What Didn't Happen

Last year, I ended 2014 with What Just Happened and started 2015 with What Is Going To Happen.

I’ll do the same tomorrow and friday, but today I’d like to talk about What Didn’t Happen, specifically which of my predictions in What Is Going To Happen did not come to be.

- I said that the big companies that were started in the second half of the last decade (Uber, Airbnb, Dropbox, etc) would start going public in 2015. That did not happen. Not one of them has even filed confidentially (to my knowledge). This is personally disappointing to me. I realize that every company should decide how and when and if they want to go public. But I believe the entire startup sector would benefit a lot from seeing where these big companies will trade as public companies. The VC backed companies that were started in the latter half of that last decade that did go public in 2015, like Square, Box, and Etsy (where I am on the board) trade at 2.5x to 5x revenues, a far cry from what companies get financed at in the late stage private markets. As long as the biggest venture backed companies stay private, this dichotomy in valuations may well persist and that’s unfortunate in my view.

- I said that we would see the big Chinese consumer electronics company Xiaomi come to the US. That also did not happen, although Xiaomi has expanded its business outside of China and I think they will enter the US at some point. I have a Xiaomi TV in my home office and it is a really good product.

- I predicted that asian messengers like WeChat and Line would make strong gains in the US messenger market. That most certainly did not happen. The only third party messengers (not texting apps) that seem to have taken off in the US are Facebook Messenger, WhatsApp and our portfolio company Kik.

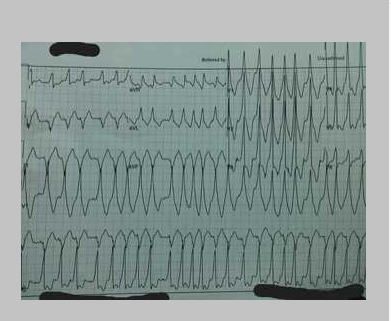

Here’s a shot of the app store a couple days after the kids got new phones for Christmas.

Here’s a shot of the app store a couple days after the kids got new phones for Christmas. - I said that the Republicans and Democrats would find common ground on challenging issues that impact the tech/startup sector like immigration and net neutrality. That most certainly did not happen and the two parties are as far apart as ever and now we are in an election year where nothing will get done.

So I got four out of eleven dead wrong.

Here’s what I got right:

- VR has hit headwinds. Oculus still has not shipped the Rift (which I predicted) and I think we will see less consumer adoption than many think when it does ship. I’m not long term bearish on VR but I think the early implementations will disappoint.

- The Apple Watch was a flop. This is the one I took the most heat on. So I feel a bit vindicated on this point. Interestingly another device you wear on your wrist, the Fitbit, was the real story in wearables in 2015. In full disclosure own a lot of Fitbit stock via my friends at Foundry.

- Enterprise and Security were hot in 2015. They will continue to be hot in 2016 and as far as this eye can see.

- There was a flight to safety in 2015 and big tech (Google, Apple, Facebook, Amazon) are the new blue chips. Amazon was up ~125% in 2015. Google (which I own a lot of) was up ~50% in 2015. Facebook was up ~30% in 2015. Only Apple among the big four was down in 2015 and barely so. Oil on the other hand, was down something like 30% in 2015 and gold was down something like 15-20% in 2015.

Here’s what is less clear:

- Bitcoin had a big comeback in 2015. If you look at the price of Bitcoin as one measure, it was up almost 40% in 2015. However, we still have not see the “real decentralized applications” of Bitcoin and its blockchain emerge, as I predicted a year ago, so I’m not entirely sure what to make of this one. And to make matters worse, we now seem to be in a phase where investors believe you can have blockchain without Bitcoin, which to my mind is nonsense.

- Healthcare is, slowly, emerging as the next big sector to be disrupted by tech. The “trifecta” I predict will usher in an entirely new healthcare system (smartphone becomes the EMR, p2p medicine, and a market economy in healthcare) has not yet arrived in full force. But it will. It’s only a matter and question of when.

So, I feel like I hit .500 for the year. Not bad, but not particularly impressive either. But when you are investing, batting .500 is great because you can double down on your winners and stop out your losers. That’s why it is important to have a point of view, ideally one that is not shared by others, and to put money where your mouth is.