I tweeted out this article from Techcrunch in the middle of last week:

And the response from the Twittersphere was a desire to hear my views on it.

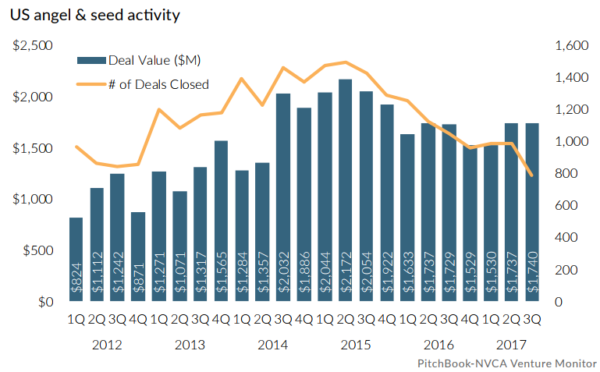

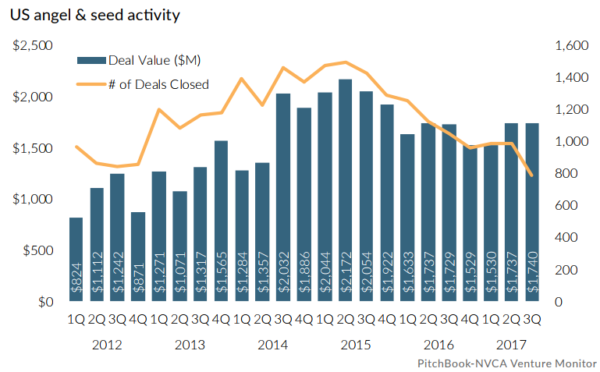

The data is pretty clear. The seed and early stage investing market has cooled substantially in the past few years.

On a dollar basis, the cooling off has been mild.

On a deals basis, the cooling off has been dramatic and looks to be getting worse.

So what is going on?

When I talk to my friends who do a lot of angel investing, I hear that they are being more selective, licking some wounds, and waiting for liquidity on their better investments.

When I talk to my friends who started seed funds in the past decade, I hear them thinking about moving up market into larger funds and Series A rounds.

You can see that in the data. Less deals and bigger deals.

Here is the thing. Seed is really hard. You lose way more than you win. You wait the longest for liquidity. You lose influence as larger investors come into the cap table and start throwing their weight around.

It is where most people start out. Making angel investments, raising small seed funds. They learn the business and many see better economics higher up in the food chain and head there as soon as they can.

If you hit one or two right, you can make a fortune in seed. But those bets take a long time to get liquid. And if you don’t hit one or two right, you end up with a mediocre portfolio.

The Facebook IPO in May 2012 was a real boon to the angel and seed markets. A lot of instant millionaires re-invested their gains back into startups (just as BTC and ETH instant millionaires are re-investing their gains into ICOs right now). Many startup people reinvented themselves as angel investors, AngelListers, seed VCs, and early stage VCs. As I quoted Techcrunch in my tweet “2012-2016 was a bubble in early-stage funding.” I think the bubble actually started letting out air in mid 2015.

You could see all of this in the pricing of seed rounds. For most of my career, seed rounds were sub $1mm and they bought 15-25% of the company ($4-6mm post money). At the peak of the seed bubble, uncapped notes of $3-5mm were the norm for seed rounds. That wasn’t going to work. It was unsustainable.

So where does that leave us now?

For entrepreneurs just starting out, it will be tougher to raise your first rounds. That is how it always has been so it is a return to normal. It is not great news, but it is the reality. If you price your seed round appropriately and have a good team and plan, you can raise money. But it will be harder.

For investors, it means seed rounds are going to be the place to be. When others leave the market, it is time to get in. The uncapped note will turn into a priced $1mm round at $4mm pre/$5mm post. This is as it should be. The risks of seed investing are so significant that the valuations need to be reasonable. When you lose on 60-80% of your investments, you really need the ability to make 10-20x on your winners. And getting the entry pricing right is part of how that happens.

You can tell where there is too much money and too little money by looking at valuations. When valuations are extended, that means there is too much money. That was seed in 2014, growth in 2015/2016, and ICOs in 2017. The trick is to get into these sectors before the money shows up and get out when it does. And then get back in after it leaves. And not get burned along the way.