Funding Friday: Crowdfunding Restaurants Via Blackbird

It has been a long time since I did a Funding Friday here at AVC. I used to do them every Friday. We have funded a lot of bars, restaurants, coffee shops, and bakeries here over the years. Here are a few examples.

There is a new wrinkle in crowdfunding restaurants, bars, coffee shops, bakeries, etc courtesy of USV portfolio company Blackbird, which I recently wrote about.

Blackbird is a loyalty/membership platform for the hospitality industry and it allows operators to issue memberships in-store (at check-in or check-out) or elsewhere. Although Blackbird did not imagine its platform being used for crowdfunding, operators have started to use it that way.

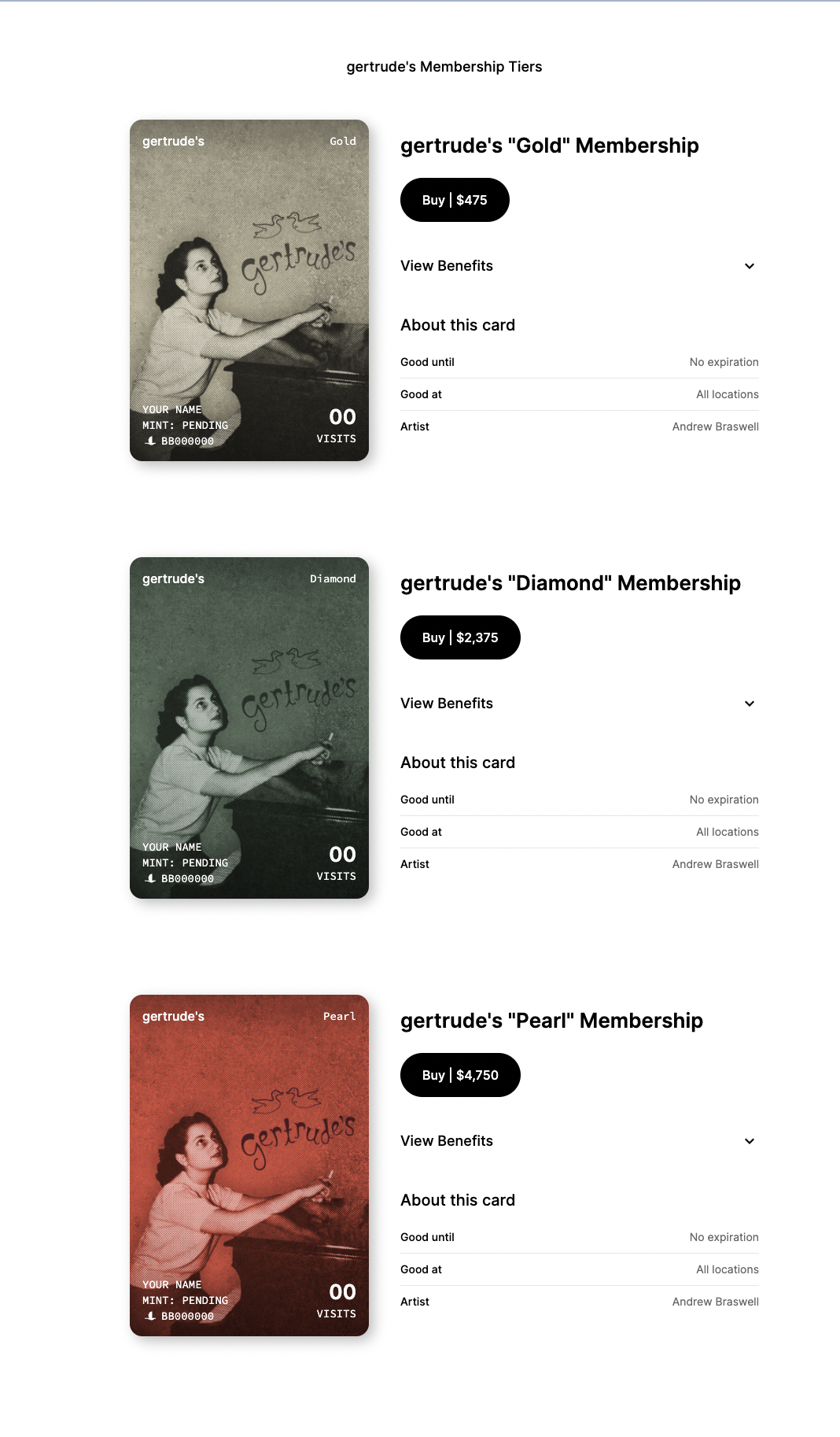

A great example is gertrude’s, a new restaurant in Prospect Heights Brooklyn which hopes to open next month.

gertrude’s is offering anyone the opportunity to become a member in advance of opening and there are three levels of membership:

The benefits of each membership ladder on top of each other and get better and better.

If you live in NYC, particularly if you live in our near Prospect Heights, you can help gertrude’s pay for the cost of opening the store and get your money back in the form of dining opportunities and long-term membership benefits.

This strikes me as a fantastic way for restaurant operators to defray (or ideally fully fund) the cost of opening a new venue. They give up less equity and spend less on raising it and their customers become VIPs and regulars and enjoy the benefits of that. A true win/win.

If you want to help gertrude’s get open, go here and become a member.