Video Of The Week: Albert and Beezer at Slush

A few weeks ago, at the Slush Conference in Finland, my partner Albert and our limited partner Beezer talked to Colette Ballou about a bunch of interesting topics. The talk is about 25mins long.

A few weeks ago, at the Slush Conference in Finland, my partner Albert and our limited partner Beezer talked to Colette Ballou about a bunch of interesting topics. The talk is about 25mins long.

I just backed these two projects from Mexico. They are both focused on kids and they both look awesome.

and

There’s an interesting thing going on right now in Bitcoin land. The core developers have released a new version of the core Bitcoin software which includes a number of updates and the “segregated witness” approach to scaling the Bitcoin technology. This release won’t be “confirmed” until 95% of nodes adopt it. That 95% is a choice that the core developers made.

Right now “SegWit” is at roughly 1/3 of nodes (based on this tweet which I have no idea if its valid). The Internet is for fake news after all 🙂

I am curious what all of you Bitcoin folks out there in the AVC community think of SegWit’s prospects and what it means for Bitcoin if it is not confirmed.

One of the issues with the emergence of programmatic and re-targeted advertising is that brands target people not publications with their ad spend. And the result is a brand’s ads end up on sites that they don’t really want them on. Brands can blacklist publishers they don’t want to do business with but they have to choose to opt out. And they need to be notified when this happens.

I saw a cool approach to dealing with this yesterday. Craig Shapiro blogged about a Twitter account called Sleeping Giants.

Here is how it works:

People take a screenshot of an ad running on a site that is likely not appropriate for that brand, they tweet that screenshot to the ad’s parent company to notify them of the placement, and tag Sleeping Giants in the tweet.

Then the word spreads. Sleeping Giants promotes each tweet to it’s 11,000 followers. It also offers simple instructions how to blacklist sites from your ad campaign, so your brand won’t show up on objectionable publishers sites.

I followed Sleeping Giants today and will participate in this community driven effort to help brands keep their ads off objectionable websites. You might want to do that as well.

Longtime AVC community member Jeremy Epstein (who launched the first AVC Meetup in the summer of 2008) has been working on bringing marketing to the blockchain sector.

He asked thirty-three leaders of the blockchain sector to write short one or two page descriptions of why blockchains are important.

They are compiled in a free ebook that is available here.

I read the entire ebook (which is roughly 55 pages) over the past weekend and I was struck by how uneven these short blurbs are.

Some, like the ones by Naval and Jake Brukhman are excellent. You really should go read them. They explain some really important things about the blockchain.

Some, like the ones by William and Joel are solid. I have featured their writing and talks on the blockchain here at AVC a number of times.

But many of these short blurbs are awful. They are full of platitudes and jargon and don’t help the reader connect to why this is important to them.

I told all of this to Jeremy and he was disappointed to hear it. But he also recognized that it was an uneven read.

For me, this ebook highlights the challenges of marketing the blockchain. We have done a poor job of it to date and the sector is full of technologists and mostly empty of marketers.

That needs to change. We need more people like Jeremy and William who can popularize deeply technical stuff and make it make sense to the average person.

I’ll know we are getting somewhere when my Mom understands the blockchain and why it is important to her.

We aren’t anywhere near there right now.

I don’t do this very often, but I am going to break a rule and recommend a book that I just bought and have not yet read.

My friend Joi Ito, along with Jeff Howe, a professor at Northeastern, have written Whiplash. It comes out tomorrow.

Here’s my edited version of the blurb:

The world is more complex and volatile today than at any other time in our history. The tools of our modern existence are getting faster, cheaper, and smaller at an exponential rate, just as billions of strangers around the world are suddenly just one click or tweet or post away from each other. When these two revolutions joined, an explosive force was unleashed that is transforming every aspect of society, from business to culture and from the public sphere to our most private moments.Such periods of dramatic change have always produced winners and losers. The future will run on an entirely new operating system. It’s a major upgrade, but it comes with a steep learning curve. The logic of a faster future oversets the received wisdom of the past, and the people who succeed will be the ones who learn to think differently.In WHIPLASH, Joi Ito and Jeff Howe distill that logic into nine organizing principles for navigating and surviving this tumultuous period. From strategically embracing risks rather than mitigating them (or preferring “risk over safety”) to drawing inspiration and innovative ideas from your existing networks (or supporting “pull over push”), this dynamic blueprint can help you rethink your approach to all facets of your organization.

The Gotham Gal and I just spent four days in Miami at Art Basel, one of the big global art fairs that collectors come to every year.

