Anti-fragile Systems

The Internet was developed by the US Defense Department to create a network that was capable of surviving a military attack. They accomplished that with a design where no part of the system was central to its operation. You can take out any part of the Internet and it will still operate.

When I read the Bitcoin White Paper for the first time, I was struck by the similarity of its design to the Internet.

And we are watching an “attack” on the Bitcoin system right now, in the form of a purge in China.

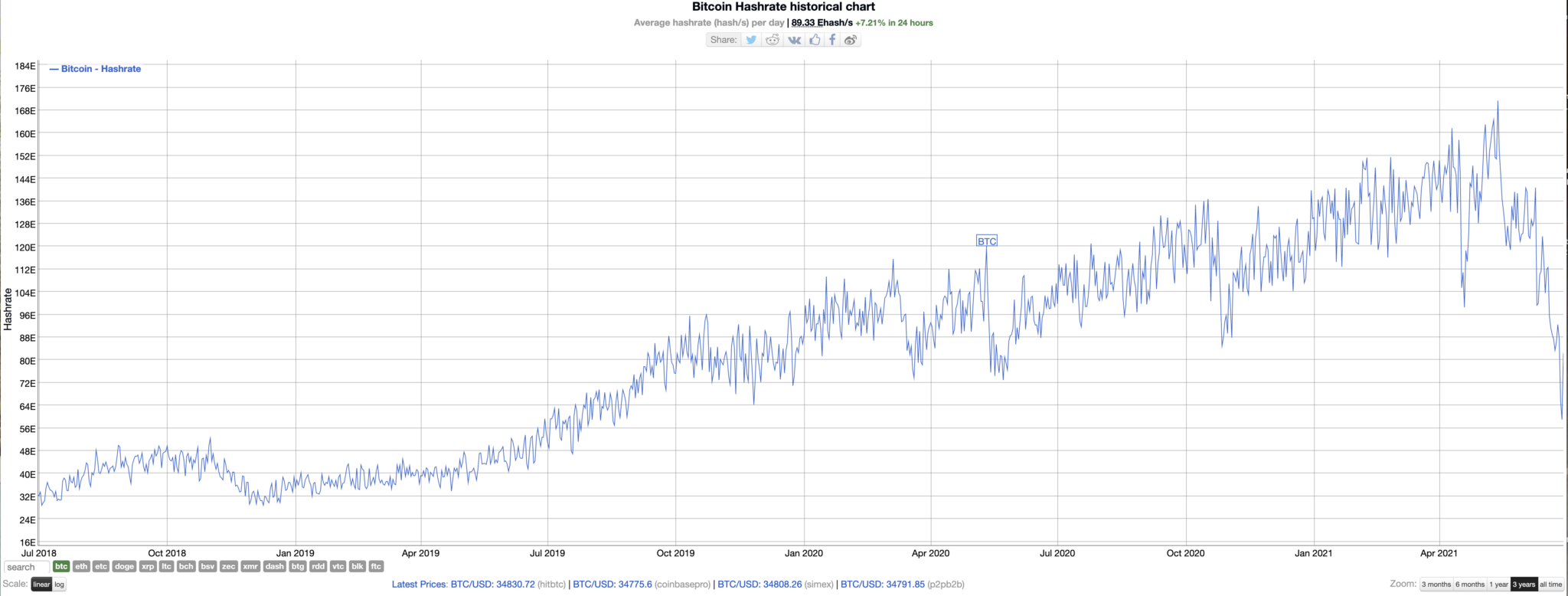

Over the last three months, the government in China has moved to rid the country of Bitcoin mining. You can see the effect of the purge on the chart of Bitcoin Hashrate:

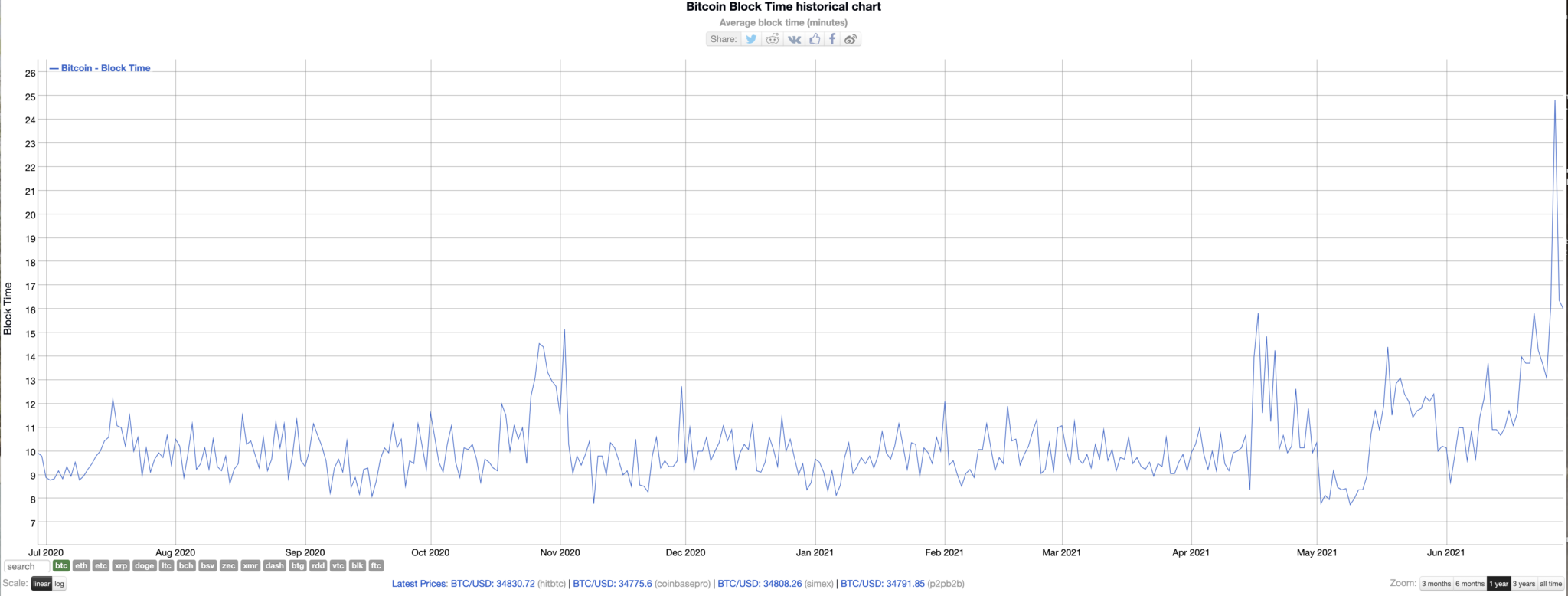

This is a significant reduction in the processing power of the Bitcoin network and the result has been slower transaction clearing times:

It will take time for miners outside of China to pick up the slack and get the hashrate and transaction times back to where they were, but that will happen. There are economic incentives for that to happen. What would be even better, and could happen, is for this new mining capacity to get built on clean/renewable energy.

I believe the Chinese purge of Bitcoin mining is short term bearish but long term bullish for Bitcoin and crypto more broadly. It shows that a powerful government can take its best shot at a cryptonetwork and the only thing that will happen is capacity will move elsewhere.

Anti-fragility is a beautiful thing to behold.