I took some time on Sunday afternoon to read Warren Buffett's annual letter. I don't make it an annual practice to read the Berkshire Hathaway letter as many do (nor have I ever been to the shareholder's meeting which Buffett calls "Woodstock for Capitalists"). But given that 2008 was a year unlike any that I have ever witnessed, it seemed like the thing to do on a cold and snowy afternoon.

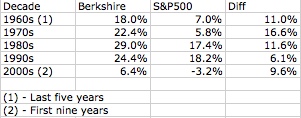

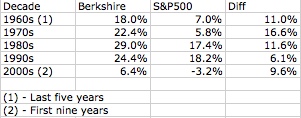

Buffett and his partner Charlie Munger are the most successful stock market investors of the 20th century and they have consistently outperformed the public markets as shown by this table of annualized returns that I put together with data from the first page of Berkshire's annual report (I love that Buffett starts with the numbers):

It is very interesting to me that the past five decades have seen the S&P significantly outperform the long term average for equities of around 7% per annum. Even with the miserable performance of the public markets this decade, we'd have to be flat for another decade at least for the markets to average 7% per annum from 1965 on.

But Buffett and Munger's performance is something else entirely. While it is correlated to the market for sure, it has been so consistently superior for so long that it is clear that they are doing something right (and better).

So with that in mind, here's my take aways from reading Warren's letter.

1) The economy – It's really bad. Warren says the "freefall in business activity" is "accelerating at a pace that I have never witnessed before."

2) TARP and related efforts to stablize the financial system – The Fed "stepped in to avoid a financial chain reaction of unpredictable magnitude. In my opinion, the Fed was right to do so." But it will "bring on unwelcome aftereffects." One likely consequence is "an onslaught of inflation." And "major industries have become dependent on Federal assistance, and they will be followed by cities and states bearing mind-boggling requests. Weaning these entities from the public teat will be a political challenge. They won't leave willingly." That last line is classic and true and Obama's greatest challenge.

3) Berkshire's two most important businesses are insurance and utilities, sectors that "produce earnings that are not correlated to those of the general economy."

4) Buffet and Munger are value investors and contrarians. Warren says "When investing, pessimism is your friend, euphoria the enemy" and "Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down" and "Beware the investment activity that produces applause; the great moves are usually greeted by yawns." Words to live by.

5) Housing – Berkshire has exposure to the mortgage and housing market by virtue of its ownership of Clayton Homes, the largest company in the prefab home market. Buffett says "Enjoyment and utility should be the primary motives for [home] purchase, not profit or refi possibilities. And the home purchased ought to fit the income of the purchaser." And "an honest to God down payment of at least 10% [I think 20%] and monthly payments that can be comfortably handled by the borrowers income. That income should be carefully verified."

6) History as a predictor of the future – "If merely looking up past financial data would tell you what the future holds, the Forbes 400 would consist of librarians."

7) Quants – "Beware of geeks bearing formulas."

8) Lean and mean organizations – "BHAC: Who, you may wonder, runs this operation? While I help set policy, all the heavy lifting is done by Ajit and his crew. Sure they were already generating $24 billion of float along with hundreds of millions of operating profit annually. But how busy can that keep a 31-person group? Charlie and I decided it was high time for them to start doing a full day's work." Wow. I'm stunned. And now I have something other than Craigslist to use as an example of a lean and mean profit generating machine.

9) Bubbles and Panics – "The investment world has gone from underpricing risk to overpricing it." And "When the financial history of this decade is written, it will surely speak of the Internet bubble of the late 1990s and the housing bubble of the early 2000s. But the US Treasury bond bubble of late 2008 may be regarded as almost as extraordinary."

10) Derivatives – "Derivatives are dangerous" and "When Berkshire purchashed General Re in 1998, we knew we could not get our minds around the book of 23,218 derivative contracts, made with 884 counterparties. So we decided to close up shop. Though we were under no pressure and we operating in benign markets as we exited, it took us five years and more than $400 million in losses to largely complete the task. Upon leaving, our feelings about the business mirrored a line in a country song: "I liked you better before I got to know you so well."

11) Risk and Responsibility – "It is my belief that the CEO of any large financial organization must be the Chief Risk Officer as well. If we lose money on our derivatives, it will be my fault."

I'll stop there because I really like lists with eleven entries. It's a quirk of my personality. All you have to do is read Warren's letter (or even my cliff notes version) to understand why he's the best investor of the past century. Common sense married with a native understanding of markets and value is what produces the returns at the top of this post. Everyone who invests and manages money for a living can take a lot away from Berkshire Hathaway and Warren and his partner Charlie.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=18c61a03-dcfc-4acb-a9bb-a6c3be68040c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=1a1b325f-5c30-4889-a43a-34c37a6e0d69)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=950ef638-9fde-4a09-82fd-c1999a769f9f)

Yawn….

This is nice functionality, but there are numerous people who have come at this problem from similar perspectives.

Here’s what’s right: telephony apps will be delivered via the cloud,

and they will be assembled from pre-built modules on someone’s app

server.

Here’s what’s wrong: this is still a telco play, meaning the company

is in the minutes business. Margins will approach fractions of a cent a

minute, not the $0.05 cent level they’re hoping to get now. So, fingers

crossed these guys can get people to deliver billions of minutes across

their platform.

The comps for this are not TellMe. Ribbit is fair comparison, but

this is really something Telera was doing almost 10 yrs ago. Angel is

probably the best comp.

No way the investors understand what they put money into.