The Twitter Contradiction

So everyone around here knows I’m bullish on Twitter and we own a lot of stock. So take all of this in that context please.

I just don’t understand the narrative around Twitter. “It is in trouble. It isn’t growing. It’s time has come and gone. The kids all use Snapchat and Instagram.”

That last part is true, to a degree. But it isn’t as simple as that.

The presumptive Republican nominee for President of the United States has largely conducted his campaign on Twitter and in massive public appearances that feel like rock concerts. He has avoided the traditional media channels and taken his message direct to the people on Twitter. Not on Facebook. Not on Instagram. Not on Snapchat. Not on Pinterest. Not on his website or mobile app. On Twitter.

My brother in law and I watched the best basketball game of the year so far on Saturday night. Steph Curry was unreal. And he won it with a few seconds left in overtime with a bomb from something like 40 feet that everyone knew was going in. And what happened next?

This:

@StephenCurry30 needs to stop it man!! He’s ridiculous man! Never before seen someone like him in the history of ball!

— LeBron James (@KingJames) February 28, 2016

And this:

He can’t be human.

— DeMar DeRozan (@DeMar_DeRozan) February 28, 2016

And this:

is this real life?

— Kristaps Porzingis (@kporzee) February 28, 2016

Steph’s opponents expressed their appreciation for what he is doing on Twitter in the moment. Not on Facebook. Not on Instagram. Not on Snapchat. Not anywhere else. And you don’t have to be on Twitter to see that. You can see that here and many other places.

Here’s the thing about Twitter. You don’t need to be logged into Twitter to see these tweets. You can see them on Twitter logged out. Or you can see them embedded in other places on web and mobile or on TV and elsewhere. You only need to be logged into Twitter to tweet.

So anyone who is focusing on the logged in monthly active user number is missing something bigger. Twitter is where people who have something to say go to say it. And right now we are witnessing Twitter being used for what is arguably the biggest thing out there. A run for President of the United States.

That is the contradiction of Twitter.

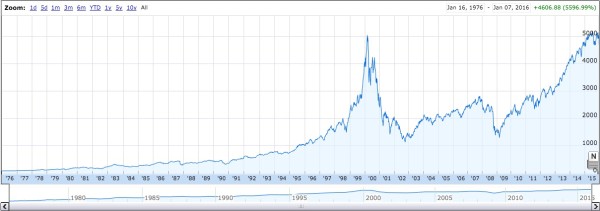

Here’s a shot of the app store a couple days after the kids got new phones for Christmas.

Here’s a shot of the app store a couple days after the kids got new phones for Christmas.