Audio Of The Week: Andy and Flyover

Here’s a podcast my partner Andy did with Flyover Labs recently:

Here’s a podcast my partner Andy did with Flyover Labs recently:

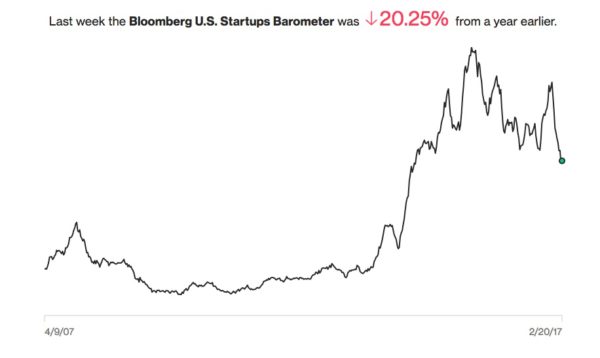

I came across this index from Bloomberg that tracks the health of the US startup ecosystem.

This index “incorporates both the money flowing into VC-backed startups, as well as the exits that are making money for investors. To smooth out some of the volatility, we calculated the average value for the last 12 weeks.”

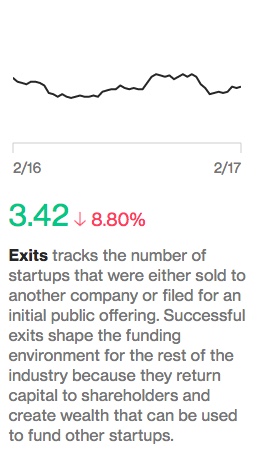

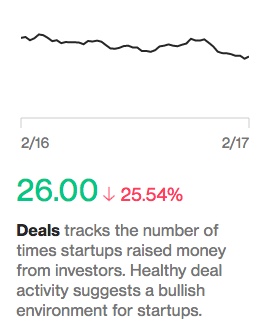

I like that they are tracking both inflows (investments) and outflows (exits). What’s interesting is that over the past year, the exit chart is looking better than the investment chart:

If exits continue to outpace investments, that’s a very bullish thing for the startup sector, particularly for investors. But what is good for investors is ultimately good for founders because strong performance will lead to more capital flowing into the sector.

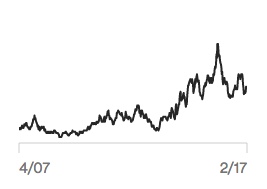

This chart is investments since 2007:

You can see that the VC sector ramped its investing activity significantly in 2010 & 2011 and has maintained it at roughly those levels (with some tailoff recently) since then.

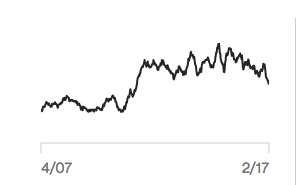

This chart is exits since 2007:

You can see that exits did not start increasing until 2014, roughly three to four years after the significant pickup in investment pace. That makes sense because of the “gestation period” of startups is at least four years and in most cases longer.

I will be keeping my eye on this new index from time to time. And I will be most interested in the shape of the exit chart because it is the strongest predictor of the long term health of the startup ecosystem.

I posted the discussion my partner Andy and I did at the Upfront Summit last week.

There were other great conversations at the Upfront Summit.

This discussion with Mark Cuban was great. I totally agree with Mark that we need more tech companies to go public and have been saying that publicly for several years.

A couple weeks ago my partner Andy and I talked about generational change in a VC firm in a conversation moderated by our longtime investor Lindel Eakman. I blogged a bit about generational change prior to that conversation.

Here is the video of that conversation:

I am old enough to remember the gogo days of cable TV when entrepreneurs who wanted to launch a new cable channel would go, hat in hand and cap table in tow, to the big cable companies and beg to get distribution on their networks.

When the Internet came along in the early 90s, we saw something completely different. Here was a level playing field where anyone could launch a business without permission from anyone.

We had a great run over the last 25 years but I fear it’s coming to an end, brought on by the growing consolidation of market power in the big consumer facing tech companies like Google, Apple, Facebook, Amazon, etc, by the constricted distribution mechanisms on mobile devices, and by new leadership at the FCC that is going to tear down the notion that mobile carriers can’t play the same game cable companies played.

Here is a quote from the incoming FCC Chair:

“Today, the Wireless Telecommunications Bureau is closing its investigation into wireless carriers’ free-data offerings,” FCC Chairman Ajit Pai said in a statement. “These free-data plans have proven to be popular among consumers, particularly low-income Americans, and have enhanced competition in the wireless marketplace. Going forward, the Federal Communications Commission will not focus on denying Americans free data. Instead, we will concentrate on expanding broadband deployment and encouraging innovative service offerings.”

It is certainly true that consumers, particularly low-income consumers, like getting free or subsidized data plans. There is no doubt about that. But when the subsidies are coming from the big tech companies, who can easily pay them, to buy competitive advantage over that nimble startup that is scaring them, well we know how that movie ends.