We have been collecting art as a hobby since we were in our mid 20s. We got a bit more serious about it in our mid 30s and have been collecting emerging artists ever since.

We have never sold any of our art and I doubt we ever will. We don’t approach art as an investment or a business. We approach it as something we enjoy doing together and enjoy having around us. We also enjoy knowing the artists and watching them develop their craft over time. We also have gotten to know and like a number of dealers over the years.

Our focus on emerging artists is much like the angel investments the Gotham Gal makes or the VC investments my partners and I make at USV. We like to meet artists as they are starting their career and follow them, and collect them, as their careers develop.

We have bought art at shows that art students have done in undergraduate and graduate school. We have bought art at edgy underground galleries and shows where new artists and new styles emerge. I feel like these are like seed investments in some ways.

We mostly like to buy art from the galleries that specialize in emerging artists and the art fairs that cater to this market. These are like Series A and Series B investments in some ways.

We have not participated in the more established artist sector even when the artists we have collected get there. We maybe should change that. Like USV did with our Opportunity Fund.

Over the past thirty years we have bought some wonderful pieces. We have them around us, in our offices and homes. And we get joy from them every day.

We bought some new work this week at Basel and may buy some more of what we saw in the weeks and months ahead as we think more about it.

Yesterday as we worked our way through one of the most edgy fairs down here, I asked the Gotham Gal about a sculpture we had seen about twenty minutes previously. She said “I have moved on from it”. But both of us were still thinking about another work we had seen around the same time. We ended up purchasing the latter one.

The same is true of seed and early stage investments. Sometimes when you meet a company and you like what you hear but a day or two later you aren’t enthusiastic about it. Other times you can’t stop thinking about the opportunity for days and weeks after the meeting. That’s how you know what early stage investments to make and the same is largely true with art, at least in the way that we collect it.

I came across this talk by Jeff Lawson, Founder/CEO of our portfolio company Twilio. It is about having conviction and not relying completely on things like A/B testing to make decisions. It’s very good (and only 18 mins long).

I think Mute is one of the most underused features on Twitter, second only to Unfollow. I went on a bit of a rant about this on Twitter last week.

@johnolilly try unfollowing or muting the people who are filling your feed with noise. It’s amazing what it feels like to be rid of them

— Fred Wilson (@fredwilson) November 28, 2016

and

@bijan @andrewparker mute and unfollow are two of Twitter’s most underrated and under used features. They should make them easier to use

— Fred Wilson (@fredwilson) November 28, 2016

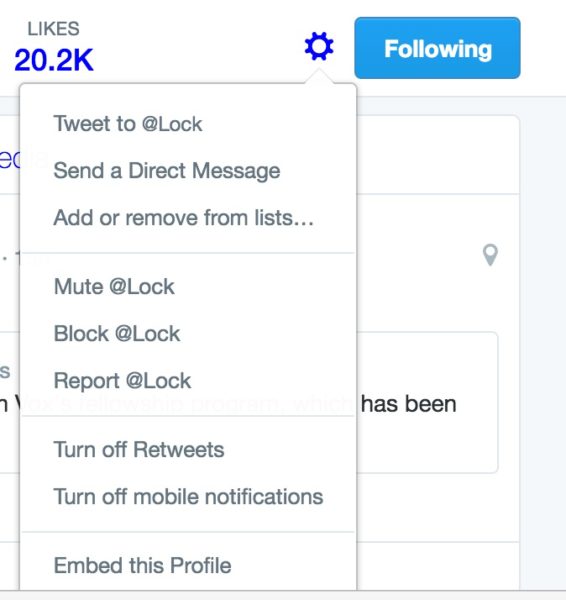

Here is how you mute someone on Twitter:

My friend Lock has a great Twitter, but when he watches the hated Red Sox and the Patriots, I just can’t take it. So I need to mute him. Here is how you do that on the web.

If you follow people on Twitter that you just need to turn off every now and then set up the mute option and use it when necessary. It makes Twitter such a better experience.

One of the things I often press for in my role as a board member and investor is a greater “sense of urgency” in our portfolio companies. The founders and CEOs, it turns out, are hungry for that even more than I am. It is a collective frustration.

So when I hear a suggestion on driving urgency, I take notice. I got this one from a CEO who I’ve worked closely with for years.

I find many business books to be fairly useless or at best irrelevant to my situation but I read John Kotter’s book “A Sense of Urgency” over the weekend and it was excellent. I highly recommend it.

The best thing about the book is that it creates a common definition of what “urgency” and “complacency” mean and even cautions against creating “false urgency,” which is a lot of anxious frenetic activity without no forward motion. False urgency is just as bad as complacency.