Capitalism and Inequality

I was talking to a friend about AOC’s proposal to increase marginal federal rates to 70% to fund investments in fighting climate change. My friend said he was disappointed that she didn’t propose a top federal rate of 83.25% so that the marginal rate in NYC would be 100%. He was joking but his remark is important because it speaks to the nuance of the marginal rate, something AOC and her followers don’t really understand as much as they claim.

It reminds me of a heated conversation I had with my kids and their friends during our family ski trip over the year end break. Our kids, like most millennials I know, are struggling with the notion of capitalism at any cost and the massive income and wealth inequality that we are witnessing.

This headline I came across on Twitter today kind of sums it up well:

.@AOC: Economic system that allows billionaires is “immoral” https://t.co/qINA2oXiwu pic.twitter.com/Z3mSVRXuti

— The Hill (@thehill) January 22, 2019

I am in the business of helping founders start companies which results in some of them becoming billionaires. Contrary to what some think, my wife and I aren’t in that club ourselves. But I know a fair number of billionaires and I have had a front row seat to the process of them going from not having a penny in their pockets to billions on their balance sheet.

And we are participants in the “economic system that creates billionaires.” I do not think it is immoral and I do not think billionaires are immoral. I do think the inequality that we allow in our country is immoral.

To me, these are two different things. And that is the gist of the discussion I was having with my kids and their friends over the year end holiday. They asked me why I don’t believe in massively raising taxes on the rich to pay for all of these new social programs that the candidates on the left are proposing.

I am a fan of many of these social programs, like medical care for all, like more affordable education for all, like new approaches to what we once called “welfare” and now is taking shape as Universal Basic Income. I have been called a communist, a socialist, a liberal, and more on this blog and all of those labels could be accurate in someone’s mind. I believe that society must find ways to support the basic needs of everyone, which include wellness, knowledge, and income. That we do not is immoral. That we allow billionaires is not.

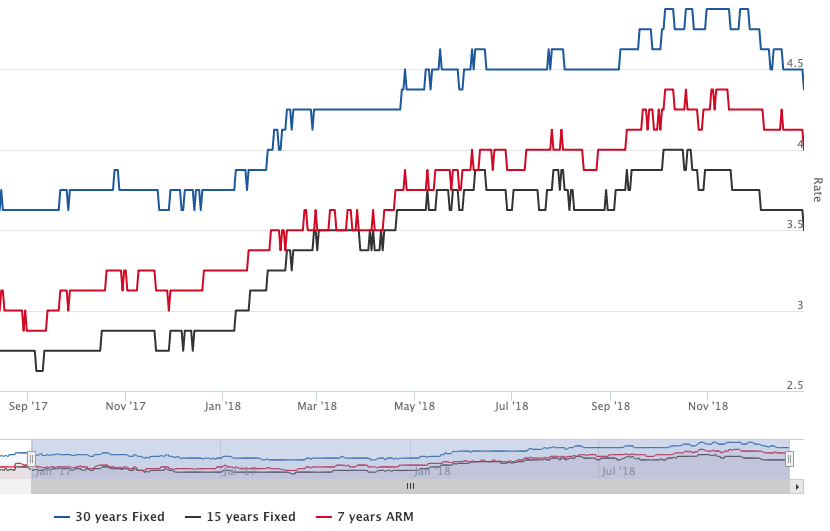

I am a capitalist and a business person. I understand that increasing taxes on the wealthiest leads many of them to move their income and assets to lower tax jurisdictions and can be counter productive, particularly when you go beyond a certain threshold. I also understand that government is bloated and there are many places where we could cut spending to fund these new innovative programs that could help counter the immoral wealth imbalance we have in our country.

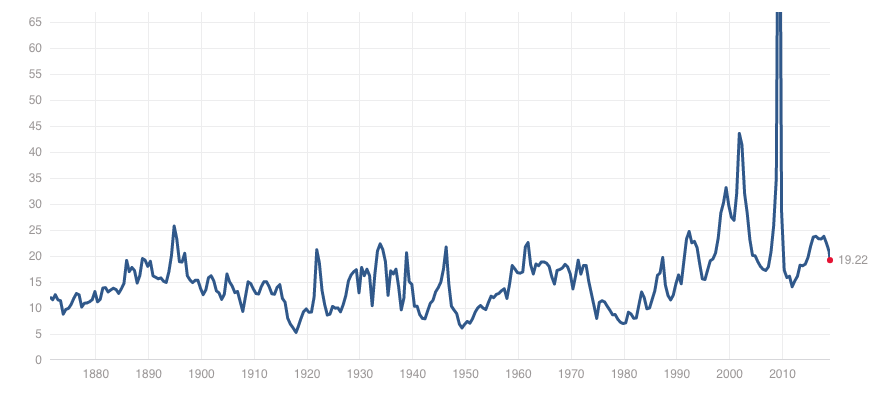

I believe that technological revolutions, like the industrial revolution and the information revolution, create opportunities for entrepreneurs to reimagine how the economy should operate. Those entrepreneurs, like Rockefeller, Carnegie, Morgan, Bezos, Page, Zuckerberg, build very powerful monopolies and amass billions.

As these revolutions reimagine how the economy should operate, many people lose jobs, can’t find jobs, find themselves in lower paying jobs, and there is real dislocation that results. And you get this “immoral wealth imbalance.”

The one part of the economy that seems immune to re-imagination is the government. If we were to force it to go through the same technological revolution that the private sector is going through, we would see massive efficiencies, and massive job losses, that would free up a huge amount of capital that could be used to pay for things like medical care for all, affordable education for all, and some amount of income for all.

That is what I am for. That is what I explained to my kids and their friends that I am for.

Times of change are times of change. And we can’t change some things but not everything.

I will end with a story from a book I read a few years ago. The book is called The Prize that was written by Dale Russakoff and is about the effort by Chris Christie, Cory Booker, and Mark Zuckerberg to fix the broken Newark NJ public school system.

The story takes place at an anti-charter school rally. Dale meets a woman who is protesting against the charter schools that are replacing the district schools. As she is talking to this woman, she explains that she is late to the rally because she had to spend all morning in line trying to get her child into the new charter school in her neighborhood. Dale is perplexed. Why would she be protesting charter schools if she is that committed to getting her child into one? The woman explains that most of her family works in the district schools and will lose their jobs if the city moves to charter schools.

And that’s where we are. We are not willing to move away from the things of the past to get the things of the future. So our elected officials decide to try to give us both and we struggle with how to pay for it all.

I am not for the emerging progressive Robin Hood narrative. I am certainly not for the entrenched conservative Let Them Eat Cake narrative. I am for a new narrative that understands that everything must change if we are to find ways to support everyone in our society.