have today a real market sustaining the high valuation expectation of tech companies. What we lack however is a new “shell” for this revolution to unfold. In Europe at least we seem stuck in the past while the world is changing under our nose. If we keep this approach I feel we are heading towards a painful adjustment period (and the bull market will only be a temporary result of QE)

huge drop in unemployment from Bush’s Great RecessionAre these good jobs (and the right jobs) or just “jobs”. Sure I saw the WSJ headline. But this is a perfect example of how you can make numbers say anything you want.Is a guy that was making 6 figures working at a Pharma company that is now employed as a assistant manager at Walmart or his wife who is a teaching assistant and was highly paid in manufacturing really “employed”?

.The unemployment situation is still a disaster. The labor force participation rate is the lie detector. We are at late 1970 levels and the population has increased substantially since then.I recognize the utility of comparing Obama to Bush — Bush BAD/Obama GOOD — is a powerful lure and perhaps the only good thing that anyone can find to say about Obama.The numbers? Which ones? Unemployment, dependency, food stamps, disability, immigration, national debt, the unending scandals? The guy is a disaster by any objective measure of accountability.And what exactly has the administration done to improve manufacturing? When the administration gets out the way — such as domestic oil production and drilling — there is some selective progress.Let’s not talk about foreign policy — only fair since the administration really doesn’t have one.JLM.

.I agree with you, as I always have, on the issue of the folly of outsourcing. This was political alchemy that did not work. The Congress destroyed American jobs as a payoff to their political supporters.JLM.

The whole economic mess is structural. We are deep into a financial cup-de-sac of ballooning paper assets/GDP ratio that is unsustainable. All the while the so called experts are busy arguing economic minutiae and moving the deck chairs around on the Titanic.At some point we have to stop with the denial and start to seriously consider reframing our assumptions about economic fundamentals.In computing terms it time to stop thing in term of mainframes.

.The economic problems are absolutely structural — we spend more than we make. And apparently we intend to continue this forever.What is encouraging is the Fed revenue is at an ALL TIME HIGH!If we had just a thimble full of restraint, the budget would come into balance and the deficit could be whittled down to a surplus. We could repay the National Debt and farts would smell like lilacs.Structural repairs require adult leadership and restraint. Discipline.JLM.

.Texas balances its budget every two years at a time. The Legislature meets every other year so we not only balance the freakin’ budget, we do it two years at a time. No way to tinker with it in between.Of course, we know that Texas is peopled with giants–gods really–and the rest of the Nation can’t hold its proverbial jock, no?Eisenhower balanced eight straight budgets while keeping us out of war, building the American nuclear arsenal, launching the Interstate Highway system.Reagan balanced eight straight California budgets.Yes, we can!BTW, all these folks are Republicans.JLM.

And I am not running a VC fund. 🙂

Agreed but you missed my main point.That structural problem revolves around the issue that collectively our pay is not sustainably proportional to our collective participation in the production of goods/services.This pay vs effective-demand cyclical-stasis distortion creates an endless wealth-concentrating paper-asset bubble that ultimately stalls the product/consumption equilibrium.This endless debt bubble is required to backfill/fudge the distorted consumption side the supply/effective-demand equation.Cancel all that government debt-driven spending will only accelerates that inevitable supply/effective-demand disequilibrium stall point.Our structural problem is in essence the over concentration of wealth both locally and globally! Concentration of wealth is not so much immoral as it is mathematically unsustainable.Carl Marx got almost every thing wrong.But as long as we are ideologically unwilling to make a sober reassessment of his mathematically-pivotal supply/effective-demand economic-framing we will remain trapped in this endlessly self-reenforcing debt-driven economic eddy current.Da’nile is not just a river in Egypt, it is a river of modern economic pain.Long live the attempt to modernize capitalism. That attempt seems to suffer many of the same features inherent in the attempt to modernize Islm.