It is sad to see this era ending. It was a lot of fun and quite profitable too. I am hopeful that some new competitive vector, like the Internet, will come along and make all of this moot and we are spending a lot of our time looking for it. Because backing startups on a field tilted in the favor of the incumbents is not fun and not particularly profitable either.

Today, sometime around 5:30/6pm PT at the Upfront Summit, my partner Andy and I are going to talk about generational change in VC firms, in a talk moderated by Lindel Eakman, who has been our lead limited partner investor at USV since we started the firm in 2003.

The subject is timely with the news that the leadership of Sequoia, surely one of the greatest VC firms in the business, is transitioning a third time, from Jim Goetz to Roelof Botha and Alfred Lin.

I don’t want to steal our thunder for what is going to be a lively conversation with Lindel this afternoon, but I think this is a very important topic. When my partner Brad Burnham and I started USV in 2003, we told prospective investors, including Lindel, that we had no intention of building an institution. We said we just wanted to create a place we could do great work and when we were done, the firm would be done as well.

That was naive. Whether we like it or not, we did create an institution at USV and the key stakeholders in that institution are not the partners of USV, or the team at USV, or the limited partners at USV. The key stakeholders are the founders, leaders, and team members of the 80ish portfolio companies of USV. They have attached their companies to our brand and we owe it to them to sustain it and build it over time.

I didn’t understand that in 2003, but I do now. And so did Don Valentine in 1996 when he passed the baton to Mike and Doug. That is an act of courage and respect for what is special about a venture capital firm and I think it is something to emulate. Which we are doing at USV now and which Andy and I will talk more about later today.

Reserves is the term VCs use to describe funds they “reserve” for follow-on financings of their portfolio companies.

Here are some things entrepreneurs should know about VCs and reserves:

So, given all of this, here is what entrepreneurs should understand:

At USV, we take reserves very seriously. We know that early stage companies require a fair amount of capital to grow into profitable sustainable businesses and we work hard to make sure that we have the staying power that our portfolio companies require from us. Specifically, we have done two things to help us manage this reserves issue:

One of the most common mistakes I see new “emerging VC managers” make is that they don’t sufficiently reserve for follow-on investments. They don’t go back for a new fund until they have invested 70 to 80% of their first fund and then they run out of money and can’t participate in follow-on rounds. They put too many companies into a portfolio and they can’t support them all. That hurts them because they get diluted by those rounds they can’t participate in. But it also hurts their portfolio companies because the founder and/or CEO has to explain why some of their VC investors aren’t participating in the financing round.

Most people think that VC is all about the initial portfolio construction, selecting the companies to invest in. But the truth is that is only half of it. What happens with the portfolio after you have selected it is the other half. That includes actively managing the portfolio (board work, adding value, etc) and it includes allocating capital to the portfolio in follow-on rounds, and it includes working to get exits. And it is that second part that is the harder part to learn how to do. The best VC firms do it incredibly well and they benefit enormously from it.

Happy New Year Everyone. Yesterday we focused on the past, today we are going to focus on the future, specifically this year we are now in. Here’s what I expect to happen this year:

These are my big predictions for 2017. If my prior track record is any indication, I will be wrong about more of this than I am right. The beauty of the VC business is you don’t have to be right that often, as long as you are right about something big. Which leads to going out on a limb and taking risks. And I think that strategy will pay dividends in 2017. Here’s to a new year and new challenges to overcome.

As has become my practice, I will end the year (today) looking back and start the year (tomorrow) looking forward.

As a starting point for looking back on 2016, we can start with my What Is Going To Happen In 2016 post from Jan 1st 2016.

Easy to build content (apps) on a cheap widespread hardware platform (smartphones) beat out sophisticated and high resolution content on purpose built expensive hardware (content on VR headsets). We re-learned an old lesson: PC v. mainframe and Mac; Internet v. ISO; VHS v. Betamax; and Android v. iPhone.

And Fitbit proved that the main thing people want to do with a computer on their wrist is help them stay fit. And yet Fitbit ended the year with its stock near its all time low. Pebble sold itself in a distressed transaction to Fitbit. And Apple’s Watch has not gone mainstream two versions into its roadmap.

So that’s the rundown on my 2016 predictions. I would give myself about a 50% hit rate. Which is not great but not horrible and about the same as I did last year.

Some other things that happened in 2016 that are important and worth talking about are:

updated duopoly #s. new IAB data came out yesterday. easy to run vs earnings for goog and fb, it’s evident everyone else is zero sum game. pic.twitter.com/wolgdpfcxp

— Jason Kint (@jason_kint) December 30, 2016

So that’s my rundown on 2016. I wish everyone a happy and healthy new year and we will talk about the future, not the past, tomorrow.

If you are in need of a New Year’s Resolution, I suggest moving to super secure passwords and some sort of tool to manage them for you, using two factor authentication whenever and wherever possible, encrypt as much of your online activities as you reasonably can, and not saying or doing anything online that you would not do in public, because that is where you are doing it.

Happy New Year!

Like a great software product that keeps getting better and better as it ages, the classic book by Brad Feld and Jason Mendelson, Venture Deals, is now on its third version.

Here is the forward I wrote for the first version of the book and that continues to provide the opening context for it: