Digital Asset Mining In New York State

Digital Asset Mining is shorthand for “proof of work consensus validation of public blockchain infrastructure”. Thankfully we have the shorthand. But it is important to understand what digital asset mining is.

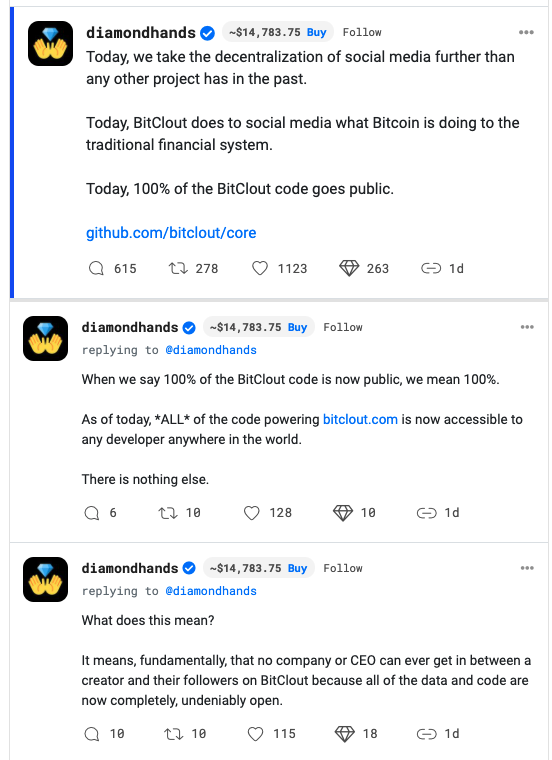

Public blockchains, like Bitcoin and Ethereum, store data securely but publicly in a cooperative ecosystem that is not controlled by any company or government. When you store data on a public blockchain, it is your data, secured by your keys, and nobody can do anything to it without your approval.

That is a big deal and it is the future of all internet data. In time, all software systems will operate on top of secure public blockchains.

The consensus mechanism in public blockchains is the method that they use to cooperatively validate transactions without a controlling party.

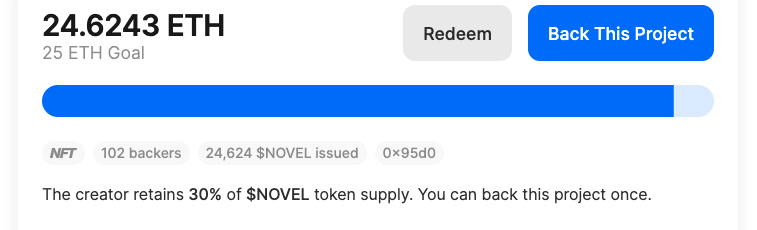

Proof of work consensus is when computers all over the world run software (called nodes) and validate transactions and are rewarded with digital assets (tokens).

So proof of work mining and its cousins like proof of stake validating is the foundational infrastructure for the coming architecture for internet data.

Think of Bitcoin mining operations as the next Amazon, Google, and Microsoft Cloud offerings except that they are owned by everyone.

That’s a huge deal. As big of a deal as anything in tech and tech policy right now.

Ok. Now that we’ve had that discussion, let’s talk about a bill under consideration by the New York State Legislature that would put a three-year moratorium on proof of work mining in New York State. I had thought that this bill was going nowhere as of last weekend, but it seems to be back on the table now.

I am a fan of regulation on the emerging blockchain and crypto sectors. Anything as important as the next generation of internet data architecture needs regulation.

But this New York State bill is like using a sledgehammer when what is needed is a scalpel.

Three years is a long time in a fast growing emerging tech sector. The foundational infrastructure for public blockchains is being built now and regions that get going now will have long lasting businesses that provide good jobs and lots of growth. Who wouldn’t want Google, Amazon, and Microsoft operating their data centers in their state? This is the next generation of that.

The issue that has everyone up in arms is the carbon footprint of proof of work mining and that is something that is important to discuss and using regulation to address it makes sense. It may well be that proof of work consensus has no larger carbon footprint than the data centers of the cloud era, but that’s not really the point. We can and should do better. We can have a climate-neutral data architecture when we build the next-generation tech stack.

So here is what I think would be better policy for New York State:

1/ Apply a tax surcharge to digital mining operations in New York State that use fossil fuels to power them.

2/ Use those tax revenues to subsidize digital mining operations in New York State that use clean (renewable, nuclear, etc) energy to power them.

3/ Encourage digital asset mining in New York State with other policies that will bring the data centers here vs elsewhere.

4/ Become the home to the cleanest and largest digital asset mining operations in the world.

We can do that New York State. We just need to want to.