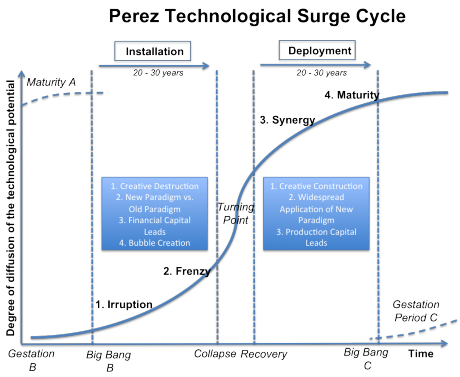

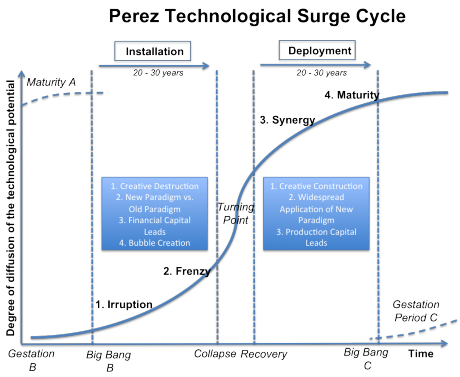

It is my view and our view at USV that the crypto market is in what Carlota Perez calls the installation phase.

We believe that we are still putting the pieces in place for a new technology architecture to take hold.

The “big bang” for this technology cycle was the publishing of Satoshi’s whitepaper, almost ten years ago.

But we still don’t have consensus mechanisms that can scale to transaction speeds that are typical of mainstream web apps, we don’t yet have consensus mechanisms that are both energy efficient and battle-tested at scale, we don’t have an array of development tools that make building applications on this stack easy, quick, safe, and secure, we don’t have hundreds of millions of users with crypto browsers & wallets, and we don’t have all the other things that would need to be in place in order to move into the deployment phase.

But we do have the one thing that is the hallmark of a classic installation phase. We have a frenzy of innovation and financial capital that has been unleashed by the ICO boom, itself a creation of the crypto tech cycle.

Over $20bn has been raised by crypto projects via ICOs in the last 18 months.

And that is not counting the amount of capital that has gone into crypto companies via traditional means (venture capital, angel capital, etc).

This frenzy of entrepreneurship and investment has unleashed thousands of crypto projects all around the world.

And many of these teams, projects, companies are shipping things now.

Which is leading to an incredible amount of innovation coming to market in a very short period of time.

Like any early market, most of these projects and companies will fail. Some will fail to ship. Some will ship things that don’t work. Some will ship things that work but aren’t adopted. And some will ship things that are adopted but are surpassed by something better. The failure rate of these thousands of projects will be very high.

But inside this cohort of companies and projects will be the next Google, Amazon, Facebook, Twitter, Dropbox, Uber, and Airbnb.

And so the job of a crypto investor is to sort through all of them and decide which ones have the best chance of emerging as a winner.

We have been doing that for seven years now, since we first started poking around this sector in 2011.

And it has never been harder.

It is like drinking from a firehose right now.

There are so many high-quality projects, high-quality teams, and blue-chip financings happening in the crypto market right now.

It makes my head spin just trying to stay on top of it all.

And we have a great team of investors at USV working on this, and we have a network of crypto funds we have invested in that we collaborate with, and we have a bunch of like-minded VC firms that we work with in this sector.

That produces a lot of information flow and helps us better understand what is going on.

And what is going on is a frenzy of innovation that will lead to many important things.

But keeping up with it all is exhausting.