Last week my friend Tom Evslin left this comment here at AVC:

Trial investment thesis: deflation is here to stay, get used to it. Of course we’re used to that in high tech and communication because of Moore’s Law. we don’t model price increases in our business plans. But the rest of the modern economy and the goals of various central banks assume inflation is normal and desirable.

I’ll leave aside whether it’s desirable because I’m positing that deflation is going to happen (except in terms of certain debased currencies).

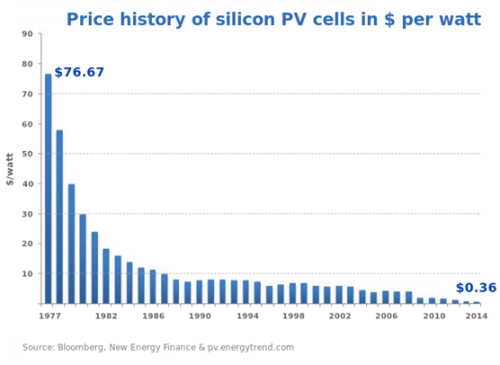

Energy prices are going relentlessly down. They drive costs, of course, through the economy. Moore’s law has had an effect on these prices both in the more efficient use of energy and more effective ways to extract or even generate it it and manage it in grids. But historically, if you measure by manhours required to generate a BTU, energy costs HAVE gone way down since the first fire was intentionally lit in dry sticks.

Moore’s law will eventually even drive the price of health care down (see Andy Kessler).

Food costs are arguable but energy has much effect here as does genetic engineering and computerized farming.

Currency devaluation as an instrument of national financing becomes more difficult with globalization and perhaps nation-independent currencies.

Obvious losers from deflation are the current banking system (built for inflation), debtors with non-productive assets, and governments both because they are debtors and because they lose the taxes on inflationary portion of interest is there is not interest.

The winners are? That’s the investment question I’m thinking about.

I did not reply to Tom’s comment but I’ve been thinking about it ever since. I had a long conversation last night at dinner with another friend about it. What if we have seen peak energy prices on our lifetime? What if we won’t see long term rates in the US of 10% again in our lifetime? What if deflation is what we are managing instead of inflation?

We’ve been in a low rate and deflationary cycle since the financial crisis of 2008, but the assumption has always been that we will someday come out of that and we will return to economic conditions that existed prior to that event. What if that is not the case and we are in the new normal and it is here to stay?

I am writing this post because I’m still trying to wrap my head around what this means. If the global economy is going to have a deflationary bias for the foreseeable future, what should we all be doing and what should we not be doing? That’s the question and I’m looking for a discussion and some answers. Which I hope we will all find in the comments.