Guest Post: Beware The Post Money Trap

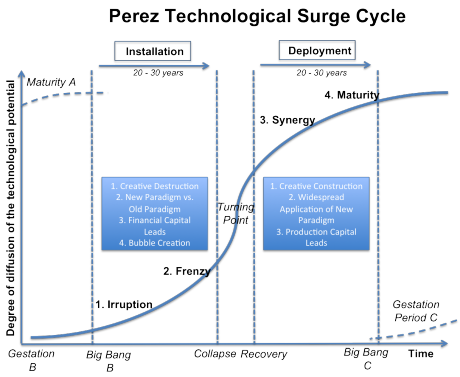

My partner Albert wrote this a few weeks ago. Since then I have met with a number of founders who are most certainly headed for this problem. As valuations are extended and it feels very late in this cycle, I feel that the risk of this happening to entrepreneurs is quite high now.

—————————————–

In the current valuation environment many entrepreneurs seem to believe that only two numbers matter in a financing: the amount of the raise and the dilution. This leads them to buy into the idea that more money for the same dilution is always strictly better. Combined with a lot of money being available from investors this is resulting in Series A rounds of $10 million and more.

What could possibly go wrong? The number everyone seems to be forgetting about is the post-money valuation. It is a crucial number though as long as a company is not yet financed to profitability. It determines how far the company needs to come to be able to raise money again. It needs to build enough value so that the next round of fundraising can be at or ideally above the current post money valuation.

If you do a Series A with a $50 million post-money, it means you have to build something that people will consider to be worth $50 million when you next raise money. Now if your company hits a great growth trajectory and the financing environment stays as it is then great. But if either of those two conditions are not met you will find yourself in the post money trap.

Again, you can get caught in this trap in two different scenarios. The first one is that you hit a bump in the road. Users or revenues or whatever the most relevant metric for your business wind up not growing as fast as you think or worse yet hitting a temporary plateau, possibly even a small setback just as you need to raise more money. The second one is that the external financing environment adjusts for instance because the stock market drops 20%. Then even if you hit all your milestones, suddenly that may no longer let you clear the hurdle you set for yourself.

Some founders seem to ignore this logic entirely. Others come back and say “but we will have that much more money to and hence time to clear the hurdle.” That too, however, is faulty logic. It reminds me a lot of the problem of getting rockets into space. The simplistic answer would seem to be: just add more fuel. The problem though is that fuel too weighs something which now needs to be lifted into space. Your burn rate is pretty much the same thing. Unless you are super disciplined on how you spend the money you will have a higher burn rate the more you raise which makes subsequent funding harder (instead of easier).

Another, less common, founder objection is: well, if necessary we will just do a down round. This ignores that down rounds are incredibly hard to do. For reasons of founder, employee and investor psychology they rarely happen. And if they do they are often damaging to the company. So when you are in the post-money trap you have largely made your company non-financeable entirely.

Finally, this situation is highly asymmetric from the point of view of funds versus companies. First, funds have portfolios, so some deals with dangerously high post money valuations can be offset — if one is disciplined — with others that are more attractive. Second, when investing in preferred there is a lot of downside protection built in that’s not available to the common shares. Hence a simple test to see just how far you are stretching into is to ask investors (and better yet yourself) how much common they (you) would buy right now and at what price.