What Happened In 2022

I like to bookend the New Year holiday with two posts, one looking back at the year that is ending and one looking forward to the year ahead. This is the first of these two posts. The second one will run tomorrow.

What happened in 2022 is the bottom fell out of the capital markets and the startup and tech sector more broadly.

Back in February 2021, I wrote a post called How This Ends. In it, I wrote:

I believe it ends when the Covid 19 pandemic is over and the global economy recovers. Those two things won’t necessarily happen at the same time. There is a wide range of recovery scenarios and nobody really knows how long it will take the global economy to recover from the pandemic.

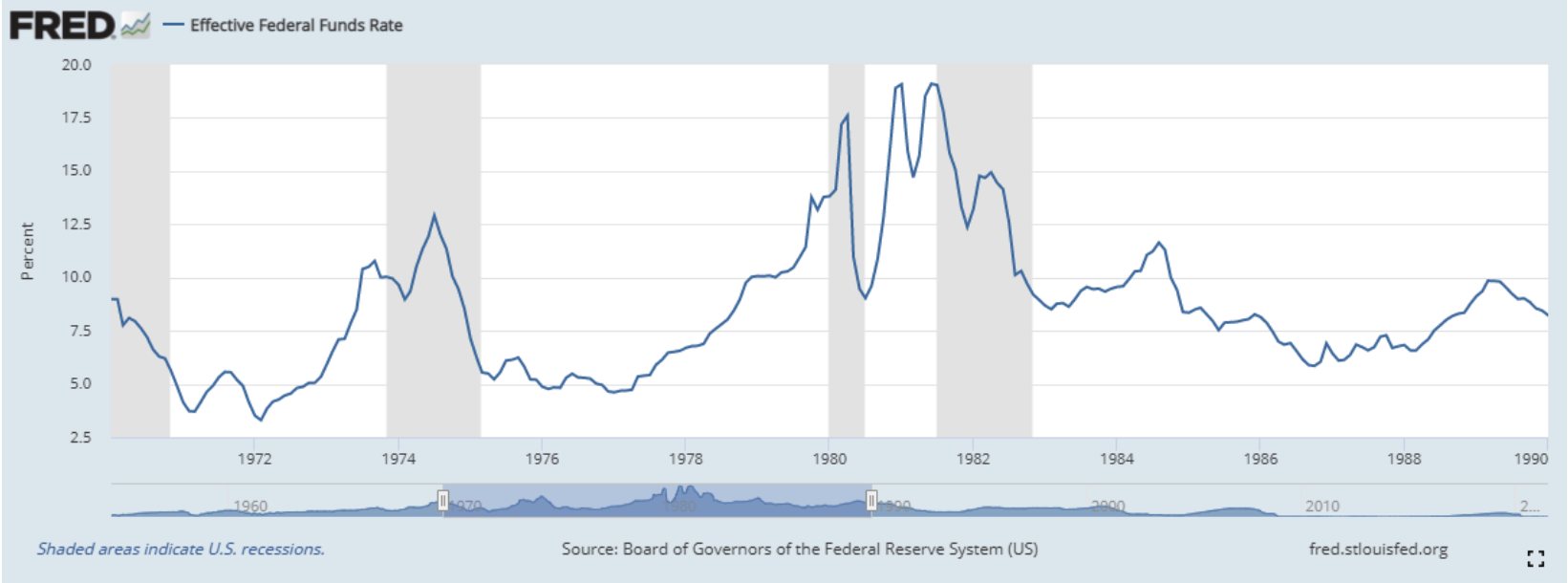

But at some point, economies will recover, central banks will tighten the money supply, and interest rates will rise. We may see price inflation of consumer goods and labor too, although that is less clear.

When economies recover and interest rates rise, the air will come out of the asset price bubbles that have built up and the go go markets will hit the brakes.

I went on to say that I had no idea when all of that would happen, but I was confident it would.

Well, it happened in 2022.

The air came out of the asset price bubbles that had built up over the last decade and were accelerated/exaggerated by the pandemic. There have been a number of other factors at work, like a war in Europe, that made things even worse, but it is my view that most of what happened in 2022 was entirely predictable, expected, and necessary.

In the areas that USV works in; tech, startups, and web3, there have been a number of important downstream effects of the popping of the bubble and they are worth enumerating.

