The First Law Of Internet Physics

I’ve written a lot about free vs paid here on AVC. There was a time I was obsessed about this topic. We even coined the word freemium here at AVC (thanks Jarid) during that phase. I’ve moved on to other obsessions but I still think a lot about it. I got in a long twitter discussion with a bunch of people yesterday about this topic, spurred by this tweet by Jonathan Weber:

@WeberWest I think that’s not even a debate anymore. The question is can paid media be profitable

— Fred Wilson (@fredwilson) November 13, 2014

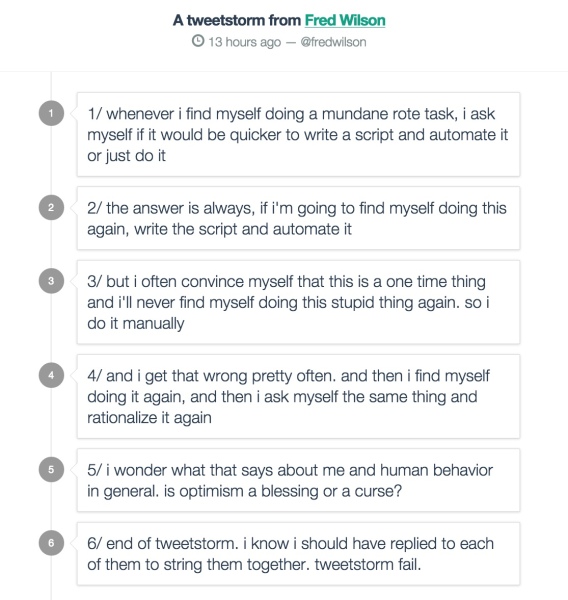

That led to a long twitter discussion in which a bunch of people joined. I can’t find a good way to showcase the discussion so I’m not going to. But during the course of the discussion I tweeted this. I made it up last night but it’s something I’ve experienced many times over the years.

@garyvee many*lowarpu >>> few*higharpu. That is the first rule of the Internet @Jessicalessin

— Fred Wilson (@fredwilson) November 13, 2014

Isaac Newton observed some things about motion and encoded them into his three laws of motion. I think we should do the same thing with the Internet. There are some things that just are, and we should acknowledge them. I posit that one of them is this:

many users * low arpu >>>> few users * high arpu

I’ve seen so many people try paid content on the Internet and the result is less users, a lot less. You can extract a higher average revenue per user (arpu) from a paid model, but you get so many less users that is it better to extract a lower arpu with a free model and get many more users. I guess a corollary to the first law of Internet physics is that you can implement a freemium model on top of a free model and turn some of your users into high arpu customers, but they will always be a small portion of the total number of users.

That’s a long way of saying that you can do paid, but you had better have a free tier first and foremost as most users will go for that. And if you put too much of your content behind a paywall, you’ve effectively turned your core product into a paid one and you are back to {few users*high arpu}. So be careful with the freemium offering.