A new blockchain & cryptocurrency project, Libra, was announced today. Libra has been incubated by Facebook. USV will be one of the founding members of the governing body, the Libra Association. Libra is a stable, fiat-backed cryptocurrency that will launch inside some of the world’s largest consumer-facing applications. We believe Libra has the potential to be the catalyst that brings the entire cryptocurrency and cryptoasset market into the mainstream.

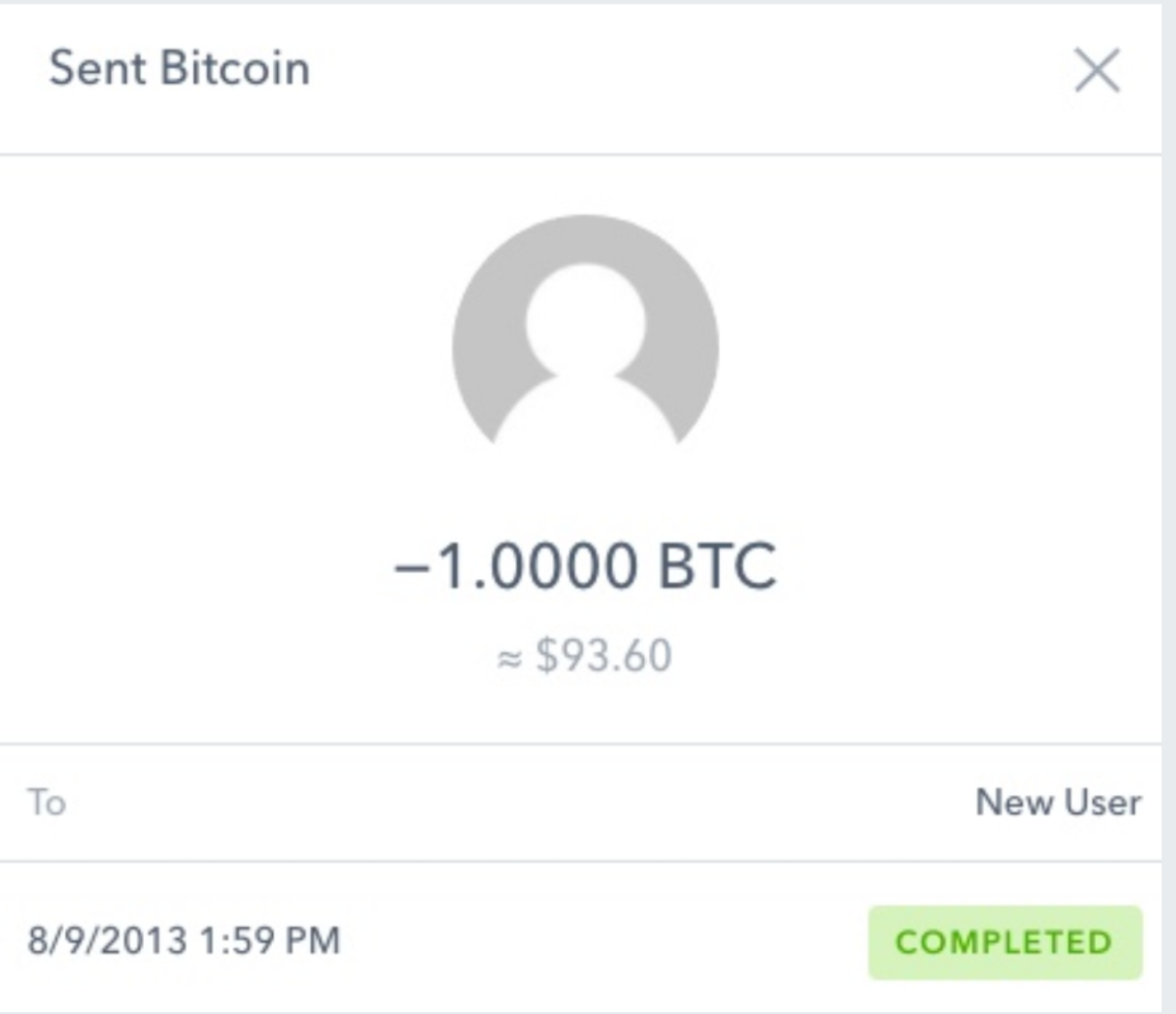

When USV invested in Coinbase in early 2013, our rationale was that digital currencies and digital assets (like Bitcoin and beyond) were a breakthrough technology, similar to TCP/IP, HTTP and SMTP. But we also knew that it would take significant investment in the surrounding infrastructure to make them useful for businesses and consumers, just like it did with the Web back in the 80s and 90s. At the time of that investment, we wrote:

“There is much that must be built on top of of these digital currencies to make them work well enough to support real business at scale”

This has proven to be true. If we look back at the past 10 years since the invention of Bitcoin, we have seen a lot of infrastructure built to support an increasing variety of use cases. But there is still a long way to go.

We think about the crypto sector as the intersection of Finance 2.0 (“Money Crypto”) and Web 3.0 (“Tech Crypto”), and what we have seen is that the “Money Crypto” use cases have been the earlier to materialize, especially “slow money” use cases (those that don’t require high throughput):

For consumer use cases (including both Finance 2.0 and Web 3.0 use cases), the biggest barrier to date, beyond technical scalability, has been the rollout of crypto wallets to mainstream consumers. As of today, there is still no mainstream web browser with crypto built-in, no mainstream phone with crypto built-in, and relatively few mainstream applications with crypto built-in. As that changes, crypto assets have the potential to move from being curiosities for enthusiasts to being default internet and financial infrastructure.

Once we have crypto-compatibility built-in to applications, browsers, and phones, many new behaviors and use cases will emerge. The financial system, in general, will become more accessible (smartphone adoption is outpacing bank account adoption globally). Payments can become faster, more reliable and less expensive. Magical new user experiences will be possible due to interoperability and reduced friction, the same way that the Web’s native interoperability unlocked countless new use cases and experiences. And, perhaps most importantly, we will open the door to self-sovereign digital identities (private keys) that are the underpinnings of user-controlled privacy and control of data.