As the capital markets, including crypto/web3, came undone, companies reacted by adjusting their burn rates to reflect that the growth at any cost phase was over and it was time to get on a path to breakeven. That has meant layoffs across the tech, startup, and web3 sectors. The voracious appetite for talent has waned. Spending for growth has largely stopped and most tech companies and startups are growing more slowly but with better unit economics and lower cash burn.

Some startups have failed, particularly the ones with upside-down unit economics or with a lack of product market fit. I think we have just seen the start of this trend and I plan to talk more about this in tomorrow’s post.

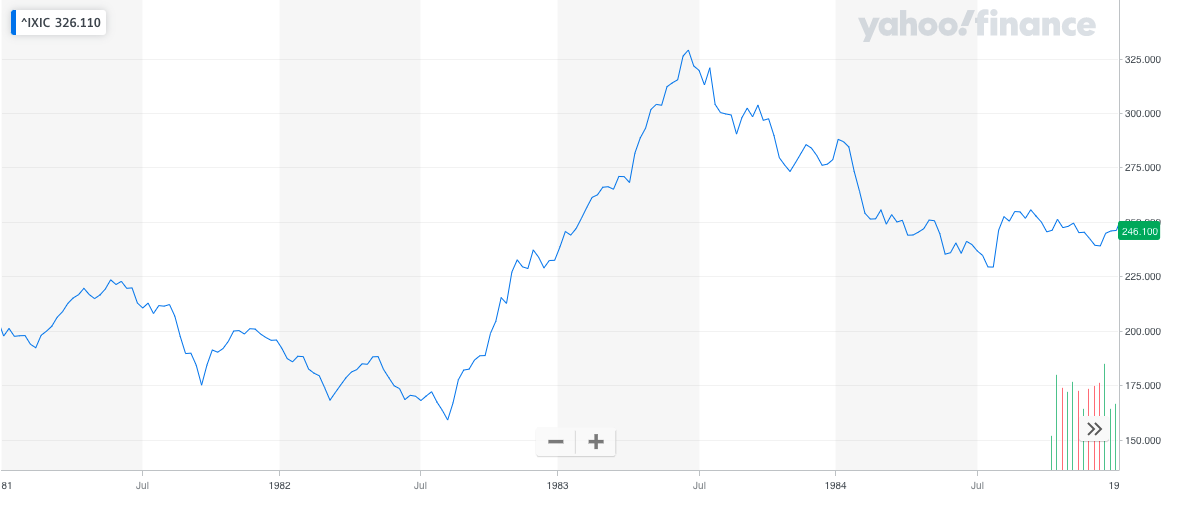

The sector with the largest impact, obviously, has been web3. Many large centralized entities; lenders, exchanges, crypto funds, etc, blew up when the value of web3 assets declined 70-90% over the course of 2022. The carnage has been massive and reminds me of what happened to the web sector in 2000/2001. Some of this has been markets doing their thing, but not all of it was. There was fraud, mismanagement, irresponsible risk-taking, and more, at play in the web3 sector.

And yet, I am not aware of any leading decentralized protocols blowing up in 2022. The smart contracts that run these protocols did what they were programmed to do and they have come through intact. It is a testament to the power of decentralized protocols over centralized entities and, for me, the major lesson of 2022 in web3.

I used the word necessary a few paragraphs ago to describe what happened in 2022. I understand that this year has been painful for most and devastating for many. I am not immune to it. Our family’s net worth has taken a massive hit. The carrying value of USV’s assets under management has been cut in half this year. And yet, I am fine, my family is fine, and USV is fine. Many are not. I understand that and have a lot of empathy for those who lost so much, including their jobs, this year.

And yet, I know that the unwinding of an unhealthy and unsustainable growth at all costs/cheap capital environment was necessary and will be healthy in the long run. We already see many of our portfolio companies operating at much more sensible cost structures with clear paths to profitability at much lower growth rates.

The ending of the war for talent in tech also is incredibly healthy. Some leading tech company CEOs I know believe they can operate with much lower headcounts in product/engineering/design than they have been for the long term. That talent can move into new startups and new growth areas, like climate and healthcare, that need it.

Like all transitions, this is messy, painful, disruptive, and ugly. And this year has been all of that and more. I am happy to see it in the rearview mirror and looking forward to better things in 2023. Which will be my topic for tomorrow.