So as we think about the potential drivers for mainstream crypto adoption, a simple, fully-collateralized, cryptocurrency used inside the world’s largest applications, touching hundreds of millions or billions of consumers, is perhaps the most promising one. It is our hope that Libra will serve as a major on-ramp to cryptocurrencies and cryptoassets, to the benefit of the entire ecosystem.

USV will be joining as a founding member of the Libra Association, the governing body that will manage both the Libra technology and the Libra Reserve. As one of the initial 20 members of the Association, we will have the opportunity to participate in design and policy choices that will shape the network. It is worth noting that Facebook will be just one equal member of the Association, which was an important factor in our decision to join.

This will be a large and complex undertaking, as there are many unresolved and challenging questions, involving the technology itself (security, privacy, path to decentralization), the regulatory environment, and the nature of the ongoing governance. In some ways, the initial Association resembles a constitutional convention, where the main goal is to draft the long-term governance mechanisms themselves.

To be clear, we view this as both an ecosystem investment and a financial investment. In addition to participating in the governance process at the Libra Association, USV plans to invest in the Libra Reserve, which will provide the stability for the currency. This is an unusual type of investment for us, but we have learned that investing in the crypto sector requires us to explore a variety of new investment structures.

We appreciate that Facebook invited USV to be an initial founding member of the Libra Association and we take our role in that seriously. We will advocate for those things that USV values most: openness, transparency, decentralization, and permissionless innovation. We think that those features will help accelerate adoption within the entire crypto ecosystem — including our many existing investments in the space — and also help Libra succeed in its goals.

This has also been posted on usv.com.